NVR Inc (NVR) Reports Decrease in Q4 and Full Year Earnings Amidst Market Challenges

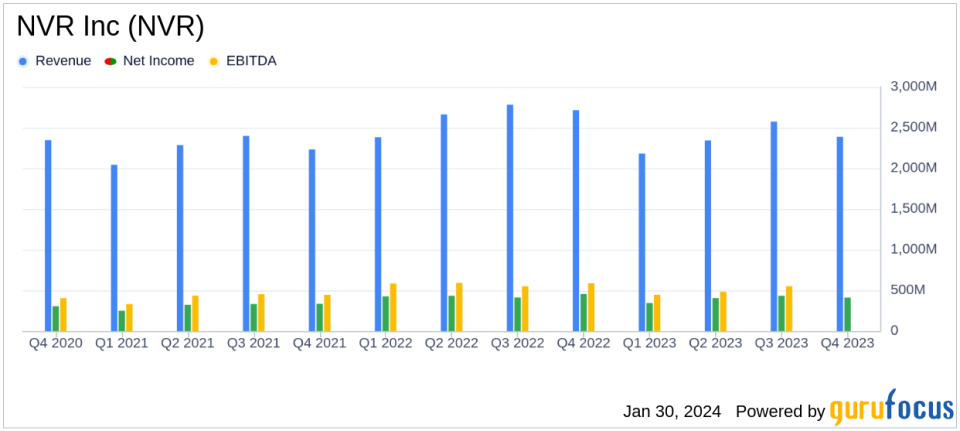

Net Income: Q4 net income fell by 10% to $410.1 million, and full-year net income decreased by 8% to $1.59 billion.

Revenue: Q4 consolidated revenues dropped by 10% to $2.43 billion, with a full-year decline of 10% to $9.52 billion.

Earnings Per Share (EPS): Diluted EPS for Q4 decreased by 9% to $121.56, and full-year EPS was down by 6% to $463.31.

New Orders: Q4 new orders increased by 25% to 5,190 units, but the average sales price of new orders decreased by 2%.

Gross Profit Margin: Gross profit margin for Q4 decreased to 24.1%, and for the full year, it decreased to 24.3%.

Mortgage Banking: Income before tax from the mortgage banking segment increased by 12% in Q4 and 9% for the full year.

Effective Tax Rate: The effective tax rate for Q4 was 15.3%, and for the full year, it was 17.5%, reflecting a decrease from the previous year.

On January 30, 2024, NVR Inc (NYSE:NVR), a prominent homebuilding and mortgage banking company, released its 8-K filing, disclosing its financial results for the fourth quarter and full year ended December 31, 2023. The company reported a decrease in net income and diluted earnings per share for both the quarter and the year, reflecting broader market challenges despite a rise in new orders.

NVR Inc operates in over 33 metropolitan areas across the eastern United States, constructing single-family detached homes, townhomes, and condominiums under the Ryan Homes, NVHomes, and Heartland Homes brands. The company's unique approach to avoiding direct land development activity distinguishes it among public homebuilders and contributes to its relatively high return metrics. NVR also operates a mortgage banking segment, providing services to support its homebuilding operations.

Financial Performance Overview

The company's financial performance in the fourth quarter showed a 10% decrease in net income to $410.1 million and a 9% decrease in diluted earnings per share to $121.56, compared to the same quarter in the previous year. Full-year net income also saw a decline of 8% to $1.59 billion, with diluted earnings per share decreasing by 6% to $463.31. These declines were accompanied by a 10% reduction in consolidated revenues for both the quarter and the year.

Despite the downturn in revenue and earnings, NVR Inc experienced a 25% increase in new orders during the fourth quarter, signaling potential for future growth. However, the average sales price of these new orders decreased by 2%, and settlements in the fourth quarter decreased by 7% to 5,332 units. The company's backlog of homes sold but not settled as of December 31, 2023, increased by 12% to 10,229 units, with a dollar value increase of 10% to $4.76 billion.

Segment Performance and Challenges

The homebuilding segment's revenues of $2.39 billion in the fourth quarter represented an 11% decrease compared to the same period in the previous year. The gross profit margin also decreased to 24.1%, and income before tax from the homebuilding segment decreased by 17% to $454.3 million. For the full year, homebuilding revenues totaled $9.31 billion, a 10% decrease from 2022, with a gross profit margin decrease to 24.3% and a 16% decrease in income before tax to $1.80 billion.

The mortgage banking segment, on the other hand, showed resilience with a 12% increase in income before tax to $29.7 million in the fourth quarter and a 9% increase for the full year to $132.8 million. This performance came despite a slight decrease in mortgage closed loan production for the quarter and year.

The company's effective tax rate for the fourth quarter was 15.3%, and for the full year, it was 17.5%, primarily due to a higher income tax benefit recognized for excess tax benefits from stock option exercises.

Value investors may note that while NVR Inc faces challenges such as a decrease in average sales prices and settlements, the increase in new orders and a strong backlog could position the company for recovery as market conditions evolve. The lower effective tax rate and the mortgage banking segment's improved performance also provide some positive aspects to the company's financial health.

For a more detailed analysis of NVR Inc's financial results and potential investment insights, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from NVR Inc for further details.

This article first appeared on GuruFocus.