NuStar Energy LP Reports Solid Earnings for Q4 and Full-Year 2023

Net Income: NuStar Energy LP (NYSE:NS) reported a net income of $70 million for Q4 2023, with a full-year net income of $274 million.

Earnings Per Unit: Q4 earnings per unit stood at $0.37, while the full-year figure was $0.72 per unit.

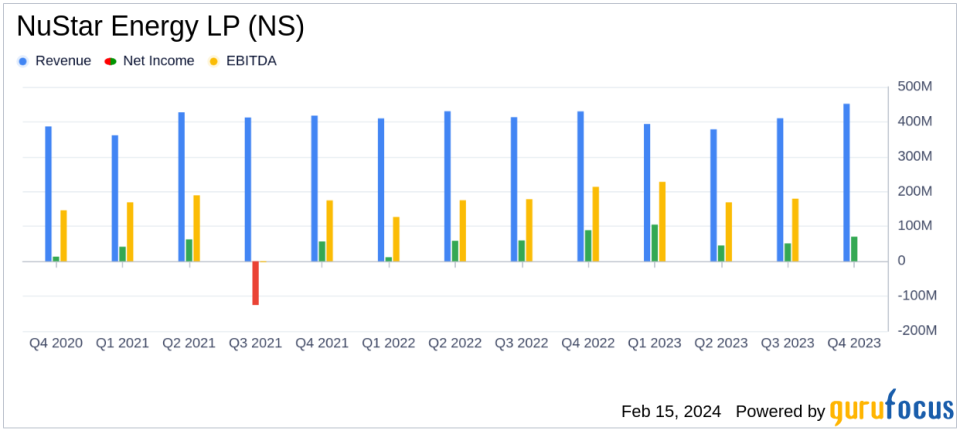

Adjusted EBITDA: The company saw an increase in adjusted EBITDA, reaching $735 million for the full year, up from $722 million in 2022.

Distributable Cash Flow: DCF for Q4 was $87 million, with a full-year adjusted DCF of $354 million.

Debt-to-EBITDA Ratio: NuStar ended Q4 with a healthy debt-to-EBITDA ratio of 3.85 times.

Throughput Volumes: Pipeline segment throughput averaged 1,917,775 barrels per day in Q4.

Revenue Trends: Total revenues for Q4 reached $451.7 million, with full-year revenues totaling $1.63 billion.

On February 15, 2024, NuStar Energy LP (NYSE:NS) released its solid fourth quarter and full-year 2023 earnings results, showcasing the company's resilience and strategic advancements. The detailed financial performance can be reviewed in the company's 8-K filing. NuStar, a leading US-based pipeline and terminal operator, operates a vast network of pipelines and storage facilities, primarily focusing on the transportation and storage of petroleum products, anhydrous ammonia, and specialty chemicals.

Financial Performance and Challenges

NuStar's performance in the fourth quarter was marked by a net income of $70 million, or $0.37 per unit, a decrease from the $92 million, or $0.18 per unit, reported in the same period of the previous year. However, this comparison is affected by a gain from insurance proceeds in 2022. Adjusting for these effects, the net income for Q4 2022 was $75 million, or $0.34 per unit. The full-year net income for 2023 stood at $274 million, or $0.72 per unit, compared to $223 million, or $0.36 per unit, in 2022. Adjusted for specific non-cash charges and gains, the full-year adjusted net income for 2023 was consistent with the previous year at $0.92 per unit.

Despite facing challenges such as operational issues in the Permian Crude System and customer transitions in the Storage Segment, NuStar reported an increase in adjusted EBITDA for the full year to $735 million, up from $722 million in 2022. The company's strategic initiatives, particularly in the refined products systems and the West Coast Renewables Strategy, contributed to this solid performance.

Financial Achievements and Industry Significance

The company's financial achievements, including a healthy debt-to-EBITDA ratio and a strong distribution coverage ratio of 1.73 times for Q4, underscore its financial stability and operational efficiency. These metrics are particularly important in the Oil & Gas industry, where capital-intensive operations and market volatility can significantly impact financial health.

Key Financial Details

NuStar's income statement reflects robust service revenues of $304.9 million for Q4 and $1.15 billion for the full year. The balance sheet remains solid with ample liquidity, as evidenced by $652 million available on its $1.0 billion unsecured revolving credit facility. The cash flow statement indicates a distributable cash flow of $87 million for Q4, supporting a distribution coverage ratio that speaks to the company's ability to sustain and potentially grow its distributions to unitholders.

"I am pleased to report that we have delivered another quarter of solid earnings results and made significant progress on many of our strategic initiatives in 2023," said NuStar Chairman and CEO Brad Barron.

Analysis of Company's Performance

Analysis of NuStar's performance reveals a company adept at navigating industry headwinds while capitalizing on its strategic assets. The Pipeline Segment's slight decrease in operating income and EBITDA for Q4 was offset by the full-year improvement of 7%. The Storage Segment's growth, particularly in the West Coast region, and the Fuels Marketing Segment's consistent performance further bolstered the company's results.

Looking ahead, NuStar provided a positive outlook for 2024, with projected net income ranging from $220 to $260 million and EBITDA between $720 to $780 million, even as it prepares for a merger with Sunoco LP expected to close in the second quarter of 2024.

For investors and potential GuruFocus.com members, NuStar Energy LP's latest earnings report reflects a company with solid fundamentals, strategic growth initiatives, and a commitment to delivering value. The full earnings report and additional details can be accessed through the provided 8-K filing link, offering a comprehensive view of the company's financial health and future prospects.

Explore the complete 8-K earnings release (here) from NuStar Energy LP for further details.

This article first appeared on GuruFocus.