A. O. Smith (AOS) Beats on Q2 Earnings, Revises 2023 View

A. O. Smith Corporation’s AOS second-quarter 2023 adjusted earnings (excluding 3 cents from non-recurring items) of $1.01 per share surpassed the Zacks Consensus Estimate of adjusted earnings of 91 cents per share. The bottom line jumped 23.2% year over year due to the continued demand for North America commercial and residential water heater products and lower steel costs.

Net sales of $960.8 million underperformed the consensus estimate of $971 million. The top line dipped 0.5% year over year.

Segmental Details

A. O. Smith’s quarterly sales in North America (comprising the United States and Canada water heaters and boilers) decreased 3% year over year to $722.3 million due to lower boiler volumes and pricing. Our estimate for North America sales in the segment was $733.9 million.

Segment earnings increased 25% year over year to $199.1 million. The upside was due to lower material costs and higher volumes of commercial and residential water heaters.

Quarterly sales in the Rest of the World (including China, India and Europe) segment increased 6% year over year to $244.2 million. Our estimate for sales in the segment was $240.5 million. The increase in sales was primarily due to stronger consumer demand in China, particularly for residential and commercial water treatment products, as well as favorable product mix. Sales in India increased 15% in local currency.

The segment’s earnings were $28.3 million, up 56% year over year. The upside was due to higher volumes and favorable mix in China.

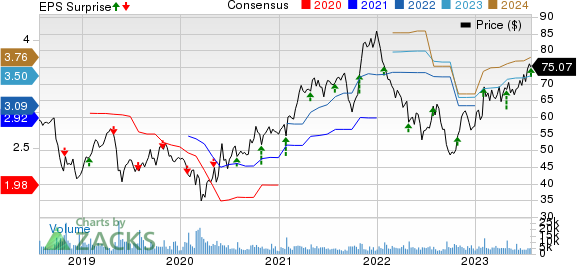

A. O. Smith Corporation Price, Consensus and EPS Surprise

A. O. Smith Corporation price-consensus-eps-surprise-chart | A. O. Smith Corporation Quote

Margin Details

In the reported quarter, A.O. Smith’s cost of sales was $576.1 million, down 8.8% year over year. Selling, general & administrative expenses were $180.3 million, up 8.2%.

Gross profit increased 15% year over year to $384.7 million. The gross margin was 40% compared with 34.6% in the year-ago period. Interest expenses surged more than 100% to $4.5 million.

Liquidity & Cash Flow

As of Jun 30, 2023, A.O. Smith’s cash and cash equivalents totaled $378.9 million, compared with $391.2 million at the end of December 2022.

At the end of the reported quarter, long-term debt was $196 million, compared with $334.5 million at December 2022-end.

In the second quarter, cash provided by operating activities totaled $260.2 million, compared with $54.4 million in the year-ago period.

Share Repurchases

In the second quarter, A.O. Smith repurchased 1.1 million shares for $69.6 million. Approximately 6.8 million shares are yet to be repurchased under the existing share repurchase authorization. In January, AOS’ board boosted the existing share buyback program by authorizing the repurchase of an additional 7.5 million shares. The company expects to repurchase $300 million worth of shares in 2023. In the second quarter, the company paid dividends of $90.6 million, up 3.1% year over year.

2023 Outlook Revised

A.O. Smith expects net sales of $3,750-$3,830 million for 2023 compared with the $3,680-$3,830 million stated earlier. The mid-point of the guided range — $3,790 million — lies below the Zacks Consensus Estimate of $3.80 billion.

The company expects adjusted earnings per share of $3.45-$3.60 for the year compared with $3.30-$3.50 mentioned earlier. The mid-point of the guided range — $3.50 — is in line with the consensus estimate. AOS’ adjusted earnings guidance indicates an 11.5% year-over-year increase at the mid-point.

Zacks Rank & Other Stocks to Consider

AOS currently carries Zacks Rank #2 (Buy). Some other top-ranked companies from the Industrial Products sector are discussed below:

Greif, Inc. GEF presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks.

GEF delivered a trailing four-quarter earnings surprise of 7.7%, on average. GEF’s earnings estimates have increased 13.4% for fiscal 2023 in the past 60 days. Its shares have risen 4.2% in the past year.

Caterpillar Inc. CAT presently carries a Zacks Rank of 2. CAT’s earnings surprise in the last four quarters was 14.3%, on average.

In the past 60 days, estimates for Caterpillar’s earnings have increased 1.3% for 2023. The stock has gained 37.6% in the past year.

IDEX Corporation IEX presently carries a Zacks Rank of 2. IEX’s earnings surprise in the last four quarters was 3.5%, on average.

In the past 60 days, estimates for IDEX’s earnings have remained steady for 2023. The stock has gained 2.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

IDEX Corporation (IEX) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report