Nurix Therapeutics Inc (NRIX) Reports Robust Year-End Financials and Clinical Progress

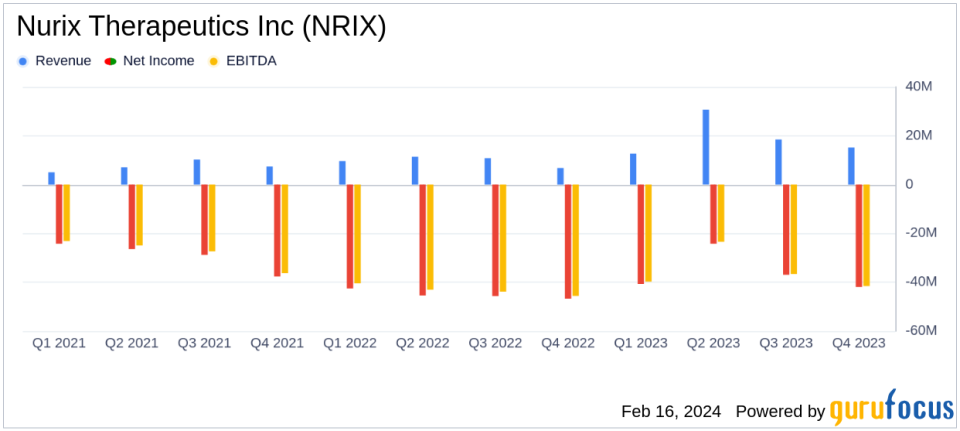

Revenue Growth: Reported a significant increase to $77.0 million for FY 2023 from $38.6 million in FY 2022.

Research and Development: R&D expenses slightly increased to $189.1 million in FY 2023 from $184.5 million in FY 2022.

Net Loss Improvement: Net loss decreased to $143.9 million, or ($2.65) per share in FY 2023, from $180.4 million, or ($3.71) per share in FY 2022.

Liquidity Position: Cash, cash equivalents, and marketable securities stood at $295.3 million as of November 30, 2023.

Strategic Collaborations: Achieved $100 million in non-dilutive capital from partners, including upfront and milestone payments.

On February 15, 2024, Nurix Therapeutics Inc (NASDAQ:NRIX) released its 8-K filing, detailing the financial results for the fourth quarter and fiscal year ended November 30, 2023, and providing a corporate update. The biopharmaceutical company, which focuses on developing novel treatments for cancer and immune disorders through targeted protein modulation, has reported a year of significant clinical and financial achievements.

Financial Highlights and Clinical Advancements

Nurix Therapeutics has seen a substantial increase in revenue, with the fiscal year 2023 revenue reaching $77.0 million, a notable rise from the previous year's $38.6 million. This growth is attributed to the successful completion of performance obligations and the achievement of valuable milestones, including a $20.0 million license option exercise payment from Gilead. Research and development expenses saw a marginal increase to $189.1 million, driven by higher personnel costs and clinical trial activities. Despite these increased investments in R&D, the company improved its net loss position, reducing it to $143.9 million, or ($2.65) per share, compared to the prior year's $180.4 million, or ($3.71) per share.

The company's liquidity remains robust, with cash and investments totaling $295.3 million. This strong financial position is further bolstered by $100 million in non-dilutive capital secured through strategic partnerships, including significant upfront payments from Seagen and milestone payments from Gilead and Sanofi.

Strategic Collaborations and Regulatory Milestones

Nurix's strategic collaborations have been a cornerstone of its success. The company formed a notable partnership with Seagen (now Pfizer) to advance a portfolio of degrader-antibody conjugates and licensed a new development candidate, NX-0479/GS-6791, to Gilead for rheumatoid arthritis treatment. These partnerships not only provide financial support but also enhance the company's pipeline and market presence.

On the regulatory front, Nurix's NX-5948 received Fast Track designation from the FDA for the treatment of adult patients with relapsed or refractory chronic lymphocytic leukemia (CLL) or small lymphocytic lymphoma. This designation is expected to facilitate the development and expedite the review of NX-5948, potentially leading to earlier patient access to this promising treatment.

Operational and Clinical Developments

The company's operational advancements include the presentation of positive clinical data for its BTK degrader NX-5948 and dual BTK and IKZF1/3 degrader NX-2127 at the American Society of Hematology (ASH) Annual Meeting. These presentations highlighted the drugs' favorable pharmacokinetics, tolerability, and preliminary efficacy. Moreover, high-profile publications have provided a scientific basis for the BTK scaffold function and degrader mechanism, further validating Nurix's approach.

Looking ahead, Nurix anticipates continued progress with its clinical programs and strategic collaborations. The company plans to accelerate enrollment in the NX-5948 leukemia and lymphoma program and aims to resolve the partial clinical hold on the NX-2127 clinical trial to enable the introduction of newly manufactured drug product.

In summary, Nurix Therapeutics Inc (NASDAQ:NRIX) has demonstrated a year of strong financial performance and clinical progress. The company's strategic collaborations, regulatory milestones, and robust pipeline position it well for future growth and development. Value investors and potential GuruFocus.com members may find Nurix's approach to targeted protein modulation and its financial health to be of significant interest.

For more detailed information, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Nurix Therapeutics Inc for further details.

This article first appeared on GuruFocus.