Nucor Corp (NUE) Posts $785.4 Million in Q4 Earnings; Full Year 2023 Net Earnings Reach $4. ...

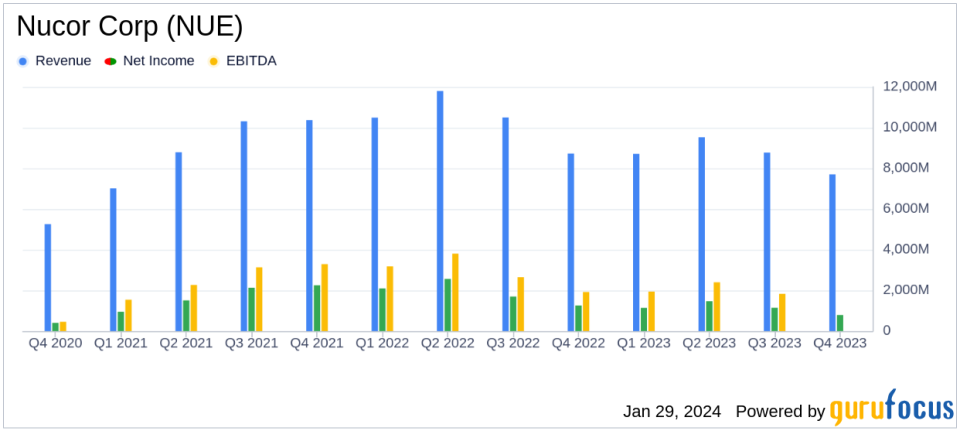

Consolidated Net Earnings: Q4 earnings of $785.4 million, down from Q3's $1.14 billion and Q4 2022's $1.26 billion.

Full Year Earnings: 2023 net earnings totaled $4.52 billion, a decline from $7.61 billion in 2022.

Net Sales: Q4 sales fell 12% to $7.70 billion from Q3 and the same quarter the previous year.

Average Sales Price: Decreased by 8% from Q3 2023 and 15% from Q4 2022.

Shipments: Approximately 5,934,000 tons shipped to outside customers in Q4, a 5% decrease from Q3 but a 3% increase from Q4 2022.

Dividend: Declared a cash dividend of $0.54 per share, marking a 6% increase over the prior dividend.

Share Repurchases: Repurchased approximately 1.0 million shares in Q4 at an average price of $177.18 per share.

On January 29, 2024, Nucor Corp (NYSE:NUE), a leading manufacturer of steel and steel products, released its 8-K filing, detailing the financial results for the fourth quarter and the full year of 2023. The company, which operates through segments including steel mills, steel products, and raw materials, has reported a decrease in consolidated net earnings for the fourth quarter, with $785.4 million, or $3.16 per diluted share, compared to $1.14 billion, or $4.57 per diluted share, in the third quarter of 2023, and $1.26 billion, or $4.89 per diluted share, in the fourth quarter of 2022.

Nucor's full-year earnings for 2023 amounted to $4.52 billion, or $18.00 per diluted share, a notable decrease from the $7.61 billion, or $28.79 per diluted share, reported in 2022. Despite the downturn, Leon Topalian, Nucors Chair, President, and CEO, highlighted the year as the third-most profitable in the company's history and expressed optimism for future growth driven by a resilient U.S. economy and steel-intensive megatrends.

Financial Performance and Challenges

Nucor's consolidated net sales in Q4 2023 decreased by 12% to $7.70 billion compared to the previous quarter and the same quarter in 2022. The average sales price per ton saw an 8% decrease from Q3 2023 and a 15% decrease from Q4 2022. Shipments to outside customers in Q4 also dropped by 5% from the previous quarter, although there was a 3% increase compared to Q4 2022. The average scrap and scrap substitute cost per gross ton used was $397 in Q4, marking a decrease from both the previous quarter and the same quarter in the previous year.

The company's financial achievements, including a strong balance sheet and a commitment to returning capital to shareholders, are significant in the steel industry, where market conditions can be volatile. Nucor's strategy of diversifying its product offerings and maintaining operational efficiency has helped it navigate the challenges of fluctuating demand and raw material costs.

"The Nucor team delivered a strong finish to 2023, which represents the third-most profitable year in our Companys history," said Leon Topalian, Nucors Chair, President, and Chief Executive Officer.

Financial Highlights and Outlook

Earnings for the fourth quarter decreased across all segments due to lower pricing and volumes, with the steel mills segment experiencing the most pronounced drop in realized pricing at sheet and plate mills. The steel products segment saw decreased earnings due to moderating average selling prices and lower volumes, while the raw materials segment earnings fell due to lower pricing for raw materials and planned outages at direct reduced iron (DRI) facilities.

Looking ahead to the first quarter of 2024, Nucor expects earnings to increase compared to the fourth quarter of 2023, with the steel mills segment anticipated to see higher average selling prices and volumes, particularly at sheet mills. However, earnings in the steel products segment are expected to decrease due to lower average selling prices, while the raw materials segment is projected to see increased earnings.

Nucor's commitment to shareholder returns remains steadfast, with the company having returned approximately $2.1 billion to stockholders in the form of share repurchases and dividend payments in 2023, aligning with its practice of returning at least 40% of earnings to stockholders.

For value investors and potential GuruFocus.com members, Nucor Corp's financial resilience, strategic growth initiatives, and shareholder-friendly policies make it a company worth considering in the dynamic steel industry landscape.

Explore the complete 8-K earnings release (here) from Nucor Corp for further details.

This article first appeared on GuruFocus.