NXP Semiconductors NV (NXPI) Posts Modest Revenue Growth Amidst Market Challenges

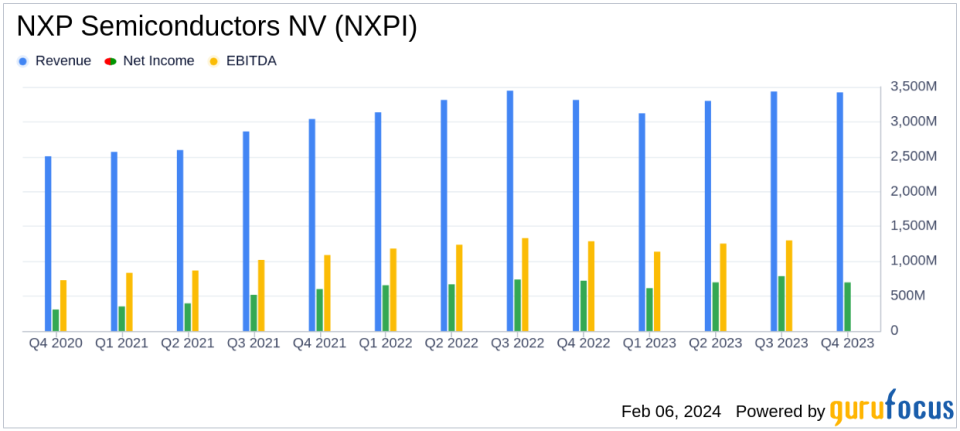

Revenue: Full-year revenue increased by 1% to $13.28 billion, with Q4 revenue up 3% year-on-year to $3.42 billion.

Profitability: Full-year GAAP gross margin remained stable at 56.9%, with non-GAAP gross margin at 58.5%.

Earnings Per Share (EPS): GAAP diluted EPS for the full year was $10.70, with non-GAAP diluted EPS at $14.01.

Free Cash Flow: Non-GAAP free cash flow for the year was a robust $2.69 billion.

Capital Return: Capital return to shareholders totaled $2.06 billion, representing 77% of non-GAAP free cash flow.

Strategic Investments: Investments in Zendar Inc. and new product introductions like the S32M2 and Trimension NCJ29D6 highlight NXP's commitment to innovation.

Guidance: Q1 2024 revenue is expected to be between $3.025 billion and $3.225 billion, with non-GAAP gross margin projected between 57.5% and 58.5%.

On February 6, 2024, NXP Semiconductors NV (NASDAQ:NXPI) released its 8-K filing, announcing its financial results for the fourth quarter and full-year 2023. The company, a leading supplier of high-performance mixed-signal products, reported a full-year revenue of $13.28 billion, marking a 1% increase from the previous year. The fourth quarter saw a revenue of $3.42 billion, a 3% year-on-year increase, which was above the mid-point of the company's guidance range.

Financial Performance and Market Position

NXP Semiconductors NV (NASDAQ:NXPI) has demonstrated resilience in a challenging semiconductor market, achieving solid results throughout 2023. The company's consistent gross margin and healthy free cash flow generation underscore its strong execution capabilities. NXP's strategic investments and product launches, such as the collaboration with Zendar Inc. and the introduction of the S32M2 motor control solution, reflect its commitment to maintaining technological and market leadership, particularly in the automotive radar sector.

Financial Highlights and Challenges

The company's financial achievements, including a stable gross margin and a significant return of capital to shareholders, are crucial in a competitive semiconductor industry. NXP's ability to generate a substantial free cash flow of $2.69 billion and return 77% of it to shareholders through dividends and share repurchases is a testament to its financial health and commitment to shareholder value. However, the modest revenue growth indicates the challenges faced by the semiconductor industry, including trade disputes and supply chain disruptions.

Analysis of Financial Statements

From the income statement, we observe that the GAAP operating margin for the full year was 27.6%, with a non-GAAP operating margin of 35.1%. The balance sheet reflects a strong liquidity position, with $3.86 billion in cash and cash equivalents as of December 31, 2023. The cash flow statement shows robust operations, with $3.51 billion in cash flow from operations for the full year.

Key financial metrics such as the cash conversion cycle and channel inventory levels are important indicators of NXP's operational efficiency and market demand fulfillment. The cash conversion cycle stood at 84 days, and channel inventory was maintained at 1.5 months, ensuring readiness to meet customer demand without overstocking.

"We are navigating a soft landing by managing what is in our control, especially limiting over shipment of products to customers," said Kurt Sievers, NXP President and Chief Executive Officer.

Looking ahead, NXP has provided guidance for the first quarter of 2024, with expected revenue in the range of $3.025 to $3.225 billion and a non-GAAP gross margin between 57.5% and 58.5%. This forward-looking approach, combined with the company's strategic investments and product innovations, positions NXP to continue navigating the complex semiconductor market landscape.

For a more detailed analysis of NXP Semiconductors NV (NASDAQ:NXPI)'s financial results and to access the full 8-K filing, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from NXP Semiconductors NV for further details.

This article first appeared on GuruFocus.