O-I Glass Inc (OI) Reports Full Year and Q4 2023 Results: A Mixed Glass of Performance

Net Sales: Increased to $7.1 billion in FY 2023, up approximately 4% year-over-year.

Adjusted Earnings Per Share (EPS): $3.09 for FY 2023, surpassing the guidance of ~$3.00.

Free Cash Flow: Reported at $130 million for FY 2023, within the forecasted range.

Debt Levels: Total debt rose to $4.9 billion at the end of 2023, from $4.7 billion in the previous year.

Q4 Performance: Adjusted EPS of $0.12 in Q4 2023, higher than the guidance of ~$0.03.

2024 Outlook: Adjusted EPS guidance set between $2.25 and $2.65, with free cash flow expected to improve to $150-$200 million.

On February 6, 2024, O-I Glass Inc (NYSE:OI), the world's largest manufacturer of glass bottles, released its 8-K filing, detailing its financial results for the full year and fourth quarter ended December 31, 2023. With a significant presence in Europe, North America, and South America, and a primary market in the beer industry, O-I Glass's performance is a bellwether for the packaging and containers sector.

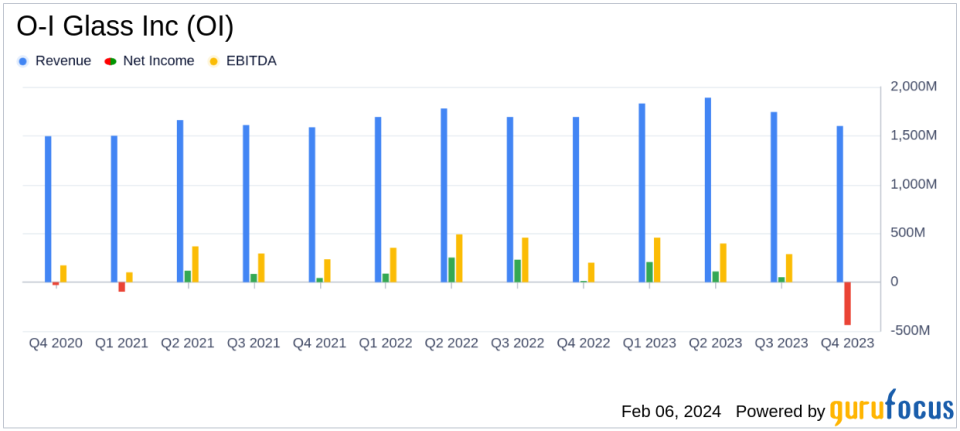

For the full year of 2023, O-I Glass reported net sales of $7.1 billion, a 4% increase from the previous year, primarily driven by higher average selling prices and favorable currency translation. However, sales volume in tons declined by 12% due to inventory de-stocking and modestly softer consumer consumption. The company faced a reported net loss of $0.67 per share, compared to a net earning of $3.67 per share in 2022, largely due to a $445 million goodwill impairment charge in its North America reporting unit and the absence of a one-time gain from 2022 sales-leaseback transactions.

Financial Highlights and Challenges

Despite the reported net loss, O-I Glass's adjusted earnings were $3.09 per share, exceeding the anticipated $3.00 per share. This figure reflects the company's ability to navigate softer macroeconomic conditions and execute margin expansion initiatives, which yielded the strongest results in the program's seven-year history. The segment operating profit increased to $1,193 million in 2023, up from $960 million in the prior year.

Operating cash flow was robust at $818 million, a significant improvement from $154 million in 2022, which included a one-time payment for the Paddock Trust. Free cash flow was reported at $130 million, within the guided range of $100 to $150 million, despite elevated capital expenditures of $688 million.

O-I Glass's total debt increased slightly to $4.9 billion, with net debt at $4.0 billion. The balance sheet is considered to be in its best position in nearly a decade, according to CEO Andres Lopez.

Looking Ahead: 2024 Outlook

For 2024, O-I Glass anticipates adjusted earnings per share in the range of $2.25 to $2.65, with an expected low-to-mid single digit volume growth. The company aims to maintain 75% of the favorable net price realized over the past two years and expects free cash flow to improve to between $150 million and $200 million.

The guidance reflects management's current view on sales and production volume, mix, working capital trends, and assumes foreign currency rates as of January 31, 2024, with an adjusted effective tax rate of approximately 25 to 27 percent.

O-I Glass's earnings call is scheduled for February 7, 2023, where further insights into the company's performance and strategies will be shared.

Value investors may find O-I Glass's ability to exceed adjusted earnings expectations and its strong cash flow generation to be positive indicators, despite the challenges faced in 2023. The company's focus on margin expansion and strategic initiatives, such as the MAGMA Greenfield project, may offer potential for growth as market conditions improve.

For more detailed information and analysis, investors are encouraged to review the full 8-K filing and stay tuned for updates following the earnings call.

Explore the complete 8-K earnings release (here) from O-I Glass Inc for further details.

This article first appeared on GuruFocus.