A.O. Smith Corp (AOS) Announces Record 2023 Earnings and Provides Optimistic 2024 Guidance

Net Sales: Achieved record sales of $3.9 billion, a 3% increase year-over-year.

Net Earnings: Soared to $556.6 million, marking a significant 136% jump from the previous year.

Earnings Per Share (EPS): Recorded a record EPS of $3.69, a 144% increase year-over-year.

Free Cash Flow: Demonstrated strong liquidity with free cash flow of $598 million, a conversion rate of 107%.

2024 Outlook: Anticipates sales growth of 3% to 5% and EPS between $3.90 and $4.15.

On January 30, 2024, A.O. Smith Corp (NYSE:AOS) released its 8-K filing, revealing a year of record-breaking financial achievements. The company, a global leader in water heating and treatment technologies, has reported a significant uptick in its financial metrics, reflecting robust demand and operational efficiency.

Company Overview

A.O. Smith Corporation is at the forefront of manufacturing and marketing residential and commercial water heaters, boilers, and water treatment products. With a strategic focus on North America and significant operations in the Rest of the World, including key markets in Asia, A.O. Smith has built a reputation for innovation and quality. The company's success is underpinned by a strong distribution network and a commitment to replacing existing products, ensuring a steady demand in the replacement market.

Financial Performance and Challenges

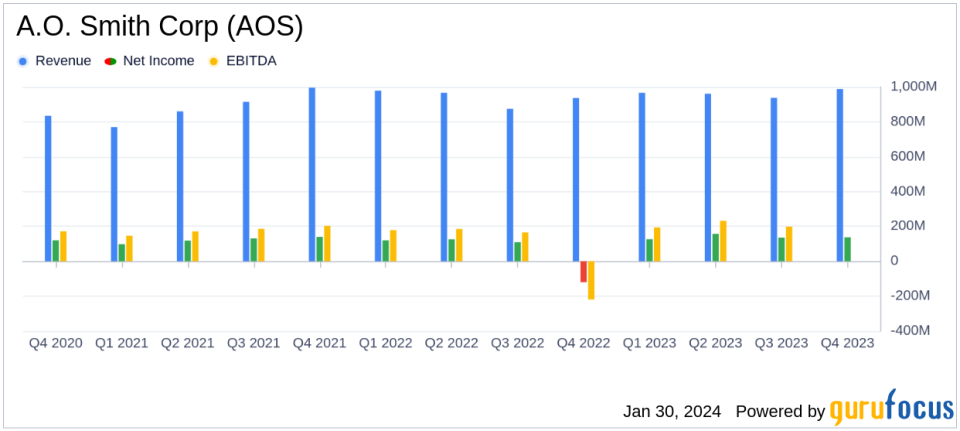

The company's performance in 2023 was marked by record sales of $3.9 billion, a 3% increase from the previous year, primarily driven by higher water heater volumes. Net earnings saw an impressive surge to $556.6 million, a 136% increase, with diluted EPS climbing to $3.69, up 144%. Adjusted earnings stood at $574.8 million, resulting in an adjusted EPS of $3.81, a 21% increase. This growth is a testament to A.O. Smith's strong market position and operational excellence, particularly in North America.

Despite these achievements, the company acknowledges the challenges it faces, including the potential for economic instability and the need to navigate global supply chain complexities. The importance of these challenges lies in their potential to impact future growth and profitability, making it crucial for A.O. Smith to maintain its strategic focus and operational agility.

Financial Achievements and Industry Significance

The company's financial achievements are particularly significant in the context of the Industrial Products industry. A.O. Smith's strong operating cash flow of $670 million and free cash flow of $598 million underscore its financial health and ability to generate shareholder value. These metrics are critical for sustaining investment in innovation and growth, as well as for pursuing strategic acquisitions.

Segment-Level Performance and Outlook

In North America, A.O. Smith experienced a 4% increase in sales, driven by robust demand for water heater products. The Rest of the World segment faced a slight decrease in sales, but local currency sales increased by approximately 4%, highlighting the growth potential in markets like China and India.

Looking ahead to 2024, A.O. Smith projects sales growth between 3% and 5% and anticipates EPS to range from $3.90 to $4.15. This guidance reflects the company's confidence in its market position and its ability to capitalize on growth opportunities.

Capital Allocation and Shareholder Returns

The company's strong balance sheet, with cash and marketable securities totaling $363.4 million and a low leverage ratio, provides the flexibility to focus on capital allocation priorities. In 2023, A.O. Smith repurchased 4.4 million shares at a cost of $306.5 million and declared a consistent dividend, marking 84 consecutive years of dividend payments.

Conclusion

A.O. Smith's record 2023 earnings and positive outlook for 2024 are indicative of its resilient business model and strategic positioning. The company's ability to generate strong free cash flow and return capital to shareholders positions it well for continued success in the dynamic Industrial Products sector. Investors and stakeholders can look forward to A.O. Smith's sustained growth and profitability as it navigates the challenges and opportunities ahead.

For a detailed analysis of A.O. Smith Corp's financials and strategic outlook, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from A.O. Smith Corp for further details.

This article first appeared on GuruFocus.