Oceaneering's (OII) Solid Fundamentals Could Push the Stock Up

Oceaneering International OII — one of the leading suppliers of offshore equipment and technology solutions to the energy industry — offers an opportunity for investors interested in the energy sector. The company also has strong fundamentals to back up its future performance.

Headquartered in Houston, TX, the company provides specialized products and services for all phases of the offshore oilfield lifecycle — from exploration to decommissioning — with a focus on deep water. The company operates in five business segments, namely Subsea Robotics, Manufactured Products, Offshore Projects Group, Integrity Management & Digital Solutions and Aerospace and Defense Technologies.

Let’s discuss the reasons that make Oceaneering International an attractive pick:

Macro Tailwinds

Even as fears related to high inflation and slowing growth somewhat cloud the outlook for Oil/Energy, the outlook gets brighter. Apart from a relatively constructive fundamental picture, the sector is enjoying support from geopolitical uncertainty amid Russia’s military operations in Ukraine. In March 2022, crude prices surged to multi-year highs of $130 on concerns about supplies from Russia, which is one of the world's largest producers of the commodity.

Agreed, oil has pulled back from those lofty levels. However, the commodity still has enough reasons to stay elevated in the near-to-medium term, with the conflict showing no signs of a quick resolution, the risk of dwindling inventory, and the influential oil exporters’ group OPEC sticking to a conservative production profile. While the banking sector turmoil did affect the sector temporarily, the crisis seems to have eased now. Crude is currently trading around $75 — a healthy enough level for market participants.

Solid Rank and VGM Score

Oceaneering is a Zacks Rank #2 (Buy) stock. In addition to the favorable rank, OII enjoys a Value and Growth Style Score of B and A, respectively, which help it round out with a VGM Score of B. Our research shows that stocks with a VGM Score of A or B, when combined with a Zacks Rank #1 or 2, offer the best upside potential.

Buying Opportunity Still Exists

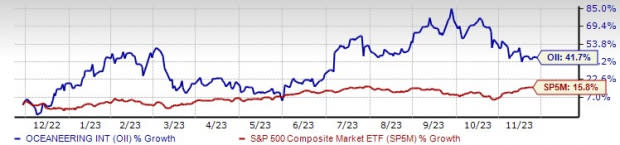

After OII shares bottomed out (around $2) during the start of the pandemic, they have turned around in style. Oceaneering International peaked in September and has held up reasonably well since then. In fact, Oceaneering International is up some 42% in a year while the markets have gone higher by just 16%. This powerful uptrend indicates that investors should start looking at the name to see if it's right for their portfolio. With the company still experiencing good market conditions, we believe that OII stock has enough firepower left to keep chugging along.

Image Source: Zacks Investment Research

Fundamental Strength

One of the leading suppliers of integrated technology solutions, Oceaneering boasts an impressive portfolio of diversified products and services. It is well-positioned to supply equipment for deep-water projects and is active at all phases of the offshore oilfield lifecycle. Oceaneering owns a geographically diversified asset base spread across the United States and the rest of the world. The company's revenue profile is evenly split between its international and domestic operations, lowering Oceaneering’s risk profile.

In particular, Oceaneering’s key Subsea Robotics unit, which provides cutting-edge technology solutions for remote working through its Remotely Operated Vehicles (ROVs) and Autonomous Underwater Vehicles (AUVs), is expected to drive the company forward. The unit accounts for some 30% of revenues and more than half of the adjusted operating EBITDA. Oceaneering expects increased ROV days on hire, higher tooling activity, and continued pricing improvements this year as the primary catalysts for improved performance.

Finally, OII's strong relationships with high-quality customers provide revenue visibility and business certainty. The clients, mostly well-capitalized, blue-chip E&P companies with long-term production growth plans, are likely to be less susceptible to commodity price fluctuations. This should ensure multi-year earnings stability for Oceaneering.

Reasonable Valuation

The valuation for this name isn’t low, but there is solid growth. OII has a forward P/E of 24.22, well above the industry average of 15.94. However, investors should know that the company is coming off a quarter that saw top-line growth of 13.5%. Moreover, although expensive, the value is significantly below the 52-week high of 66.44. OII’s forward P/S of 0.87 is also lower than the industry’s 1.34.

Bottom Line

Against this backdrop, it should be prudent to consider buying shares of Oceaneering International. While there are some apprehensions that the company may have gotten too far ahead of itself, especially with the prevailing inflationary pressures, the supportive demand/supply fundamentals for its services and robust commodity prices should keep backlog and sales elevated going forward. This suggests strong long-term cash flows that should support higher price points for its shares.

Other Energy Stocks to Buy

Along with Oceaneering International, investors interested in the energy sector might look at Suncor Energy SU, EOG Resources EOG and Murphy Oil MUR. Each of the companies has a Zacks Rank of 2.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Suncor Energy: SU beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters at an average of 15.7%.

Suncor Energy is valued at around $42.5 billion. SU has seen its shares move down 4.3% in a year.

EOG Resources: EOG Resources beat the Zacks Consensus Estimate for earnings in three of the last four quarters and missed in the other. EOG has a trailing four-quarter earnings surprise of 9.2%, on average.

EOG Resources is valued at around $72 billion. EOG has seen its shares drop 9.6% in a year.

Murphy Oil: Over the past 60 days, Murphy Oil saw the Zacks Consensus Estimate for 2023 move up 11.5%. MUR beat the Zacks Consensus Estimate for earnings in each of the last four quarters, representing an average surprise of 13.4%.

Murphy Oil is valued at around $6.7 billion. MUR has seen its shares lose 8.5% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

EOG Resources, Inc. (EOG) : Free Stock Analysis Report

Murphy Oil Corporation (MUR) : Free Stock Analysis Report

Suncor Energy Inc. (SU) : Free Stock Analysis Report

Oceaneering International, Inc. (OII) : Free Stock Analysis Report