Can Nvidia Stock Top $600 in 2024?

Nvidia (NASDAQ: NVDA) has been one of the top stocks to own in 2023, rising from $142 to around $480 now -- about a 230% gain. I don't think anyone is expecting Nvidia stock to repeat its performance of last year and triple its size; if it did, it would become the world's largest company by market cap.

Still, many wonder if Nvidia can once again be a top stock in the market and reach $600 in 2024, which would be about a 25% return. That's still a phenomenal year by most standards, but is it realistic?

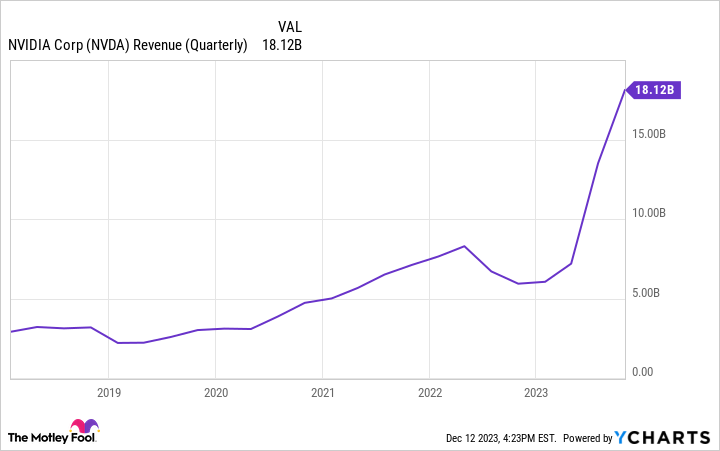

Nvidia posted astonishing growth rates in 2023

Nvidia's rise in 2023 resulted from one thing: the artificial intelligence (AI) arms race. Creating an AI model takes immense computing power, and Nvidia's GPUs (graphics processing units) are the hardware of choice for the job. While consumers may buy a single GPU to power their gaming computer, businesses creating a supercomputer or data center purchase thousands of these GPUs. By linking these devices together, an incredibly powerful computer can be created.

For example, Tesla's Dojo supercomputer, which it uses to train its full self-driving model, has 10,000 H100 GPUs connected. At about $30,000 a piece for a single H100, Tesla paid Nvidia about $300 million to outfit its supercomputer.

Tesla is just one customer; countless others are rushing to outfit their supercomputers and data centers to capitalize on the AI gold rush. As a result, Nvidia's revenue boomed throughout the year.

Period | Revenue | YOY Growth |

|---|---|---|

Q1 FY 2024 | $7.19 billion | (13%) |

Q2 FY 2024 | $13.5 billion | 102% |

Q3 FY 2024 | $18.1 billion | 206% |

Q4 FY 2024 | $20 billion (projected) | 231% |

Data source: Nvidia. YOY = year over year.

Once the results for the fourth quarter of fiscal 2024 and Q1 FY 2025 are in, Nvidia will have lapped this GPU boom, and investors will be able to see how the company is truly valued. Right now, Nvidia trades at an expensive 63 times earnings. Should Nvidia meet its $20 billion guidance for Q4 and deliver a similar profit margin as in Q3, then repeat the quarter in Q1, Nvidia would have about $35.8 billion in net income.

If you divide its market cap by that figure, you'd get a forward earnings valuation of 33, which isn't so bad.

So, the stock should look reasonably priced once Nvidia completes a full year with this elevated business. But the question is, how long can it maintain its current business pace?

When will the demand boom for Nvidia's GPU end?

As mentioned above, Tesla spent $300 million on its supercomputer. But it has no plans to build a second computer to rival the original one. Because Nvidia is a hardware business and not a subscription one, customers don't necessarily have to return for more once they've made their initial purchase.

This is a brewing problem for Nvidia and its stock. This demand cycle has bitten Nvidia before, as it dealt with a supply glut created by the crypto fallout in 2019 and 2022.

The hardest thing to determine is the market size for Nvidia's top-end GPUs used by those constructing supercomputers or data centers. If we're nearing the limit, Nvidia could have a disaster in 2024 as the stock would plummet.

On the flip side, if it's five years before this demand slows, then not owning Nvidia stock would be a huge mistake.

As a result, I'm in a wait-and-see mode for Nvidia. I'd like to see the company lap one year of accelerated business before investing in the stock again, as I sold my shares earlier this year after a strong gain (a big mistake on my part). However, if Nvidia is an outsized part of your portfolio, I would consider trimming the stock a bit, as it could be a dramatic fall from grace if demand goes away in 2024.

So, could Nvidia hit $600 in 2024? I'd say yes. But it could also crash to $200 or $300 if demand disappears.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now... and Nvidia wasn't one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 11, 2023

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Can Nvidia Stock Top $600 in 2024? was originally published by The Motley Fool