Nurix (NRIX) to Report Q3 Earnings: What's in Store?

Nurix Therapeutics NRIX is expected to provide updates related to its pipeline candidates for hematologic malignancies and solid tumor indications when it reports third-quarter 2023 results later this month.

Let's see how things might have shaped up in the soon-to-be-reported quarter.

Factors to Consider

Nurix derives its revenues from collaborations and licensing revenues. The Zacks Consensus Estimate for NRIX’s third-quarter revenues is pegged at $19.98 million.

With no marketed drug in its portfolio, investors will look for updates on Nurix’s cancer pipeline at the conference call.

NRIX’s lead candidate, NX-2127, is an orally bioavailable degrader of BTK with immunomodulatory activity being developed for patients with relapsed or refractory B-cell malignancies.

The company is developing NX-2127 in a phase I study. In the second quarter, it initiated three phase Ib expansion cohorts focused on chronic lymphocytic leukemia,diffuse large B cell lymphoma and mantle cell lymphoma patients. Nurix plans to report data from these ongoing studies this year.

The other two candidates in NRIX’s portfolio are NX-5948 and NX-1607. The company is enrolling patients in the phase Ia portion of a phase Ia/Ib dose-escalation and cohort expansion study of NX-5948 in patients with relapsed or refractory B-cell malignancies.

NX-1607 is being developed for a range of oncology indications. Nurix is also enrolling patients in the phase 1a portion of a phase Ia/Ib dose-escalation and cohort expansion study. It also plans to report data from these studies by 2023-end.

Research and development expenses are expected to have increased in the third quarter, owing to the development of the company’s early-stage pipeline candidates.

Recent Key Developments

Last month, NRIX entered into a strategic collaboration with Seagen SGEN to develop a new class of medicines called Degrader-Antibody Conjugates to target cancer.The medicines will be developed by combining two power technologies — Seagen’s antibody-drug conjugation and Nurix’s targeted protein degradation platforms.

The partnership is aimed at creating drugs with new mechanisms of action and improved specificity and anti-cancer activity, effective against a wide range of solid tumors and hematologic malignancies.

Apart from Seagen, the company has also partnered with pharma big-wigs like Gilead Sciences GILD and Sanofi. These partnerships help Nurix generate collaboration revenues, which, in turn, provide revenues to support its wholly-owned pipeline.

Earlier this March, Gilead exercised its option to license Nurix’s investigational targeted protein degrader molecule NX-0479 exclusively. The option is part of an agreement between Gilead and Nurix, signed in 2019, to develop a pipeline of innovative targeted protein degradation drugs for cancer and other challenging diseases.

In return for exercising this option, Nurix received a $20-million milestone payment from Gilead and is eligible to receive additional payments of up to $425 million. Per the terms of the agreement, GILD is now responsible for the clinical development of NX-0479.

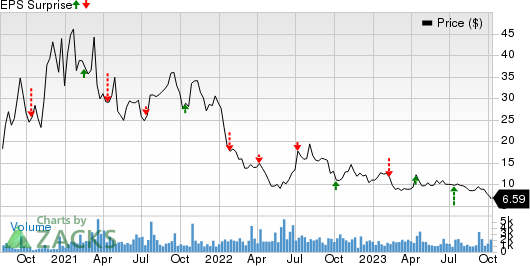

Earnings Surprise History

The company’s earnings surprise history has been decent so far. Its earnings surpassed estimates in three of the trailing four quarters and missed the mark in one, delivering an average surprise of 6.60%.

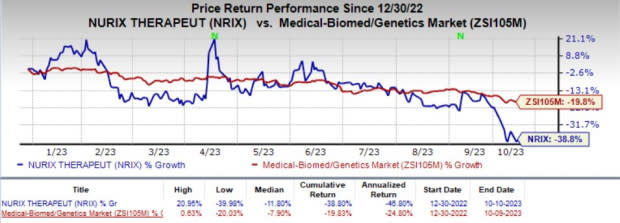

Shares of the company have lost 38.8% in the year-to-date period compared with the industry's 19.8% decline.

Image Source: Zacks Investment Research

Earnings Whisper

Our proven model does not predict an earnings beat for NRIX this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. Unfortunately, that is not the case here, as you will see below.

Earnings ESP: NRIX has an Earnings ESP of 0.00% as both the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at a loss of 69 cents per share. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Zacks Rank: NRIX currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Nurix Therapeutics, Inc. Price and EPS Surprise

Nurix Therapeutics, Inc. price-eps-surprise | Nurix Therapeutics, Inc. Quote

Stock to Consider

Here is a stock worth considering from the overall healthcare space as our model shows that it has the right combination of elements to beat on earnings this reporting cycle.

Apellis Pharmaceuticals APLS has an Earnings ESP of +21.28% and a Zacks Rank #2 at present.

APLS’ shares have lost 14.2% year to date. Its earnings beat estimates in two of the last four quarters and missed the mark in the other two, delivering an average surprise of 1.36%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gilead Sciences, Inc. (GILD) : Free Stock Analysis Report

Seagen Inc. (SGEN) : Free Stock Analysis Report

Apellis Pharmaceuticals, Inc. (APLS) : Free Stock Analysis Report

Nurix Therapeutics, Inc. (NRIX) : Free Stock Analysis Report