O-I Glass (OI) Q2 Earnings Beat Estimates, 2023 View Revised

O-I Glass, Inc. OI reported first-quarter 2023 adjusted earnings per share (EPS) of 88 cents, which beat the Zacks Consensus Estimate of 83 cents. On a year-over-year basis, earnings increased 21% reflecting strong net price realization, solid operating performance and benefits from OI’s ongoing margin expansion initiatives despite lower volumes. The bottom line was also higher than the company’s most recent guidance of 80-85 cents per share.

Including one-time items, O-I Glass reported EPS of 69 cents for the quarter, compared with $1.59 in the prior-year quarter.

O-I Glass, Inc. Price, Consensus and EPS Surprise

O-I Glass, Inc. price-consensus-eps-surprise-chart | O-I Glass, Inc. Quote

Operational Update

Revenues were $1.89 billion for the quarter under review, up 6.3% from the year-ago quarter’s level mainly due to higher selling prices as well as favorable foreign currency translation. The top line surpassed the Zacks Consensus Estimate of $1.8 billion. Sales volume (in tons) declined 9% in the quarter due to lower consumer spending and inventory destocking across the value chain.

The cost of sales was up 1% year over year to $1,474 million. Gross profit increased 28% year over year to $416 million. The gross margin was 22% for the quarter under review, compared with 18.3% in the prior-year quarter. Selling and administrative expenses were up 16.3% year over year to $143 million.

Adjusted segment operating profit amounted to $326 million for the reported quarter, up from the prior-year period’s $257 million.

Segmental Performance

Net sales in the Americas segment rose 2.6% year over year to $996 million for the second quarter. Our model estimated the segment’s net sales to be $1,014 million. Operating profit was down 3% year over year to $126 million. The figure was lower than our estimate of $143 million.

Gains from favorable net price and margin expansion initiatives were offset by a 9% drop in volumes, temporary production curtailment undertaken by the company to balance supply with lower demand as well as elevated planned asset project activity.

Net sales in the Europe segment were $863 million for the reported quarter, up 12.8% year over year. The figure was higher than our estimate of $771 million.

The segment’s operating profit surged 58% year over year to $200 million, aided by favorable net price, solid operating performance and gains from margin expansion initiatives, However, the segment witnessed a 11% decline in sales volume. Our model had predicted operating profit of $156 million.

Financial Update

O-I Glass had cash and cash equivalents of $754 million at the end of Jun 30, 2023, down from $773 million at 2022 end. The company used $291 million of cash in operating activities in the quarter under review against the prior-year quarter’s inflow of $193 million.

Its long-term debt was $4.78 billion as of Jun 30, 2023, up from $4.37 billion as of Dec 31, 2022.

Outlook

O-I Glass now expects adjusted earnings in the range of $3.10 to $3.25 per share, narrower than its previous stated guidance of $3.05 per share to $3.25 per share. OI had reported adjusted EPS of $2.30 in 2022.

Sales volume growth (in tons) is projected to be down in mid-single digits to high-single digits (compared to the earlier expectation of low-single digit to mid-single digits). OI expects free cash flow in 2023 to be around $175 million, while adjusted free cash flow is expected to be $475 million.

For the third quarter of 2023, O-I Glass expects adjusted earnings between 68 cents per share and 73 cents per share. For the fourth quarter, EPS will likely range between 25 cents and 35 cents.

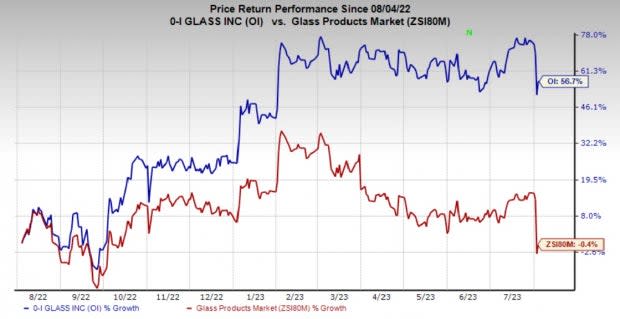

Price Performance

Shares of the company have gained 56.7% in a year’s time against the industry’s 0.4% decline.

Image Source: Zacks Investment Research

Zacks Rank and Other Stocks to Consider

O-I Glass currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the Industrial Products sector are Worthington Industries, Inc. WOR, The Manitowoc Company, Inc. MTW and Caterpillar CAT. WOR and MTW sport a Zacks Rank #1 (Strong Buy) at present, and CAT has a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Worthington Industries has an average trailing four-quarter earnings surprise of 14.9%. The Zacks Consensus Estimate for WOR’s fiscal 2023 earnings is pegged at $5.65 per share. The consensus estimate for 2023 earnings has moved 22.6% north in the past 60 days. Its shares have gained 43.4% in the last year.

Manitowoc has an average trailing four-quarter earnings surprise of 256.3%. The Zacks Consensus Estimate for MTW’s 2023 earnings is pegged at $1.12 per share. The consensus estimate for 2023 earnings has moved 7.8% north in the past 60 days. MTW’s shares have gained 54.8% in the last year.

The Zacks Consensus Estimate for CAT’s 2023 EPS is pegged at $18.75. The estimates have been revised upward 6% over the last 60 days. It has a trailing four-quarter average earnings surprise of 18.5%. CAT’s shares have gained 53% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Manitowoc Company, Inc. (MTW) : Free Stock Analysis Report

O-I Glass, Inc. (OI) : Free Stock Analysis Report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Worthington Industries, Inc. (WOR) : Free Stock Analysis Report