Nurix (NRIX) Stock Increases 9% in a Month: Here's Why

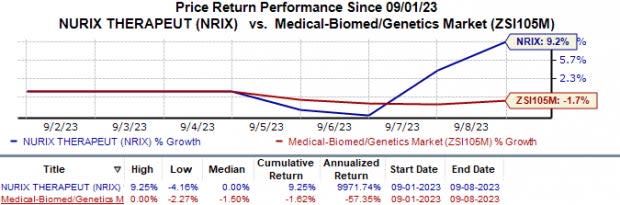

Shares of Nurix Therapeutics NRIX have increased 9.2% since the last week against the industry’s 1.7% fall.

Image Source: Zacks Investment Research

This upside is attributable to the company’s recently announced partnership with Seagen SGEN for advancing a new class of medicines called Degrader-Antibody Conjugates (“DACs”) to target cancer.

The new class of medicines will be developed by combining two power technologies — Seagen’s antibody-drug conjugation (“ADC”) and Nurix’s targeted protein degradation (“TPD”) platforms. The Nurix-Seagen partnership intends to create drugs with new mechanisms of action and improved specificity and anti-cancer activity effective against a wide range of solid tumors and hematologic malignancies.

Per the terms of collaboration, Nurix will use its proprietary platform to develop a suite of targeted protein degraders against multiple targets. Seagen will select these targets based on suitability for antibody conjugation. Seagen will be responsible for conjugating these degraders to antibodies — turning them into DACs — and advancing the candidates through preclinical and clinical development and commercialization.

In return for using its proprietary platform, Nurix will receive an upfront payment of $60 million from Seagen. This cash, combined with the company’s existing cash balance, will enable it to extend its cash runway into second-quarter 2025.

Nurix can also receive potential milestone payments of up to approximately $3.4 billion from Seagen across multiple programs. The company will also be eligible to receive mid-single to low double-digit tiered royalties from Seagen on future sales of drugs developed under this partnership.

The agreement will also provide Nurix with an option for profit-sharing and co-promotion in the United States on two products developed under this collaboration.

In the future, the agreement will likely be taken over by Pfizer PFE, which recently initiated a buyout offer for Seagen. Per the offer terms, Pfizer has agreed to pay $229 per share, adding up to a total enterprise value of approximately $43 billion for Seagen. Pfizer expects to complete the acquisition by late 2023 or early 2024.

Per Nurix, protein degraders are designed to simultaneously bind an E3 ligase and a target protein to facilitate the transfer of ubiquitin onto that target protein thus causing its degradation. This process is then continuously repeated so that each degrader can cause the degradation of multiple target proteins.

Apart from Seagen, the company also has partnerships with pharma big-wigs like Gilead Sciences GILD and Sanofi. These partnerships help the company generate collaboration revenues, which in turn provide the company with revenues to support its wholly-owned pipeline.

Earlier this March, Gilead exercised its option to license Nurix’s investigational targeted protein degrader molecule NX-0479 exclusively. The option is part of an agreement between Gilead and Nurix in 2019 to develop a pipeline of innovative targeted protein degradation drugs for cancer patients and other challenging diseases.

In return for exercising this option, Nurix received a $20 million milestone payment from Gilead and is eligible to receive additional payments of up to $425 million. Per the terms of the agreement, GILD is responsible for the clinical development of NX-0479.

With no marketed drugs in its portfolio, Nurix depends entirely on its pipeline development. The company’s collaborations are positive as the company’s partners are industry-leading pharma companies with years of drug-making experience and a well-established supply chain. The collaboration revenues earned from these partners will likely help the company narrow down its losses until it can start generating income regularly.

Nurix Therapeutics, Inc. Price

Nurix Therapeutics, Inc. price | Nurix Therapeutics, Inc. Quote

Zacks Rank

Nurix currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Gilead Sciences, Inc. (GILD) : Free Stock Analysis Report

Seagen Inc. (SGEN) : Free Stock Analysis Report

Nurix Therapeutics, Inc. (NRIX) : Free Stock Analysis Report