Nutrien (NTR) Gains on Strong Demand Amid Pricing Woes

Nutrien Ltd. NTR is expected to gain from higher demand for crop nutrients, its actions to reduce costs and strategic acquisitions amid headwinds from weaker fertilizer prices.

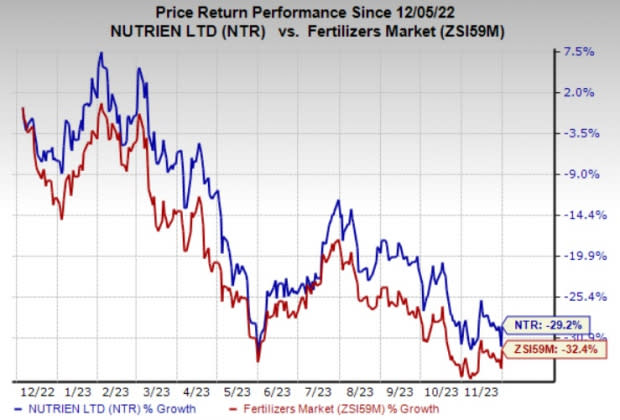

The company’s shares are down 29.2% over a year, compared with a 32.4% decline recorded by its industry.

Image Source: Zacks Investment Research

Nutrien, a Zacks Rank #3 (Hold) stock, is well-placed to benefit from increased demand for fertilizers, backed by the strength in global agriculture markets. It is seeing strong demand in its major markets, particularly North America. It delivered record potash sales volumes in the third quarter of 2023 and gained from strong crop nutrient demand in North America.

Strong grower economics and higher crop commodity prices are expected to drive potash demand globally. The phosphate market is also benefiting from higher global demand and low producer and channel inventories. Demand for nitrogen fertilizer also remains healthy in major markets. Global nitrogen requirement is being driven by demand in North America, India and Brazil.

The company should also gain from acquisitions and increased adoption of its digital platform. It continues to expand its footprint in Brazil through acquisitions. The company expanded its network through the completion of 21 retail acquisitions in 2022 with a focus on expanding its Brazil network.

Cost and operational efficiency initiatives are also expected to aid the company’s performance. Nutrien remains focused on lowering the cost of production in the potash business. Moreover, the company has announced a number of strategic actions to reduce its controllable costs and boost free cash flow this year and beyond. Lower natural gas costs are also contributing to a decline in its cost of goods sold.

However, weaker fertilizer prices are expected hurt NTR’s performance. Prices of phosphate and potash have retreated since the back half of 2022 from their peak levels attained in the first half riding on the impacts of the Russia-Ukraine war and disruptions due to the sanctions in Belarus. Global nitrogen prices have declined since the beginning of 2023 driven by a rise in global supply availability. Lower prices are expected to weigh on the company’s profitability in 2023.

Nutrien Ltd. Price and Consensus

Nutrien Ltd. price-consensus-chart | Nutrien Ltd. Quote

Stocks to Consider

Better-ranked stocks worth a look in the basic materials space include Denison Mines Corp. DNN, Axalta Coating Systems Ltd. AXTA and The Andersons Inc. ANDE.

Denison Mines has a projected earnings growth rate of 100% for the current year. DNN has a trailing four-quarter earnings surprise of roughly 225%, on average. The stock is up around 61% in a year. It currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, the Zacks Consensus Estimate for Axalta Coating Systems’ current year has been revised upward by 8.2%. AXTA, carrying a Zacks Rank #1, beat the Zacks Consensus Estimate in three of the last four quarters while missing in one quarter, with the average earnings surprise being 6.7%. The company’s shares have gained around 21% in the past year.

Andersons currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for ANDE's current-year earnings has been revised 5.1% upward over the past 60 days. Andersons beat the Zacks Consensus Estimate in three of the last four quarters. It delivered a trailing four-quarter earnings surprise of 32.8%, on average. ANDE shares have rallied roughly 45% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Denison Mine Corp (DNN) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report

Nutrien Ltd. (NTR) : Free Stock Analysis Report