Is Oceaneering (OII) Poised for a Robust Q2 Earnings Show?

Oceaneering International, Inc. OII is set to release second-quarter results on Jul 26. The Zacks Consensus Estimate for the to-be-reported quarter is a profit of 30 cents per share on revenues of $601.9 million.

Let’s delve into the factors that might have influenced the energy-related underwater robot provider’s performance in the June quarter. But it’s worth taking a look at OII’s previous-quarter performance first.

Highlights of Q1 Earnings & Surprise History

In the last reported quarter, this Houston, TX-based offshore oilfield service provider missed the consensus mark due to lower-than-expected operating income from the Aerospace and Defense Technologies segment. OII had reported adjusted earnings per share of 5 cents, 50% below the Zacks Consensus Estimate. Revenues of $537 million generated by the firm also failed to match the Zacks Consensus Estimate of $547 million.

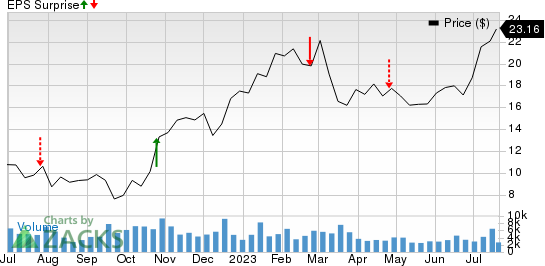

OII beat the Zacks Consensus Estimate in one of the last four quarters and missed in the other three, which resulted in a negative earnings surprise of 22%, on average. This is depicted in the graph below:

Oceaneering International, Inc. Price and EPS Surprise

Oceaneering International, Inc. price-eps-surprise | Oceaneering International, Inc. Quote

Trend in Estimate Revision

The Zacks Consensus Estimate for the second-quarter bottom line has remained unchanged in the past seven days. The estimated figure indicates a 328.6% jump year over year. The Zacks Consensus Estimate for revenues, meanwhile, suggests a 14.9% increase from the year-ago period.

Factors to Consider

Oceaneering’s key Subsea Robotics unit, which provides cutting-edge technology solutions for remote working through its Remotely Operated Vehicles and Autonomous Underwater Vehicles, is expected to drive the company’s second-quarter earnings. Going by our model, the Subsea Robotics arm of OII is projected to show strong improvement in the second quarter compared to the January-March period of 2023. Buoyed by higher activity levels, we expect the business to register $179 million in revenues and $51 million in operating profit, up 5.8% and 51.3% sequentially, respectively.

On a somewhat bearish note, the decrease in Manufactured Products profitability might have dented the company’s to-be-reported bottom line. While we project segment revenues to improve 5.6% from the first quarter — on better offshore market fundamentals — our estimate for operating income from the segment stands at $11 million, suggesting a slight fall from $11.3 million. This could be attributed to unfavorable changes in product mix and higher material costs.

What Does Our Model Say?

The proven Zacks model does not conclusively show that OII is likely to beat estimates in the second quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates. But that’s not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Oceaneering International has an Earnings ESP of 0.00%. This is because the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at 30 cents per share each.

Zacks Rank: OII currently carries a Zacks Rank #1, which increases the predictive power of ESP. However, the company’s 0.00% ESP makes surprise prediction difficult this earnings season.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Consider

While an earnings beat looks uncertain for Oceaneering International, here are some firms from the energy space that you may want to consider on the basis of our model:

TC Energy Corporation TRP has an Earnings ESP of +11.77% and a Zacks Rank #2. The firm is scheduled to release earnings on Jul 28.

TC Energy beat the Zacks Consensus Estimate for earnings in three of the last four quarters and missed in the other. It has a trailing four-quarter earnings surprise of 2.1%, on average. Valued at around $39.7 billion, TRP has lost 25.7% in a year.

Viper Energy Partners LP VNOM has an Earnings ESP of +47.14% and a Zacks Rank #3. The firm is scheduled to release earnings on Jul 31.

Viper Energy beat the Zacks Consensus Estimate for earnings in three of the last four quarters and met in the other. It has a trailing four-quarter earnings surprise of 63.1%, on average. Valued at around $4.2 billion, VNOM has lost 4.6% in a year.

California Resources Corporation CRC has an Earnings ESP of +18.05% and a Zacks Rank #3. The firm is scheduled to release earnings on Jul 31.

The 2023 Zacks Consensus Estimate for California Resources indicates 18% year-over-year earnings per share growth. Over the past 60 days, CRC saw the Zacks Consensus Estimate for 2023 move up 3.5%. Valued at around $3.4 billion, the company has gained 19% in a year.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Oceaneering International, Inc. (OII) : Free Stock Analysis Report

TC Energy Corporation (TRP) : Free Stock Analysis Report

Viper Energy Partners LP (VNOM) : Free Stock Analysis Report

California Resources Corporation (CRC) : Free Stock Analysis Report