Nucor (NUE) Sees Lower Q4 Earnings on Weaker Prices & Volumes

Nucor Corporation NUE provided guidance for its fourth quarter ending Dec 31, 2023. The company anticipates fourth-quarter earnings to be in the range of $2.75-$2.85 per share. This projection indicates a decline from the reported net earnings of $4.57 per share in the third quarter of 2023 and $4.89 per share in the same quarter of the previous year.

The expected decline in fourth-quarter earnings is likely to be caused by lower pricing and volumes across all three operating segments. In the steel mills segment, the downside in realized pricing is anticipated to be most pronounced at sheet and plate mills. The steel products segment is expected to experience lower earnings due to moderating average selling prices across most product groups within the segment and reduced volumes. Earnings in the raw materials segment are also projected to decline in the fourth quarter of 2023 compared with third-quarter 2023 levels, primarily due to lower pricing for raw materials and planned outages at the company's DRI facilities.

It's important to note that results for the fourth quarter of 2022 included certain one-time items. There was an after-tax net benefit of $60.4 million or 24 cents per share related to state tax credits and an after-tax net benefit of $88 million or 34 cents per share related to a change in the valuation allowance of a state deferred tax asset. A pre-tax write-off of $96 million or 29 cents per share was incurred for the remaining carrying value of NUE’s leasehold interest in unproved oil and gas properties within the raw materials segment.

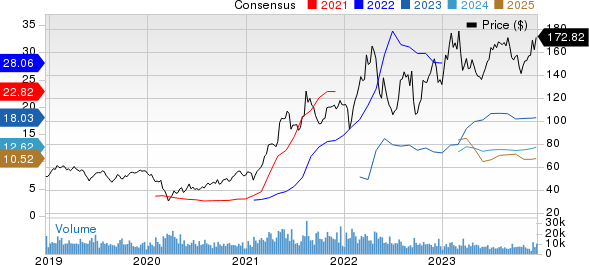

Nucor’s shares have gained 31.2% in the past year compared with the industry's 32.1% rise in the same period.

Image Source: Zacks Investment Research

In the third quarter of 2023, Nucor reported earnings of $4.57 per share, down from $6.50 in the year-ago quarter. Despite the downside, the earnings per share exceeded the Zacks Consensus Estimate of $4.26. Net sales in the quarter totaled $8,775.7 million, down approximately 16% year over year and surpassing the Zacks Consensus Estimate of $8,532.3 million.

Nucor Corporation Price and Consensus

Nucor Corporation price-consensus-chart | Nucor Corporation Quote

Zacks Rank & Key Picks

Nucor currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Axalta Coating Systems Ltd. AXTA, sporting a Zacks Rank #1 (Strong Buy), and Hawkins, Inc HWKN and Alamos Gold Inc. AGI, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for AXTA’s current-year earnings is pegged at $1.58, indicating year-over-year growth of 6.8%. AXTA beat the Zacks Consensus Estimate in three of the last four quarters and missed one, with the average earnings surprise being 6.7%. The company’s shares have increased 35.3% in the past year.

The Zacks Consensus Estimate for HWKN’s current-year earnings has been revised upward by 1.8% in the past 60 days. HWKN beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 27.5% on average. The stock has rallied around 84.6% in a year.

The consensus estimate for Alamos’ current fiscal year earnings is pegged at 53 cents, indicating a year-over-year surge of 89.3%. AGI beat the Zacks Consensus Estimate in all of the last four quarters, with the average earnings surprise being 25.6%. The company’s shares have surged 43.4% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nucor Corporation (NUE) : Free Stock Analysis Report

Alamos Gold Inc. (AGI) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report