Nutrien's (NTR) Earnings and Sales Surpass Estimates in Q3

Nutrien Ltd. NTR logged profits of $726 million or $1.25 per share in third-quarter 2021 versus a loss of $587 million or $1.03 in the year-ago quarter.

Barring one-time items, adjusted earnings per share (EPS) were $1.38. The bottom line topped the Zacks Consensus Estimate of $1.23.

Sales rose roughly 43.3% year over year to $6,024 million in the quarter. The figure beat the Zacks Consensus Estimate of $5,742 million. The company benefited from higher sales across all the segments, driven by strategic actions and strong demand for crop inputs in the reported quarter.

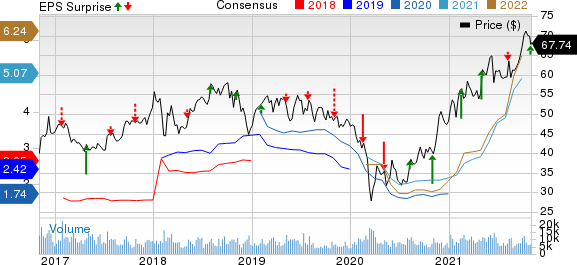

Nutrien Ltd. Price, Consensus and EPS Surprise

Nutrien Ltd. price-consensus-eps-surprise-chart | Nutrien Ltd. Quote

Segment Highlights

Sales in the Nutrien Ag Solutions segment rose about 22% year over year to $3,347 million in the quarter. Sales of crop nutrients increased significantly in the quarter on record sales volumes and higher prices. Sales of crop protection products also increased owing to higher selling prices, market share growth and higher proprietary product sales.

Potash division’s sales increased around 101% year over year to $1,188 million driven by higher sales volumes and higher net realized selling prices. Sales volumes in the segment were driven by reliable supply as well as integrated transportation and logistics system. The selling prices increased on the back of higher demand and tight supply.

Sales in the Nitrogen segment were $973 million, up around 121% year over year. The upside can be attributed to higher net realized selling prices, which offset increased natural gas costs. Sales volume increased due to strong market demand and higher availability from its facility. Prices of nitrogen rose on strength in global agriculture markets, recovery in industrial nitrogen demand, global production outages and higher energy prices in major nitrogen exporting regions.

Sales in the Phosphate segment were $401 million, up around 51% year over year on the back of higher net realized selling prices. Sales volumes fell partly due to the timing of sales.

Financials

At the end of the quarter, Nutrien had cash and cash equivalents of $443 million, down around 4.7% year over year. Long-term debt rose modestly year over year to $10,094 million.

The company generated $2.8 billion in free cash flow in the first three quarters of 2021.

Outlook

The company raised its adjusted net earnings per share (EPS) and adjusted EBITDA guidance to $5.85-$6.10 (previously $4.6-$5.1) and $6.9-$7.1 billion (previously $6-$6.4 billion), respectively, for full-year 2021. It expects strong demand for crop inputs in the fourth quarter as well as tight global fertilizer supply and demand fundamentals to continue into 2022.

Price Performance

Shares of Nutrien have gained 76% in the past year compared with a 76.4% rise of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Nutrien currently sports a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks in the basic materials space are Nucor Corporation NUE, The Chemours Company CC and Olin Corporation OLN.

Nucor has a projected earnings growth rate of around 583.5% for the current year. The company’s shares have soared 128.4% in a year. It currently sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Chemours has an expected earnings growth rate of around 86.9% for the current year. The company’s shares have gained 38.3% in the past year. It currently carries a Zacks Rank #2 (Buy).

Olin has an expected earnings growth rate of around 740% for the current year. The company’s shares have surged 233.5% in the past year. It currently flaunts a Zacks Rank #1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nucor Corporation (NUE) : Free Stock Analysis Report

Olin Corporation (OLN) : Free Stock Analysis Report

The Chemours Company (CC) : Free Stock Analysis Report

Nutrien Ltd. (NTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research