Nucor's (NUE) Q3 Earnings and Sales Surpass Estimates

Nucor Corporation NUE reported earnings of $4.57 per share for third-quarter 2023, down from earnings of $6.50 per share in the year-ago quarter. Earnings per share topped the Zacks Consensus Estimate of $4.26.

The company recorded net sales of $8,775.7 million, down around 16% year over year. The figure topped the Zacks Consensus Estimate of $8,532.3 million.

Earnings declined in the third quarter primarily due to lower prices and decreased volumes.

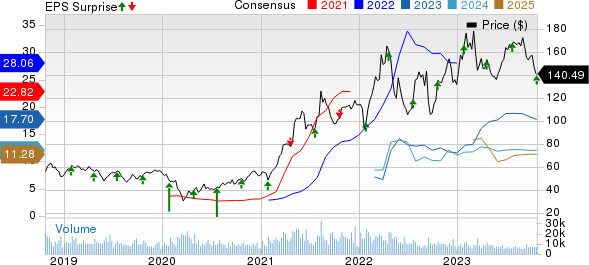

Nucor Corporation Price, Consensus and EPS Surprise

Nucor Corporation price-consensus-eps-surprise-chart | Nucor Corporation Quote

Operating Figures

Total sales tons to outside customers for steel mills in the third quarter were 4,578,000 tons, a 1% increase year over year. It fell short of our estimate of 4,705,000 tons.

The average sales price for steel mills was $1,114 per ton, which fell 14% year over year and was down around 3% sequentially. It was ahead of our estimate of $1,038 per ton.

Overall operating rates at the company's steel mills fell to 77% in the third quarter of 2023 compared with 84% in the second quarter of 2023. It also compares to 77% in the third quarter of 2022.

Segment Highlights

Earnings of the company’s steel mills unit fell 37% sequentially in the reported quarter on lower pricing and reduced metal margins.

Earnings in the steel products division were lower by 20% sequentially in the third quarter due to reduced prices and modestly lower shipments.

The raw materials segment’s earnings were down 49% sequentially on reduced prices and shipments.

Financial Position

Cash and cash equivalents were $5,855.9 million at the end of the quarter, up 71% year over year. Long-term debt was $6,620.6 million, flat year over year.

The company repurchased nearly 3 million shares of its common stock at an average price of $168.99 per share during the quarter.

Outlook

For the fourth quarter of 2023, the company foresees a sequential decline in earningsmainly attributed to lower pricing across all three operating segments, with a lesser impact from decreased volumes.

In the steel mills segment, the most pronounced decline in realized pricing is expected to take place at sheet mills. Within the steel products segment, earnings are projected to fall due to the moderation of average selling prices across most product groups in this segment and lower volume levels.

Moreover, earnings for the raw materials segment areexpected to decrease in the fourth quarter of 2023 in contrast to the third quarter of 2023, mainly due to lower raw material prices and planned shutdowns at the DRI facilities.

Price Performance

Shares of Nucor have gained 4.3% in a year compared with the industry’s 17.4% rise.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Nucor currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are WestRock Company WRK, The Andersons Inc. ANDE and Koppers Holdings Inc. KOP, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, the Zacks Consensus Estimate for Westrock’s current fiscal year has been revised upward by 5.2%. WRK beat the Zacks Consensus Estimate in three of the last four quarters while missing in one quarter, with the average earnings surprise being 30.7%. The company’s shares have rallied 2% in the past year.

The Zacks Consensus Estimate for ANDE's current-year earnings has been revised 3.3% upward over the past 60 days. Andersons beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4% on average. ANDE shares have rallied around 39.1% in a year.

The consensus estimate for Koppers’ current fiscal year earnings is pegged at $4.45, indicating year-over-year growth of 7.5%. KOP beat the Zacks Consensus Estimate in all of the last four quarters, with the average earnings surprise being 21.7%. The company’s shares have surged 50.4% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Nucor Corporation (NUE) : Free Stock Analysis Report

Koppers Holdings Inc. (KOP) : Free Stock Analysis Report

WestRock Company (WRK) : Free Stock Analysis Report