A. O. Smith (AOS) Rewards Investors With 7% Dividend Hike

In a shareholder-friendly move, A. O. Smith Corporation AOS has announced a hike in its dividend payout. The company increased its quarterly dividend by 7% to 32 cents per share (annually: $1.28). The new dividend will be paid out on Nov 15 to shareholders of record as of Oct 31.

The move underscores AOS’ sound financial health as it utilizes free cash flow to enhance its shareholders’ returns. The five-year compound annual growth rate of AOS’ dividend is more than 10%. The company has increased its dividend consecutively for more than 30 years.

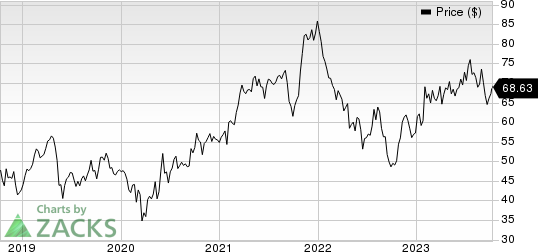

The dividend yield, based on the new payout and its Oct 9 closing price of $68.63 per share, is 1.9%.

Prior to this, the company had hiked its dividends by 7% to 30 cents per share in Oct 2022.

Sound Capital-Allocation Strategies

Strong cash flows allow AOS to effectively deploy capital for rewarding its shareholders handsomely through dividend payments and share buybacks. In the first six months of 2023, the company paid dividends of $90.6 million, up 3.1% year over year. In the same period, the company repurchased 1.08 million shares for approximately $70 million.

A. O. Smith Corporation Price

A. O. Smith Corporation price | A. O. Smith Corporation Quote

For 2023, the company expects to repurchase shares worth approximately $300 million. About 6.8 million shares are yet to be repurchased under the existing share repurchase authorization, which was boosted by an additional 7.5 million shares in January.

Zacks Rank & Stocks to Consider

A. O. Smith currently carries a Zacks Rank #3 (Hold). Some better-ranked companies from the Industrial Products sector are discussed below:

Axon Enterprise, Inc. AXON currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The company delivered a trailing four-quarter earnings surprise of approximately 60.2%, on average. In the past 60 days, estimates for Axon’s earnings have increased 13.8% for 2023. The stock has soared 72% in the past year.

Applied Industrial Technologies, Inc. AIT presently sports a Zacks Rank of 1 and a trailing four-quarter earnings surprise of 15%, on average.

AIT’s earnings estimates have increased 1.6% for fiscal 2024 (ending June 2024) in the past 60 days. Shares of Applied Industrial have risen 44.9% in the past year.

Caterpillar Inc. CAT presently carries a Zacks Rank of 2. CAT’s earnings surprise in the last four quarters was 18.5%, on average.

In the past 60 days, estimates for Caterpillar’s earnings have increased 2.2% for 2023. The stock has gained 50.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Axon Enterprise, Inc (AXON) : Free Stock Analysis Report