Ocular Therapeutix Inc Reports Growth Amidst Strategic Shifts

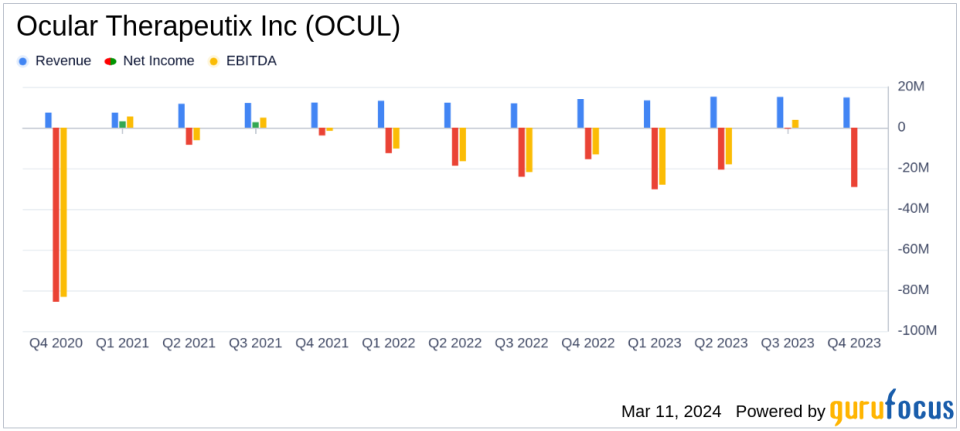

Total Net Revenue: Increased by 13.4% to $58.4 million in full year 2023 compared to $51.5 million in 2022.

Research and Development Expenses: Rose to $61.1 million in 2023, reflecting ongoing clinical trials.

Selling and Marketing Expenses: Slightly increased to $40.5 million in 2023 from $39.9 million in 2022.

Net Loss: Grew to $(80.7) million in 2023, or $(1.01) per share, from $(71.0) million, or $(0.92) per share in 2022.

Cash Position: Strong with $195.8 million as of December 31, 2023, expected to support operations into at least 2028.

Ocular Therapeutix Inc (NASDAQ:OCUL) released its 8-K filing on March 11, 2024, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The biopharmaceutical company, known for its innovative therapies for eye diseases, reported a year of strategic advancements and financial growth, despite an increase in net loss.

Ocular Therapeutix specializes in therapies for diseases and conditions of the eye, leveraging its proprietary hydrogel platform technology to deliver therapeutic agents. Its product pipeline includes Dextenza, OTX-TIC, OTX-TKI, and OTX-IVT, designed to replace traditional eye-drop therapies with long-lasting, one-time applications.

Financial Highlights and Strategic Developments

The company's total net revenue for the fourth quarter of 2023 was $14.8 million, a 5.0% increase from the same period in 2022, primarily driven by sales of DEXTENZA. For the full year 2023, total net revenue reached $58.4 million, marking a 13.4% increase from $51.5 million in 2022.

Research and development expenses climbed to $16.2 million in the fourth quarter and totaled $61.1 million for the year, reflecting the company's investment in clinical and regulatory activities. Selling and marketing expenses saw a slight decrease in the fourth quarter to $9.2 million but increased marginally for the full year to $40.5 million. General and administrative expenses decreased in the fourth quarter to $8.0 million, with a full-year increase to $33.9 million.

The net loss for the fourth quarter was $(29.2) million, or $(0.35) per share, compared to a net loss of $(15.5) million, or $(0.20) per share, in the same period of 2022. The full-year net loss widened to $(80.7) million, or $(1.01) per share, from $(71.0) million, or $(0.92) per share, in 2022.

Operational and Clinical Progress

OCUL's cash and cash equivalents stood at $195.8 million as of December 31, 2023. With an additional $325 million in gross proceeds from a February 2024 private placement, the company expects to support its operations into at least 2028.

Executive Chairman Pravin Dugel, MD, emphasized the company's progress and the initiation of the Phase 3 SOL-1 study with AXPAXLI for wet AMD. He highlighted the successful financing efforts that raised over $440 million and the company's focus on becoming a leader in retinal care.

"I joined Ocular because I see the opportunity to unlock significant value for patients and stockholders through the development of safe, effective, and durable treatments for retinal diseases, starting with our lead candidate, AXPAXLI for wet AMD," said Dr. Dugel.

The company is also planning an Investor Day in Q2 2024 to outline its updated corporate strategy, with topline clinical data for AXPAXLI in Diabetic Retinopathy and PAXTRAVA in Glaucoma expected in Q2 2024.

Looking Ahead

Ocular Therapeutix's strategic focus on retinal care and the anticipated milestones for its leading product candidates position the company for potential growth. The strong cash position and recent leadership appointments aim to accelerate clinical programs and bring innovative treatments to market. As OCUL continues to navigate the challenges of R&D investments and market dynamics, investors and stakeholders will be watching closely for the outcomes of upcoming clinical data and strategic initiatives.

For more detailed financial information and the full prescribing and safety information for DEXTENZA, please visit the company's website.

Explore the complete 8-K earnings release (here) from Ocular Therapeutix Inc for further details.

This article first appeared on GuruFocus.