Nvidia led Phase 1 of the AI trade, and these are the next three, says Goldman Sachs

A pick up in Treasury yields following slightly hotter-than-expected consumer and producer prices inflation data this week has given equity traders pause for thought.

Most Read from MarketWatch

Nvidia led Phase 1 of the AI trade, and these are the next three, says Goldman Sachs

Nvidia is no longer Wall Street’s favorite stock. This company is.

Zero. That’s how much 28% of the country has saved for retirement.

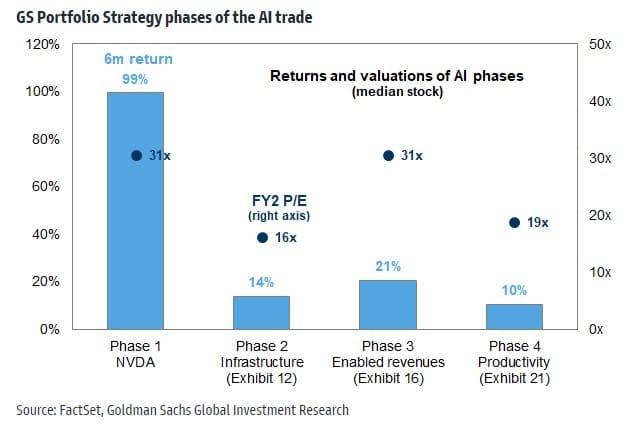

Indications that some froth has come off the top of Nvidia’s stock NVDA is also weighing on sentiment somewhat. Still, the chipmaker remains up 77.6% since the start of the year, and its consolidation likely only represents investors moving on to examine the next winners in the AI secular growth story, suggests Goldman Sachs.

“In addition to NVDA, investors frequently ask about potential beneficiaries as the AI trade broadens,” said a team of equity strategists at Goldman led by Ryan Hammond.

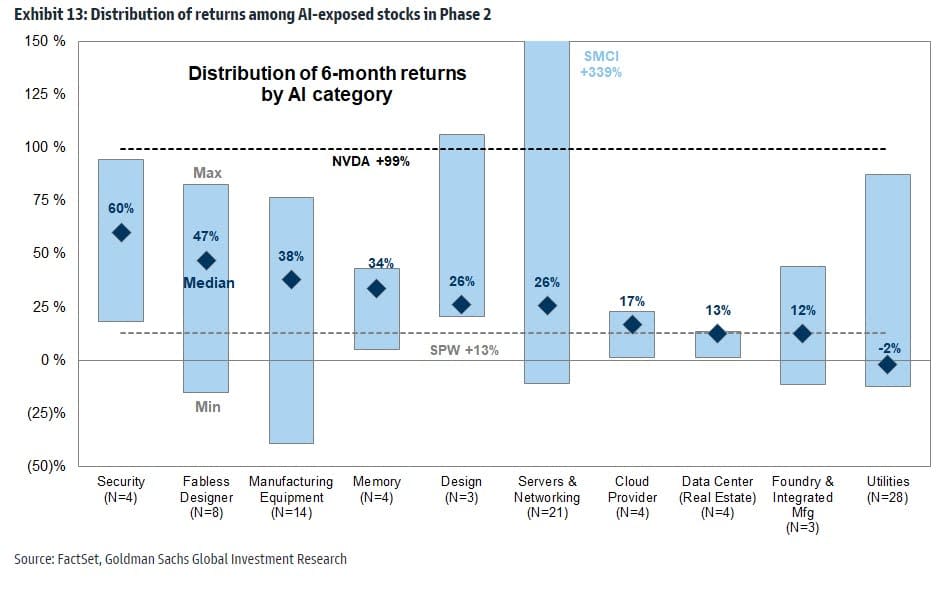

In a new note released late Thursday, the Goldman team say there are three more phases to consider. The second is infrastructure, which will focus on companies other than Nvidia that are involved in the infrastructure necessary to build AI. “Based on our framework, this phase includes semiconductor firms, cloud providers, data center REITs, hardware and equipment companies, security software stocks, and utilities companies,” says Goldman.

Most Phase 2 companies have already seen valuation expansions, but earnings revisions have varied widely. Aside from the mega-caps on many investors’ radar, they include: Synopsys SNPS, Monolithic Power Systems MPWR, KLA KLAC, American Tower AMT, and Vertiv VRT.

The third phase is what Goldman terms enabled revenues, and will focus on AI-enabled companies with business models that can incorporate AI in product offerings to boost revenues. “This phase aligns with management commentary and stock performance of many software and IT services companies,” says the Goldman team.

Again, away from the well-known big companies like Meta Platforms META, the list of such stocks includes Cloudflare NET, Autodesk ADSK, MongoDB MDB and Nutanix NTNX.

The typical Phase 3 stock in Goldman’s screen has returned 8% year-to-date: “The outperformance of these stocks, while driven by many factors other than exclusively AI, suggests investors have begun to trade Phase 3 already,” Goldman notes.

Finally, Phase 4 relates to productivity gains, and will focus on all companies harnessing AI technology to improve productivity. The largest potential efficiency gains will come in labor-intensive industries with jobs more exposed to AI automation, such as software and services and commercial and professional services.

Goldman has a Long-Term AI basket which it says offers investors a list of stocks with the largest potential upside from such AI-induced labor productivity and it includes New York Times NYT, Amazon.com AMZN, Walmart WMT, Fidelity National Financial FNF, Tenet Healthcare THC and Guidewire Software GWRE.

“We expect investors will trade Phase 2 and Phase 3 faster than Phase 4, as many companies in these two phases are necessary for every other company to use the technology to improve productivity. The median stock in Phase 2 trades at 16x forward earnings, compared with 31x for Phase 3 and 19x for Phase 4,” says Goldman.

Markets

U.S. stock-index futures ES00 YM00 NQ00 are lower as benchmark Treasury yields BX:TMUBMUSD10Y reverse earlier declines to trade little changed on the day. The dollar DXY is steady, while oil prices CL.1 slip and gold GC00 trades around $2,160 an ounce.

For more market updates plus actionable trade ideas for stocks, options and crypto, .

The buzz

The Empire State manufacturing survey for March tumbled to minus 20.9, way lower than February’s minus 2.4 and forecasts of minus 7. Industrial production rose 0.1% month-on-month in February, rebounding from January’s 0.5% contraction.

Michigan Consumer sentiment for March was 76.5 against forecasts of 77.1, and lower than February’s 76.9.

It’s a triple-witching Friday, with options tied to more than $5 trillion in stocks, exchange-traded funds and equity indexes set to expire.

Adobe shares ADBE are down 12% and Ulta Beauty stock ULTA is dropping nearly 7% after solid results from the pair after Wednesday’s close were still not able to match investors hopes.

Shares in trading platform Coinbase Global COIN are down nearly 2% as Bitcoin BTCUSD continues its retreat from recent highs, dropping below $67,000 in early trading.

Japan’s unions won wage hikes of more than 5% in this year’s pay round, an increase which is the highest in 33 years and which would justify the Bank of Japan exiting negative interest rates at its meeting next week.

Best of the web

These professionals aren’t retired, they just have zero to prove.

An $80 billion crash in India’s small caps flashes warning signs.

Hundreds rescued from love scam center in the Philippines.

The chart

Uh oh, this isn’t good. Swiss chocolate maker Lindt this week warned that those candy Easter bunnies you like to scoff will be more expensive this year. The chart below shows why. Low production in west Africa has caused the price of cocoa to surge to a record high above $7,500 a ton.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

Ticker | Security name |

NVDA | Nvidia |

TSLA | Tesla |

FSR | Fisker |

MSTR | MicroStrategy |

TSM | Taiwan Semiconductor Manufacturing |

AAPL | Apple |

AMD | Advanced Micro Devices |

SOUN | SoundHound AI |

ADBE | Adobe |

MSFT | Microsoft |

Random reads

Need to Know starts early and is updated until the opening bell, but to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Check out On Watch by MarketWatch, a weekly podcast about the financial news we’re all watching – and how that’s affecting the economy and your wallet. The latest episode is on the uneven and unequal job market.