Oceaneering (OII) Q3 Earnings Beat Estimates, Revenues Lag

Oceaneering International OII reported third-quarter 2023 adjusted profit of 38 cents per share, which beat the Zacks Consensus Estimate of 27 cents. The bottom line also outpaced the year-ago quarter’s figure of 23 cents. This outperformance was largely due to robust results in certain segments.

Total revenues were $635.2 million, which missed the Zacks Consensus Estimate of $638 million due to a decrease in year-over-year sales in OII’s Offshore Projects Group segment. The top line, however, increased approximately 13.5% from the year-ago quarter’s level of $559.7 million.

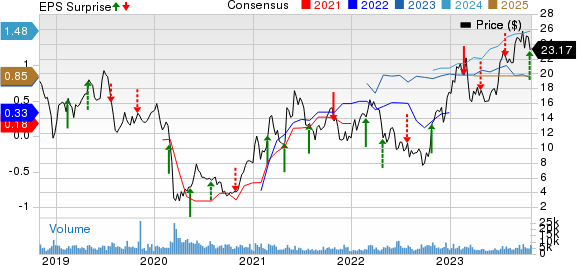

Oceaneering International, Inc. Price, Consensus and EPS Surprise

Oceaneering International, Inc. price-consensus-eps-surprise-chart | Oceaneering International, Inc. Quote

Segmental Information

Subsea Robotics: The unit provides remotely operated submersible vehicles for drill support, vessel-based inspection, subsea hardware installation, pipeline surveys and maintenance services.

Revenues totaled $197.3 million compared with the year-ago quarter’s figure of $169.4 million. The top line missed our projection of $198 million.

The segment also reported an operating income of $47.8 million compared with $37.1 million a year ago. The figure was also higher than our estimate of $44.4 million.

Manufactured Products: The segment focuses on the manufactured products business, theme park entertainment systems and automated guided vehicles.

Revenues amounted to $122.9 million, up substantially from the prior-year figure of $94 million. The figure missed our projection of $144.1 million. Moreover, the segment posted an operating profit of about $8.2 million in the third quarter, up from the year-ago quarter’s level of $4.3. The figure was higher than our estimate of $5.3 million. Meanwhile, the backlog rose to $556 million as of Sep 30, 2023 from $365 million as of Sep 30, 2022.

Offshore Projects Group: This involves Oceaneering’s former Subsea Projects segment, excluding survey services and global data solutions, and the service and rental business, excluding ROV tooling.

Revenues decreased about 1.8% to $150.3 million from $153 million in the year-ago quarter. The figure outpaced our projection of $137.2 million. The unit’s operating income of $26.7 million compared favorably with the prior-year quarter’s level of $20.3 million. The figure was also higher than our estimate of $17.3 million.

Integrity Management & Digital Solutions: This segment mainly covers Oceaneering’s Asset Integrity segment along with its global data solutions business.

Revenues of $66.1 million went up from the year-ago quarter’s reported figure of $58.5 million. The figure outpaced our projection of $62.6 million. Moreover, the segment reported an operating income of $3.2 million, up from the prior-year quarter’s figure of $3.1 million. The figure, however, missed our estimate of $6.7 million.

Aerospace and Defense Technologies: The segment is engaged in Oceaneering’s government business, which focuses on defense subsea technologies, marine services and space systems.

Revenues totaled $98.6 million, indicating an increase from $84.8 million recorded in the third quarter of 2022. The figure was also higher than our estimate of $93.9 million. As a result, the operating income rose to $14.1 million from $13 million in the year-ago quarter. The figure, however, missed our estimate of $17 million.

Capital Expenditure & Balance Sheet

The capital expenditure in the third quarter, including acquisitions, totaled $25.9 million. As of Sep 30, 2023, OII had cash and cash equivalents worth $556.4 million and $568.7 million, respectively, along with a long-term debt of about $568.5 million. The debt-to-total capital was 49.8%.

Outlook

Oceaneering anticipates a decline in fourth-quarter 2023 EBITDA on relatively flat revenues compared with the third-quarter results. The company anticipates a revised organic capital expenditure range of $95-$105 million for fourth-quarter 2023. It also expects revised cash income tax payments in the band of $70-$75 million during the same period.

For the Offshore Projects Group segment, OII projects a slight reduction in revenues and a significant drop in operating income. The company anticipates a decrease in both revenues and operating income for The Integrity Management & Digital Solutions. For the Aerospace and Defence Technologies segment, OII estimates slightly lower revenues and operating income. For the fourth quarter of 2023, Oceaneering predicts unallocated expenses in the mid-$40 million range.

For 2023, Oceaneering now projects consolidated EBITDA in the $275 million-$295 million range and continued free cash flow in the band of $90-$130 million.

Zacks Rank and Other Key Picks

Currently, OII sports a Zack Rank #1 (Strong Buy).

Investors interested in the energy sector might look at some other top-ranked stocks like CVR Energy CVI and USA Compression Partners USAC, each sporting a Zacks Rank #1, and Harbour Energy HBRIY, carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

CVR Energy is valued at $3.13 billion. In the past year, its shares have lost 22.6%.

CVI currently pays a dividend of $2 per share or 6.42% on an annual basis. Its payout ratio currently sits at 30% of earnings.

USA Compression Partners is valued at around $2.47 billion. USAC currently pays a dividend of $2.10 per unit, or 8.35% on an annual basis.

USAC provides natural gas compression services and offers compression services to oil companies and independent producers, processors, gatherers, and transporters of natural gas and crude oil. It also operates stations.

Harbour Energy is worth approximately $2.30 billion. HBRIY currently pays a dividend of 21 cents per share, or 6.69% on an annual basis.

The company's activities include acquiring, exploring, developing, and producing oil and gas reserves. It has ownership stakes in several properties in the United Kingdom, Norway, Indonesia, Vietnam and Mexico.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Oceaneering International, Inc. (OII) : Free Stock Analysis Report

CVR Energy Inc. (CVI) : Free Stock Analysis Report

USA Compression Partners, LP (USAC) : Free Stock Analysis Report

Harbour Energy PLC Sponsored ADR (HBRIY) : Free Stock Analysis Report