Occidental Petroleum Is Looking to Cash in on This High-Yield Dividend Stock

Occidental Petroleum (NYSE: OXY) is reportedly exploring a sale of its stake in Western Midstream Partners (NYSE: WES). The oil giant owns nearly half of the master limited partnership (MLP). A sale would enable it to quickly repay the debt it will incur by acquiring CrownRock.

Here's a look at why Occidental wants to cash in on its stake in the high-yielding MLP (it currently yields 7.5%) and which companies might be interested in the midstream specialist.

Seeking to make quick work of its funding plan

Occidental recently made a big splash, agreeing to acquire CrownRock in a $12 billion deal. It primarily plans to use debt to fund the transaction (it will issue $9.1 billion of new debt and assume CrownRock's existing $1.2 billion of debt). That deal structure is a major deviation from the acquisition blueprints of Chevron and Exxon, which are using stock to fund their megadeals.

Occidental's use of debt to fund a major acquisition has burned it in the past. It outbid Chevron to acquire Anadarko in 2019 by offering a cash-heavy deal financed with debt and a preferred stock investment secured from Warren Buffett's Berkshire Hathaway. The oil producer had planned to quickly repay that debt by selling assets. However, it ran into regulatory issues and an oil-price slump, which impacted its ability to pay down debt as fast as it had hoped.

That's leading Occidental to be more proactive this time. It's aiming to sell $4.5 billion to $6 billion in assets to repay the debt it will take on to acquire CrownRock. The company plans to repay at least $4.5 billion of debt within 12 months through cash flow and asset sales.

Selling its 49% stake in Western Midstream (which it obtained when it bought Anadarko) would enable it to reach that target quickly. The midstream company currently has a $11.6 billion market cap. While Occidental would lose the cash flow from the MLP's distributions, it expects its CrownRock deal will boost its free cash flow by $1 billion within the first year, which will help offset that lost income.

Lots of potential suitors

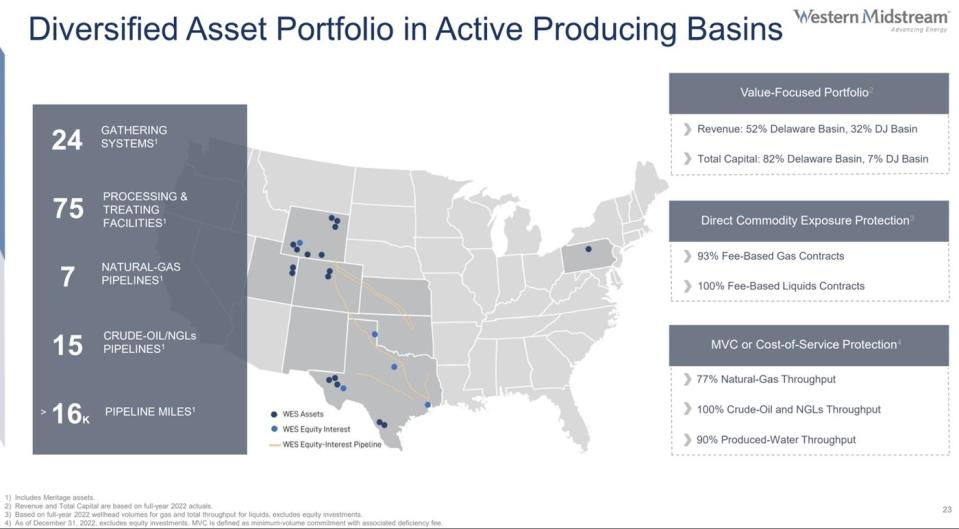

Western Midstream would make an appealing investment for other midstream companies and private equity funds. It operates a diversified midstream business with assets across several major producing regions:

Western Midstream has a premier position in the Delaware Basin. It's the only midstream specialist that provides oil, water, and gas services. It has the second-largest water gathering and disposal capacity and is the fifth-biggest gas processor. Western Midstream also has a large position in the DJ Basin, where it provides oil and gas infrastructure services. It's also the biggest gathering and processing (G&P) company in the Powder River Basin.

The company's extensive midstream assets across those major production basins could make it an attractive acquisition target for another midstream business. Pipeline giants Williams, Energy Transfer, and Enterprise Products Partners have G&P operations in those regions, making them ideal strategic buyers. They could seek to acquire Occidental's stake as part of a larger takeover of the entire company. Meanwhile, private equity infrastructure funds are another potential buyer of Occidental's stake in the MLP. They could purchase it as a passive investment to generate income for their investors or as part of a larger acquisition of the whole midstream company.

An interesting sale to keep an eye on

Occidental Petroleum is looking to sell its stake in Western Midstream to help fund its purchase of CrownRock. Its desire to divest that stake could ultimately lead to a merger with a bigger midstream company or a deal with a private equity fund. That makes it an interesting transaction process to watch. It could enable Occidental to quickly reach its balance sheet target while potentially allowing a larger midstream company to complete a needle-moving merger.

Should you invest $1,000 in Occidental Petroleum right now?

Before you buy stock in Occidental Petroleum, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Occidental Petroleum wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 20, 2024

Matt DiLallo has positions in Berkshire Hathaway, Chevron, Energy Transfer, and Enterprise Products Partners. The Motley Fool has positions in and recommends Berkshire Hathaway and Chevron. The Motley Fool recommends Enterprise Products Partners and Occidental Petroleum. The Motley Fool has a disclosure policy.

Occidental Petroleum Is Looking to Cash in on This High-Yield Dividend Stock was originally published by The Motley Fool