Nu Skin (NUS) Misses Q3 Earnings Estimates, Lowers Guidance

Nu Skin Enterprises, Inc. NUS posted third-quarter 2023 results, wherein earnings and revenues missed the Zacks Consensus Estimate. Although the bottom line increased year over year, the top line declined.

The company encountered challenging year-over-year comparisons and persistent macroeconomic obstacles. It is worth noting that management revised its revenue and earnings per share (EPS) projections for 2023 downward.

Nu Skin's third-quarter results were hurt by macro-economic challenges, which impacted consumer spending and customer acquisition, mainly in the Mainland China and the Americas segments. This was compounded by the continued strength of the U.S. dollar. However, Europe/Africa experienced double-digit gains. Accelerated growth of the Rhyz businesses remains a source of satisfaction, as Nu Skin continues to leverage its synergistic enterprise ecosystem.

NUS has been actively pursuing long-term success through initiatives like introducing the ageLOC WellSpa iO, launching a channel growth incentive program and increasing monthly active users for its apps. The company has also rolled out a channel growth incentive program and has made progress in increasing the number of monthly active users for its Vera and Stela apps.

Nu Skin also plans to continue developing its social commerce business model to enhance connections with consumers and affiliates. Apart from this, the company is making steady progress toward the Nu Vision 2025 strategy.

Nu Skin Enterprises, Inc. Price, Consensus and EPS Surprise

Nu Skin Enterprises, Inc. price-consensus-eps-surprise-chart | Nu Skin Enterprises, Inc. Quote

Q3 in Detail

Nu Skin’s adjusted earnings of 56 cents a share increased from the 47 cents reported in the year-ago quarter. However, the metric lagged the Zacks Consensus Estimate of 64 cents.

Revenues of $498.8 million tumbled 7.3% year over year. Revenues included a negative impact of 1% from foreign currency fluctuations. The top line missed the Zacks Consensus Estimate of $525 million.

Sales leaders were down 6% year over year to 47,031. Nu Skin’s customer base dropped 21% to 978,907. The company’s paid affiliates were down 23% to 186,162.

The gross profit of $292.3 million declined from the $364.3 million reported in the year-ago quarter. The gross margin came in at 58.6%, down from the 67.7% reported in the year-ago quarter. The Nu Skin business’ gross margin came in at 61.8%, down from the 73% reported in the year-ago quarter.

Selling expenses declined to $187.8 million from the $216.5 million reported in the prior-year quarter. As a percentage of revenues, the metric was 37.7%, down from the 40.3% reported in the year-ago quarter. Nu Skin business’ selling expenses were 41.7% compared with 43.5% in the prior-year quarter.

General and administrative expenses of $130.9 million declined from $138 million in the year-ago quarter. As a percentage of revenues, general and administrative expenses were 26.2%, up from 25.7% in the year-ago period.

Image Source: Zacks Investment Research

Regional Results

Region-wise, revenues (at cc) declined 27%, 1%, 16% and 7% in the Americas, Mainland China, Southeast Asia/Pacific and South Korea, respectively in the third quarter. In Japan, EMEA and Hong Kong/Taiwan, revenues rose 5%, 3% and 6%, respectively, at cc.

The Zacks Consensus Estimate for revenues was pegged at declines of 7.6%, 3.8% and 7.5% in the Americas, Japan and South Korea, respectively in the third quarter.

Other Financial Details

Nu Skin ended the quarter with cash and cash equivalents of $233.3 million, long-term debt of $362.9 million, and total stockholders' equity of $822.2 million. In the reported quarter, the company paid out dividends of $19.5 million, and repurchased 13 million shares. NUS has $162.4 million remaining under the current share repurchase authorization.

Guidance

Nu Skin anticipates revenues of $1.92-$1.96 billion for 2023, suggesting a 14-12% decline from the year-ago period’s reported figure. Earlier, revenues were expected to be $2.00-$2.08 billion. The company envisions unfavorable foreign currency impacts of 3-2% on 2023 revenues.

Management envisions an adjusted EPS of $1.62-$1.77 compared with the $2.30-$2.60 expected earlier. The projection suggests a decline from adjusted earnings of $2.90 reported last year. On a reported basis, it is anticipated between a loss of 10 cents and earnings of 5 cents per share, down from the earlier stated earnings of $2.15-$2.45 per share.

For the fourth quarter, Nu Skin expects revenues between $440 million and $480 million, including an unfavorable foreign currency impact of 3-2%. The current revenue projection suggests a decline of 16% to 8% from the year-ago quarter’s reported level. The company expects adjusted earnings of 15-30 cents a share for the fourth quarter.

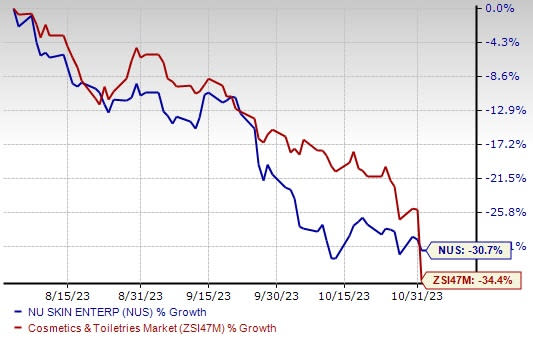

Shares of this Zacks Rank #3 (Hold) company have dipped 30.7% in the past three months compared with the industry’s decline of 34.4%.

Bet Your Bucks on These Hot Stocks

We have highlighted three better-ranked stocks, namely Coty Inc. COTY, Inter Parfums, Inc. IPAR and Lifeway Foods, Inc. LWAY.

Coty, along with its subsidiaries, manufactures, markets and distributes beauty products worldwide. The company currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Coty’s current fiscal-year sales suggests growth of 8.7% from the year-ago reported figure. COTY has a trailing four-quarter earnings surprise of 132.5%, on average.

Inter Parfums is engaged in the manufacturing, distribution and marketing of a wide range of fragrances and related products. The company currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Inter Parfums’ current financial-year sales and EPS suggests growth of 20.6% and 14.9%, respectively, from the year-ago reported figures. IPAR has a trailing four-quarter earnings surprise of 45.9%, on average.

Lifeway Foods produces Kefir, a drinkable product similar to but distinct from yogurt, in several flavors sold under the name Lifeway's Kefir. The company currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Lifeway Foods’ current financial-year sales suggests growth of 10.6% from the year-ago reported figure. LWAY has a trailing four-quarter earnings surprise of 141.7%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lifeway Foods, Inc. (LWAY) : Free Stock Analysis Report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

Nu Skin Enterprises, Inc. (NUS) : Free Stock Analysis Report

Coty (COTY) : Free Stock Analysis Report