OceanFirst Financial Corp. Reports Mixed Annual Results Amidst Economic Headwinds

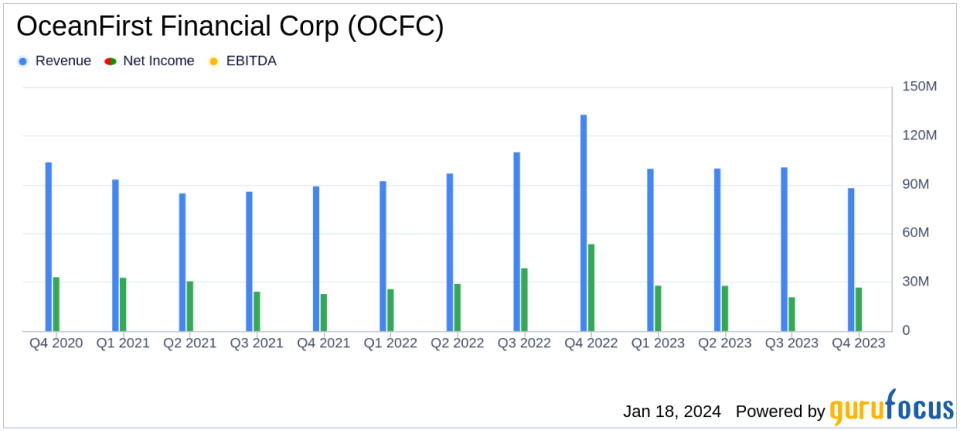

Net Income: Annual net income available to common stockholders decreased to $100.0 million in 2023 from $142.6 million in 2022.

Earnings Per Share: Diluted EPS for the year fell to $1.70, down from $2.42 in the previous year.

Net Interest Margin: Net interest margin contracted to 2.82% in Q4 2023 from 3.64% in Q4 2022.

Asset Growth: Total assets increased by $434.4 million to $13.54 billion as of December 31, 2023.

Dividends: OCFC declared a quarterly cash dividend on common stock of $0.20 per share and on preferred stock of $0.4375 per depositary share.

Efficiency Ratio: Improved to 60.02% in Q4 2023 from 64.29% in the prior linked quarter.

Capital Ratios: Common equity tier 1 capital ratio increased to 10.88% from 9.93% in the prior year.

OceanFirst Financial Corp (NASDAQ:OCFC) released its 8-K filing on January 18, 2024, disclosing its financial results for the quarter and year ended December 31, 2023. The company, which operates in the banking sector in the United States, focuses on attracting retail and business deposits to invest in various loan types, including residential mortgage and commercial real estate loans. OCFC also generates revenue from bank card services and wealth management services.

Financial Performance and Challenges

OCFC reported a decrease in net income available to common stockholders to $26.7 million, or $0.46 per diluted share, for the quarter ended December 31, 2023, compared to $52.3 million, or $0.89 per diluted share, for the corresponding prior year period. For the year ended December 31, 2023, the company reported a net income of $100.0 million, or $1.70 per diluted share, a decline from $142.6 million, or $2.42 per diluted share, for the prior year. The company's return on average assets and equity also saw a decrease, indicating pressure on profitability.

The reported net interest margin for the quarter was 2.82%, a decrease from 3.64% in the same quarter of the previous year. This contraction reflects the challenges faced by OCFC in a higher interest rate environment, where the cost of funds increased more rapidly than the yield on interest-earning assets. The efficiency ratio, however, showed improvement, indicating better cost management.

Financial Achievements

Despite the challenges, OCFC's balance sheet strength improved with total assets increasing to $13.54 billion, up from $13.10 billion in the previous year. The company's capital position also strengthened, with the common equity tier 1 capital ratio rising to 10.88%. Additionally, OCFC maintained its commitment to shareholder returns, declaring its 108th consecutive quarterly cash dividend on common stock.

Key Financial Metrics

OCFC's financial achievements are underscored by several key metrics. The company's loan-to-deposit ratio stood at 97.70%, and book value and tangible book value per share increased year-over-year. The stability in total deposits, which slightly decreased by less than 1% for the quarter but grew by 8% for the year, demonstrates the company's ability to maintain a solid deposit base amidst economic fluctuations.

"We are pleased to report on our current quarter results; rounding out the year positively and executing on our strategies to improve operating expenses, diversify and strengthen our deposit base, and bolster our capital position during a tumultuous year for the industry," said Chairman and Chief Executive Officer, Christopher D. Maher.

OCFC's performance reflects a banking institution navigating a challenging economic landscape while maintaining a focus on operational efficiency, deposit base diversification, and capital enhancement.

Analysis of Company's Performance

The company's performance in 2023 was marked by a mixed set of outcomes. While the decrease in net income and net interest margin indicates the impact of a challenging interest rate environment, OCFC's ability to grow its asset base and maintain a strong capital position speaks to its resilience. The company's strategic focus on expense management and balance sheet optimization positions it to potentially benefit from future economic stabilization.

Value investors may find OCFC's commitment to dividends and improved efficiency ratio appealing, as these factors suggest a prudent approach to capital management and operational discipline. The company's focus on maintaining a robust capital position also provides a buffer against potential economic headwinds.

For more detailed financial information and to stay updated on OCFC's performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from OceanFirst Financial Corp for further details.

This article first appeared on GuruFocus.