Oasis Petroleum to Vend Non-Core Williston Assets for $283M

Oasis Petroleum, Inc. OAS recently inked two separate deals to offload some of its non-operating assets in the Williston Basin, in a bid to upgrade its portfolio. The transaction is valued at $283 million. However, details of the buyers have been kept under wraps. The divested non-core assets comprise 65,000 acres in North Dakota and Montana, having an estimated production capacity of 4,400 barrels of oil equivalent per day (Boe/d).

The proceeds from this transaction will enable the company to pay for the acquisition of Permian acreage from San Antonio-based Forge Energy. In an attempt to diversify its holdings away from North Dakota, Oasis Petroleum acquired around 22,000 acres in the prolific Delaware Basin earlier this year. The deal has undoubtedly opened the gateway for Oasis Petroleum in the Delaware Basin, which is the most profitable area for oil explorers of late due to low production cost.

Oasis Petroleum paid a huge premium for this $946-million acquisition deal, funded through cash and stock. In order to finance the deal, the company had resorted to issuing new stocks and also planned to jettison its non-core Williston assets to raise cash. In fact, it had announced its plans to sell around 200,000 acres, accounting for 8000-10,000 Boe/d, for approximately $500 million. The latest agreements highlight the company’s progress toward its target. Oasis Petroleum remains committed to evaluate and vend the additional non-pivotal acreage in order to streamline portfolio and strengthen its position in the prolific Delaware Basin.

Zacks Rank & Key Picks

Houston, TX-based Oasis Petroleum is an independent explorer engaged in the acquisition, and development of oil and natural gas resources. The company currently carries a Zacks Rank #3 (Hold).

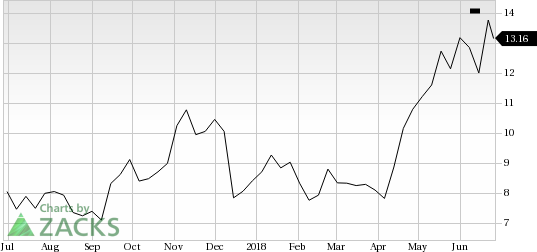

Oasis Petroleum Inc. Price

Oasis Petroleum Inc. Price | Oasis Petroleum Inc. Quote

Some better-ranked players within the same industry include Bonanza Creek Energy, Inc. BCEI, Concho Resources Inc. CXO and Devon Energy Corporation DVN, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Bonanza Creek delivered positive earnings surprise in each of the trailing four quarters, with an average beat of 215.36%

Concho Resources surpassed estimates in each of the trailing four quarters, with an average of 40.24%.

Devon’s 2018 earnings are expected to grow 171.43% year over year.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Devon Energy Corporation (DVN) : Free Stock Analysis Report

Concho Resources Inc. (CXO) : Free Stock Analysis Report

Oasis Petroleum Inc. (OAS) : Free Stock Analysis Report

Bonanza Creek Energy, Inc. (BCEI) : Free Stock Analysis Report

To read this article on Zacks.com click here.