NuStar Energy (NS) Q2 Earnings Miss Estimates, Sales Beat

NuStar Energy NS reported second-quarter 2023 adjusted earnings per unit of 9 cents, which missed the Zacks Consensus Estimate of 15 cents. The bottom line also underperformed the year-ago quarter’s level of 19 cents due to lower volumes.

NS’ revenues of $378.3 million beat the Zacks Consensus Estimate of $373 million. The impressive performance can be attributed to strong contributions from the Pipeline segment. The decline in product sales, however, caused the figure to drop about 12.1% year over year.

Operating profit totaled $102.9 million compared with $109.1 million in the corresponding period of 2022. This downside was due to poor contributions from the Storage and Fuels Marketing segments.

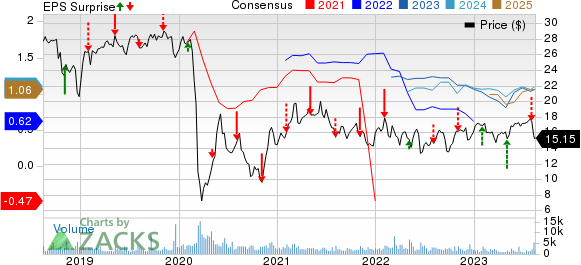

NuStar Energy L.P. Price, Consensus and EPS Surprise

NuStar Energy L.P. price-consensus-eps-surprise-chart | NuStar Energy L.P. Quote

Segmental Updates

Pipeline: Quarterly throughput volumes totaled 1,708,282 barrels per day (Bbl/d), down 5.3% from the year-ago period’s level of 1,802,940 Bbl/d. Throughput volumes from crude oil pipelines reduced about 9% to 1,111,120 Bbl/d and the same from refined product pipelines increased to 597,162 Bbl/d from 582,182 Bbl/d in the prior-year quarter.

NuStar Energy's Permian Crude System throughput volumes totaled 508,000 Bbl/d, down slightly from the year-ago quarter’s reported number. The segment’s revenues increased 3% year over year to $206.7 million. The figure beat our projection of $186.9 million.

The Pipeline unit recorded an operating profit of $107.8 million compared with $100.9 million in the prior-year period. The figure beat our estimate of $91.5 million.

Storage: Throughput volumes for the segment decreased to 391,495 Bbl/d from 446,057 Bbl/d in the year-ago quarter. Total revenues declined 11.8% year over year to $78.2 million due to lower throughput terminal and Storage terminal revenues. Throughput terminal revenues decreased from $30.9 million to $23.8 million. The figure also missed our projection of $24.4 billion. Operating profit totaled $21.2 million compared with $31.2 million in the year-ago quarter. The figure beat our projection of $16.6 million.

Fuels Marketing: Product sales decreased to $93.4 million from $140.8 million in the year-ago quarter. The figure missed our projection of $106.4 billion. The cost of goods also declined about 35.5% from $133.741 million registered a year ago. Operating earnings totaled $6.5 million compared with $6.6 million in the corresponding quarter of 2022. The figure missed our projection of $22.2 billion.

Cash Flow, Debt and Financial Position

Distributable cash flow available to limited partners totaled $36.6 million (providing 1.64x adjusted distribution coverage) for the reported quarter. A coverage ratio of more than 1 implies that NuStar Energy has generated enough cash to cover its distribution.

As of Jun 30, 2023, the company had cash and cash equivalents of $3.8 million and a long-term debt of $3.3 billion, with a debt-to-capitalization of 79.2%.

Guidance

NuStar Energy expects net income in the range of $252-$290 million for full-year 2023. It also anticipates adjusted EBITDA in the band of $700-$760 million for the same time frame.

The company plans to spend $125-$145 million in strategic capital in 2023. It also expects to spend around $25 million to expand its West Coast Renewable Fuels Network. NS intends to allocate between $35 million and $45 million for the Permian system’s development.

Zacks Rank and Key Picks

Currently, NS carries a Zacks Rank #3 (Hold).

Some better-ranked stocks for investors interested in the energy sector are CVR Energy CVI, sporting a Zacks Rank #1 (Strong Buy), and Evolution Petroleum EPM and Archrock AROC, both carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

CVR Energy (CVI) is valued at around $3.67 billion. In the past year, its shares have risen 19.5%.

CVI currently pays a dividend of $2 per share, or 5.47% on an annual basis. Its payout ratio currently sits at 30% of earnings.

Evolution Petroleum is worth approximately $320.71 million. EPM currently pays a dividend of 48 cents per share, or 4.98% on an annual basis.

The company currently has a forward P/E ratio of 8.93. In comparison, its industry has an average forward P/E of 14.60, which means EPM is trading at a discount to the group.

Archrock is valued at around $2.04 billion. It delivered an average earnings surprise of 15.08% for the last four quarters and its current dividend yield is 4.75%.

Archrock is a provider of natural gas contract compression services and aftermarket services of compression equipment.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NuStar Energy L.P. (NS) : Free Stock Analysis Report

CVR Energy Inc. (CVI) : Free Stock Analysis Report

Evolution Petroleum Corporation, Inc. (EPM) : Free Stock Analysis Report

Archrock, Inc. (AROC) : Free Stock Analysis Report