NY Times (NYT) Gets a Boost on Surge in Subscription Revenues

The New York Times Company NYT has been thriving amid a tough operating environment, thanks to sustained growth in subscriber count and strategic transformation. The addition of new revenue streams, diversification of business, cost optimization and streamlining of operations are some of the key initiatives that the company has been focusing on. The company is promoting a more strategic bundled subscription offering to boost revenues.

This New York-based company has evolved with changing times by capitalizing on technological advancements to connect with the target audience efficiently. The company’s acquisitions of the product review website, Wirecutter, and the digital subscription-based sports media business, The Athletic, have significantly broadened its reach and expanded its potential market.

Subscription Revenues Fueling Growth

The New York Times Company concluded the first quarter of 2023 with roughly 9.73 million paid subscribers across its print and digital products. Of the 9.73 million subscribers, approximately 9.02 million were paid digital-only subscribers. The company registered net growth of 190,000 digital-only subscribers in comparison to the preceding quarter, and an impressive increase of 790,000 digital-only subscribers compared with the prior-year period.

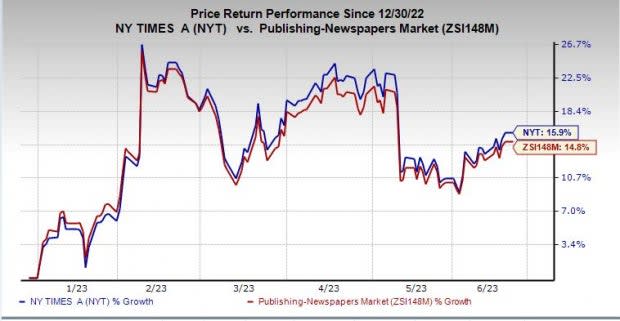

Image Source: Zacks Investment Research

In the quarter under discussion, subscription revenues showcased growth of 6.9% year over year to $397.5 million. This can be attributed to an increase in the number of subscribers of the company’s digital-only offerings, the benefits of subscriptions graduating to higher pricing tiers from initial promotional rates, and increased revenues from The Athletic stand-alone subscriptions. We note that subscription revenues from digital-only products experienced a substantial increase of 14.1% to $258.8 million.

Management anticipates 6-8% increase in subscription revenues for the second quarter of 2023, with a promising projection of 12-15% increase in digital-only subscription revenues.

Key Takeaway

With rapid digitization in the core areas of advertising and readers increasingly gravitating toward online sources, newspaper companies have been reallocating resources to focus on online publications. The New York Times Company has demonstrated unwavering attempts to rapidly acclimatized to the changing face of the multiplatform media industry. The company has been enhancing its reach through strategic buyouts and investments in games, sports and lifestyle. It has an ambitious vision to achieve 15 million subscribers by 2027.

Shares of this Zacks Rank #3 (Hold) company have advanced 15.9% year to date compared with the industry’s growth of 14.8%.

3 Stocks Worth Looking

Some better-ranked stocks are Meta Platforms META, Reservoir Media RSVR and Pearson plc PSO.

Meta Platforms, the world’s largest social media platform, sports a Zacks Rank #1 (Strong Buy). META has a trailing four-quarter earnings surprise of 15.5%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Meta Platforms’ current financial-year revenues and EPS suggests growth of 9% and 21.5%, respectively, from the year-ago period. META has an expected EPS growth rate of 21.9% for three to five years.

Reservoir Media, which operates as a music publishing company, currently carries a Zacks Rank #1. The expected EPS growth rate for three to five years is 10%.

The Zacks Consensus Estimate for Reservoir Media’s current financial-year revenues and EPS suggests growth of 6.3% and 153.9%, respectively, from the year-ago reported figure. RSVR has a trailing four-quarter earnings surprise of 10%, on average.

Pearson, a global educational publishing and services company, currently carries a Zacks Rank #2. The expected EPS growth rate for three to five years is 10.6%.

The Zacks Consensus Estimate for Pearson’s current financial-year revenues and EPS suggests growth of 1.2% and 12.5%, respectively, from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The New York Times Company (NYT) : Free Stock Analysis Report

Pearson, PLC (PSO) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Reservoir Media, Inc. (RSVR) : Free Stock Analysis Report