Nucor's (NUE) Board Approves Upto $3 Billion Shares Repurchase

Nucor Corporation NUE recently announced that its Board has approved the repurchase of up to $3 billion of the company's outstanding common stock.

This new share repurchase program replaces the previously authorized $2 billion buyback program. Under the old program, roughly $1.55 billion worth of the company's common stock had been repurchased since its authorization in 2018.

The company sees repurchase of shares to be made in frequent time intervals in the open market at prevailing market prices, through private transactions or block trades.

The amount and time of repurchase will rely on market conditions, share price, applicable legal requirements and other factors. The new repurchase authorization is discretionary and has no expiration date.

Notably, the company repurchased roughly 5.4 million shares of its common stock during the first quarter. At the end of the quarter, its cash and cash equivalents surged around 97% year over year to $2,460.7 million.

Shares of Nucor have gained 150.9% in the past year compared with 187.2% surge of the industry.

In its first-quarter call, Nucor stated that it expects second-quarter earnings to be the highest quarterly earnings in its history, exceeding the record-level set in the first quarter. Earnings are expected to be mainly driven by higher pricing and margins in the steel mills segment.

The company also sees another strong quarter for the steel products segment with second-quarter profitability projected to be comparable to the first quarter. Moreover, Nucor sees profitability in the raw materials segment to decline in the second quarter compared with first-quarter levels due to higher raw material input costs.

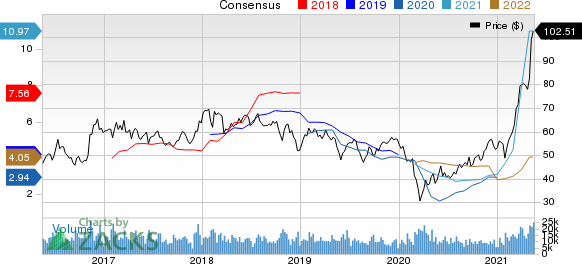

Nucor Corporation Price and Consensus

Nucor Corporation price-consensus-chart | Nucor Corporation Quote

Zacks Rank & Other Key Picks

Nucor currently sports a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks in the basic materials space are Dow Inc. DOW, Celanese Corporation CE and Cabot Corporation CBT.

Dow has a projected earnings growth rate of roughly 261.5% for the current year. The company’s shares have surged 90.1% in a year. It currently flaunts a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Celanese has an expected earnings growth rate of around 68.3% for the current year. The company’s shares have gained 98.3% in the past year. It currently sports a Zacks Rank #1.

Cabot has an expected earnings growth rate of around 126% for the current fiscal. The company’s shares have gained 90.2% in the past year. It currently flaunts a Zacks Rank #1.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nucor Corporation (NUE) : Free Stock Analysis Report

Dow Inc. (DOW) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

Celanese Corporation (CE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research