NuStar Energy (NS) Q3 Earnings Miss Estimates, Revenues Top

NuStar Energy L.P. NS reported third-quarter 2023 adjusted earnings per unit of 20 cents, which missed the Zacks Consensus Estimate of 22 cents due to lower volumes. The bottom line was in line with the year-ago quarter’s level.

NS’ revenues of $410.3 million beat the Zacks Consensus Estimate of $390 million. The impressive top-line performance can be attributed to strong contributions from the Pipeline segment. The decline in product sales, however, caused the figure to drop about 0.7% year over year.

Operating profit totaled $115.3 million compared with $111.9 million in the corresponding period of 2022. This improvement was brought about by a year-over-year decrease in total costs and expenses (from 301.3 million to 295 million).

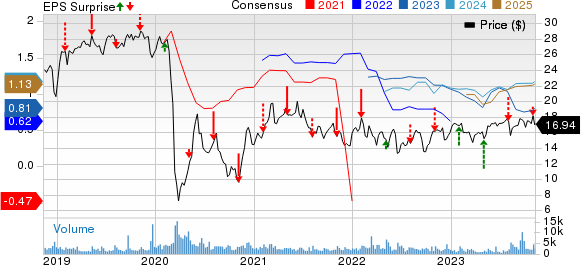

NuStar Energy L.P. Price, Consensus and EPS Surprise

NuStar Energy L.P. price-consensus-eps-surprise-chart | NuStar Energy L.P. Quote

Segmental Updates

Pipeline: Quarterly throughput volumes totaled 1,801,322 barrels per day (Bbl/d), down 5% from the year-ago period’s level of 1,895,538 Bbl/d. Throughput volumes from crude oil pipelines reduced about 10.1% to 1,200,582 Bbl/d and the same from refined product pipelines increased to 600,740 Bbl/d from 560,202 Bbl/d in the prior-year quarter.

NuStar Energy's Permian Crude System throughput volumes totaled 1,200,582 Bbl/d, down from the year-ago quarter’s level of 1,335,336 Bbl/d. The segment’s revenues increased 7.8% year over year to $225.4 million. The figure beat our projection of $205.5 million.

The Pipeline unit recorded an operating profit of $126 million compared with $110.4 million in the prior-year period. The figure beat our estimate of $105.4 million.

Storage: Throughput volumes for the segment decreased to 410,472 Bbl/d from 479,110 Bbl/d in the year-ago quarter. Total revenues declined 4.1% year over year to $75.2 million due to lower throughput terminal revenues. Throughput terminal revenues decreased from $26.9 million to $21.9 million year over year. The figure also missed our projection of $25 billion. Operating profit totaled $17.3 million compared with $22.6 million in the year-ago quarter. The figure missed our projection of $26.9 million.

Fuels Marketing: Product sales decreased to $109.7 million from $125.8 million in the year-ago quarter. The figure, however, beat our projection of $104.9 billion. The cost of goods also declined about 13.4% from $101.1 million registered a year ago. Operating earnings totaled $8.2 million compared with $8.5 million in the corresponding quarter of 2022. The figure beat our projection of $7.9 billion.

Cash Flow, Debt and Financial Position

Distributable cash flow available to limited partners totaled $21.3 million (providing 1.84x adjusted distribution coverage) for the reported quarter. A coverage ratio of more than 1 implies that NuStar Energy has generated enough cash to cover its distribution.

As of Sep 30, 2023, the company had cash and cash equivalents of $4.4 million and a long-term debt of $4 billion, with a debt-to-capitalization of 76.5%.

Guidance

NuStar Energy expects net income in the range of $261-$273 million for full-year 2023. It also anticipates adjusted EBITDA in the band of $720-$740 million for the same time frame.

The company plans to spend $120-$130 million in strategic capital in 2023. It also expects to spend around $25 million and $25 million to expand its West Coast Renewable Fuels Network and Ammonia Pipeline, respectively.

Zacks Rank and Key Picks

Currently, NS carries a Zacks Rank #3 (Hold).

Investors interested in the energy sector might look at some better-ranked stocks like Liberty Energy Inc. LBRT, sporting a Zacks Rank #1 (Strong Buy), and CVR Energy, Inc. CVI and Delek US Holdings, Inc. DK, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Liberty Energy is valued at $3.41 billion. LBRT currently pays a dividend of 20 cents per share, or 0.99% on an annual basis.

LBRT is a leading provider of hydraulic fracturing and other auxiliary services to North American onshore exploration and production companies.

CVR Energy is valued at $3.28 billion. In the past year, its shares have lost 19%.

CVI currently pays a dividend of $2 per share or 6.13% on an annual basis. Its payout ratio currently sits at 30% of earnings.

Delek US Holdings is worth approximately $1.69 billion. DK currently pays a dividend of 94 cents per share, or 3.61% on an annual basis.

The company operates in the integrated downstream energy business in the United States. It operates under three segments — refining, logistics and retail.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NuStar Energy L.P. (NS) : Free Stock Analysis Report

CVR Energy Inc. (CVI) : Free Stock Analysis Report

Delek US Holdings, Inc. (DK) : Free Stock Analysis Report

Liberty Energy Inc. (LBRT) : Free Stock Analysis Report