NY Times' (NYT) Phenomenal Success Fueled by Subscriber Growth

The New York Times Company NYT has achieved notable success in the face of operational challenges, driven by an expanding subscriber base and a well-executed strategic transformation. The company's commitment to diversifying revenue sources, optimizing expenses and streamlining operations has played a pivotal role in its performance. To enhance revenues even further, The New York Times Company is actively promoting a more strategic bundled subscription offering.

Rooted in New York, this company has leveraged technological advancements to forge robust connections with its audience. Through strategic acquisitions like Wirecutter, a platform for product reviews, and The Athletic, a digital sports media business operating on a subscription model, the company has substantially broadened its reach and unlocked novel market opportunities. As The New York Times Company continues to adapt and innovate, its prospects remain promising in the dynamic media landscape.

Let’s Delve Deep

The New York Times Company concluded the second quarter of 2023 with roughly 9.88 million subscribers across its print and digital products. Of the 9.88 million subscribers, approximately 9.19 million were digital-only subscribers. Of the digital-only subscribers, about 3.30 million were bundle and multiproduct subscribers. There was a net increase of 180,000 and 780,000 digital-only subscribers compared with the preceding quarter and the second quarter of 2022, respectively.

During the quarter under discussion, subscription revenues of $409.6 million grew 6.8% year over year. The upside can be attributed to the increase in the number of subscribers who are paying higher prices, more individuals subscribing to the company's digital-only products and others upgrading to bundle packages. We note that subscription revenues from digital-only products jumped 13% to $269.8 million.

Image Source: Zacks Investment Research

Impressively, there has been a noticeable improvement in subscription revenues compared to the prior-year quarter. The average revenue per user for digital-only subscriptions increased to $9.15 in the second quarter from $9.04 in the preceding quarter and $8.83 in the same period last year.

Management envisions third-quarter 2023 total subscription revenues to increase about 8-10%, with digital-only subscription revenues anticipated to rise approximately 14-17%.

Wrapping Up

With rapid digitization in the core areas of advertising and readers increasingly gravitating toward online sources, newspaper companies have been reallocating resources to focus on online publications. The New York Times Company has demonstrated unwavering attempts to rapidly acclimatize to the changing face of the multiplatform media industry.

On the digital advertising front, there has been a notable improvement. In the second quarter, digital advertising revenues increased 6.5% to $73.8 million. This can be attributed to higher revenues from direct-sold and open-market programmatic advertising. For the third quarter of 2023, The New York Times Company expects digital advertising revenues to increase in the mid-single-digits.

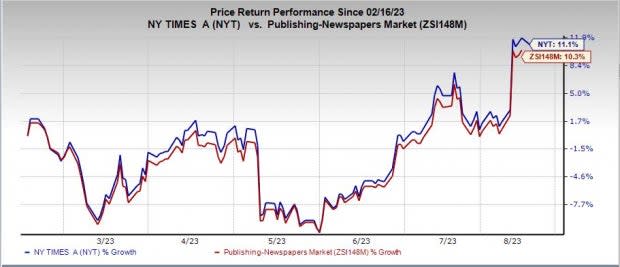

Shares of this Zacks Rank #1 (Strong Buy) company have advanced 11.1% in the past six months compared with the industry’s growth of 10.3%. You can see the complete list of today’s Zacks #1 Rank stocks here.

3 More Stocks Worth Looking

Some favorably-ranked stocks are StoneCo Ltd. STNE, Reservoir Media RSVR and Pearson plc PSO.

StoneCo, a leading provider of financial technology and software solutions, carries a Zacks Rank #2 (Buy) and has an expected EPS growth rate of 55.2% for three to five years. The company has a trailing four-quarter earnings surprise of 11.8%, on average.

The Zacks Consensus Estimate for StoneCo’s current financial-year sales and EPS suggests growth of 4.4% and 115.2%, respectively, from the year-ago period.

Reservoir Media, which operates as a music publishing company, carries a Zacks Rank #2. RSVR has a trailing four-quarter earnings surprise of 10%, on average.

The Zacks Consensus Estimate for Reservoir Media’s current financial-year revenues calls for growth of 8.2% from the year-ago period. RSVR has an expected EPS growth rate of 10% for three to five years.

Pearson, a global educational publishing and services company, currently carries a Zacks Rank #2. The expected EPS growth rate for three to five years is 10.2%.

The Zacks Consensus Estimate for Pearson’s current financial-year revenues and EPS implies growth of 1.2% and 14.1%, respectively, from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The New York Times Company (NYT) : Free Stock Analysis Report

Pearson, PLC (PSO) : Free Stock Analysis Report

StoneCo Ltd. (STNE) : Free Stock Analysis Report

Reservoir Media, Inc. (RSVR) : Free Stock Analysis Report