NV5 Global Inc (NVEE) Reports Growth Amid Challenges, Sets Sights on $1 Billion Revenue Run Rate

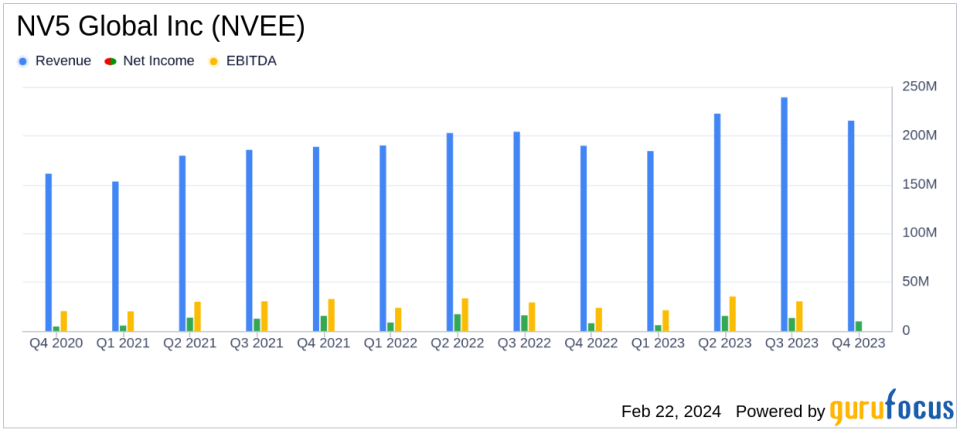

Gross Revenues: Q4 saw a 14% increase to $215.5 million, with full-year revenues up 10% to $861.7 million.

Net Income: Q4 net income rose 24% to $9.9 million, while full-year net income fell 11% to $44.6 million.

Adjusted EBITDA: Increased by 15% in Q4 to $37.3 million and by 2% for the full year to $137.9 million.

EPS: GAAP EPS for Q4 increased by 23% to $0.64, full-year GAAP EPS decreased by 12% to $2.88.

Adjusted EPS: Decreased by 6% in Q4 to $1.14 and by 7% for the full year to $4.81.

Cash Flows: Operating activities generated a 23% increase in cash flows for Q4, totaling $16,772.

2024 Guidance: Projected gross revenues between $930 million and $935 million, with GAAP EPS between $2.86 and $2.92.

On February 22, 2024, NV5 Global Inc (NASDAQ:NVEE), a leading provider of professional and technical engineering and consulting solutions, released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 30, 2023. The company, which serves clients across public and private sectors with a focus on infrastructure, utility services, and geospatial markets, has reported a solid performance despite facing headwinds such as federal project delays.

Financial Performance and Challenges

NV5 Global Inc (NASDAQ:NVEE) has demonstrated resilience in its fourth quarter, achieving a 14% growth in gross revenues compared to the same period in 2022. This growth is attributed to the company's strategic initiatives, including seven acquisitions that expanded its geospatial data analytics and software offerings. Despite the increase in revenues, the company faced challenges, such as an 11% decrease in net income for the full year, primarily due to increased interest expenses from higher rates and debt related to acquisitions. Nevertheless, the company has successfully reduced its net leverage to 1.2x, indicating a strong financial position.

Financial Achievements and Industry Significance

The company's financial achievements, particularly the growth in infrastructure and transportation sectors, are significant as they reflect NV5 Global Inc (NASDAQ:NVEE)'s ability to adapt and thrive in a competitive construction industry. The 24% increase in Q4 net income and the 15% rise in adjusted EBITDA are testaments to the company's operational efficiency and its focus on high-margin projects. These achievements are crucial for NV5 as they bolster the company's market position and investor confidence, especially when aiming for a $1 billion revenue run rate by the end of 2024.

Key Financial Metrics

Examining the key financial metrics, NV5 Global Inc (NASDAQ:NVEE) reported a 23% increase in GAAP EPS for the fourth quarter, although the full-year GAAP EPS saw a 12% decrease. Adjusted EPS, which excludes certain non-recurring items, decreased by 6% in Q4 and by 7% for the full year. The company's balance sheet remains robust, with cash and cash equivalents totaling $44.8 million at the end of 2023, an increase from $38.5 million in the previous year. These metrics are important as they provide insights into the company's profitability, liquidity, and overall financial health.

"NV5 delivered strong results in the fourth quarter and 14% growth over the same period in 2022, despite headwinds from continuing resolution federal project delays. Our growth initiatives in the core business are driving growth in infrastructure and transportation, and our buildings business continues to deliver strong organic growth both domestically and internationally. We completed seven acquisitions in 2023, including the expansion of our geospatial data analytics and software offerings to increase subscription-based revenues. These strategic actions taken in 2023 have positioned NV5 for accelerated organic growth in 2024, and we are well positioned to achieve our $1 billion revenue run rate by the end of the year," said Dickerson Wright, PE, Chairman and CEO of NV5.

Analysis of Company Performance

The company's performance in 2023, particularly the robust growth in the fourth quarter, suggests that NV5 Global Inc (NASDAQ:NVEE) is on a positive trajectory despite the challenges faced throughout the year. The strategic acquisitions and expansion into new service offerings are likely to contribute to sustainable growth. The company's guidance for 2024 indicates confidence in its ability to continue this momentum, with projected increases in both gross revenues and EPS.

For investors and stakeholders, NV5 Global Inc (NASDAQ:NVEE)'s commitment to expanding its market presence and enhancing shareholder value through strategic initiatives and financial discipline is a promising sign. The company's focus on high-margin projects and subscription-based revenues is expected to drive profitability and support its ambitious revenue target for the coming year.

For more detailed information and analysis on NV5 Global Inc (NASDAQ:NVEE)'s financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from NV5 Global Inc for further details.

This article first appeared on GuruFocus.