NY Times (NYT) Q3 Earnings Top, Subscription Revenues Up Y/Y

The New York Times Company NYT continued with its impressive performance in the third quarter of 2023. The company's adjusted earnings per share came in at 37 cents, surpassing the Zacks Consensus Estimate of 29 cents. This marked a substantial 54.2% increase from the year-ago reported number.

Total revenues reached $598.3 million, surpassing the Zacks Consensus Estimate of $590 million and registering top-line growth of 9.3% year over year. This reflects the company's ability to effectively capitalize on the changing media landscape.

The New York Times Company added approximately 210,000 net digital-only subscribers compared with the end of the second quarter, propelled by bundle and multi-product subscriber additions. This surge in subscribers pushed the company's total subscriber count beyond the significant milestone of 10 million.

Furthermore, The New York Times Company achieved consistent growth in its digital-only average revenue per user (“ARPU”) for the fifth consecutive quarter. The ARPU increased from $8.87 in the year-ago period to an impressive $9.28. This increase in ARPU can be attributed to subscribers transitioning from promotional pricing to higher rate plans and the introduction of price hikes for tenured non-bundle subscribers.

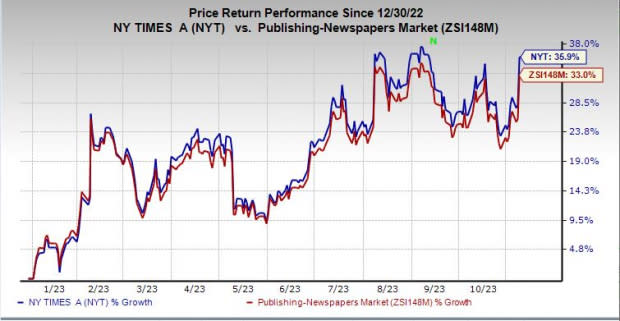

Image Source: Zacks Investment Research

Subscription Revenues Rise

Subscription revenues of $418.6 million grew 9.4% year over year. Subscription revenues from digital-only products jumped 15.7% to $282.2 million. This reflects an increase in bundle and multiproduct revenues of $44.1 million and a rise in other single-product subscription revenues of $2.2 million, partly offset by a decline in news-only subscription revenues of $8 million. Print subscription revenues dropped 1.8% to $136.3 million due to a decline in domestic home-delivery revenues.

The company ended the quarter with roughly 10.08 million subscribers across its print and digital products, including roughly 9.41 million digital-only subscribers. Of the 9.41 million subscribers, about 3.79 million were bundle and multiproduct subscribers. There was a net increase of 820,000 in digital-only subscribers compared with the third quarter of 2022.

Management envisions fourth-quarter 2023 total subscription revenues to increase about 2-5%, with digital-only subscription revenues anticipated to rise approximately 6-9% on a reported basis.

A Look at Advertising Revenues

Total advertising revenues of $117.1 million rose 6% from the prior-year period. Digital advertising revenues increased 6.7% to $75 million. This can be attributed to higher revenues from direct-sold display and open-market programmatic advertising, partly offset by lower revenues from podcasts and creative services.

Meanwhile, print advertising revenues grew 4.8% to $42.1 million in the quarter under review. The metric increased mainly in the classifieds, luxury and home furnishings categories.

Other Highlights

We note that other revenues jumped 14.9% year over year to $62.7 million during the quarter under review due to higher Wirecutter affiliate referral revenues and an increase in licensing revenues related to a Google commercial agreement.

Adjusted operating costs rose 6.2% to $508.6 million during the quarter. Management anticipates adjusted operating costs to be flat to up 2% in the fourth quarter of 2023.

The total adjusted operating profit increased 30.1% to $89.8 million during the quarter under review, while the adjusted operating margin expanded 240 basis points to 15%.

Segment Details

The New York Times Group’s revenues increased 7.6% year over year to $563.9 million. Subscription revenues rose 8.7% to $392.9 million due to growth in subscription revenues from digital-only products, partly offset by a decline in print subscription revenues. Advertising revenues grew 0.5% to $108.7 million owing to higher print advertising revenues, partly offset by lower digital advertising revenues.

Revenues totaled $34.4 million in The Athletic segment, up 45.8% year over year. Subscription revenues rose to $25.6 million from $21.2 million in the third quarter of 2022, mainly due to an increase in subscribers with The Athletic. Advertising revenues jumped to $8.4 million from $2.3 million in the third quarter of 2022, principally due to higher revenues from display advertising, which was launched at the end of the third quarter of 2022.

Financial Aspects

The New York Times Company ended the quarter with cash and marketable securities of about $587.8 million, reflecting an increase of $101.5 million from $486.3 million as of Dec 31, 2022.

The company incurred capital expenditures of about $7 million during the quarter. Management envisions capital expenditures of about $35 million in 2023.

The board of directors authorized a $150 million share repurchase program in February 2022. As of Nov 3, 2023, the company had repurchased 4,319,124 shares for about $149.5 million, and $0.5 million remained under the authorization. In February 2023, The New York Times Company’s board of directors also approved a new $250 million Class A share buyback program.

We note that this Zacks Rank #3 (Hold) stock has risen 35.9% year to date compared with the industry's growth of 33%.

3 Stocks Worth Looking

Some better-ranked stocks are Synopsys SNPS, Meta Platforms META and Snowflake SNOW.

Synopsys, which develops electronic products and software applications, carries a Zacks Rank #2 (Buy). The company has a trailing four-quarter earnings surprise of 4.2%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Synopsys’ current financial-year sales and EPS suggests growth of 14.7% and 24.6%, respectively, from the year-ago period.

Meta Platforms, the world’s largest social media platform, carries a Zacks Rank #2. META has a trailing four-quarter earnings surprise of 27.5%, on average.

The Zacks Consensus Estimate for Meta Platforms’ current financial-year revenues and EPS calls for growth of 14.2% and 43.7%, respectively, from the year-ago period.

Snowflake, which provides a cloud-based data platform for various organizations, currently carries a Zacks Rank #2. SNOW has a trailing four-quarter earnings surprise of 244.5%, on average.

The Zacks Consensus Estimate for Snowflake’s current financial-year revenues and EPS implies growth of 32.9% and 164%, respectively, from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The New York Times Company (NYT) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Snowflake Inc. (SNOW) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report