OFG Bancorp's Meteoric Rise: Unpacking the 27% Surge in Just 3 Months

OFG Bancorp (NYSE:OFG), a financial holding company operating in the banking industry, has seen a significant surge in its stock price over the past three months. The company's market cap currently stands at $1.48 billion, with its stock price at $31.41. Over the past week, the stock price has seen a gain of 4.70%, and over the past three months, it has seen a remarkable gain of 27.23%. The company's GF Value, a measure of intrinsic value defined by GuruFocus.com, is currently at $33.61, indicating that the stock is fairly valued. This is a significant improvement from three months ago when the stock was modestly undervalued with a GF Value of $32.38.

Company Overview

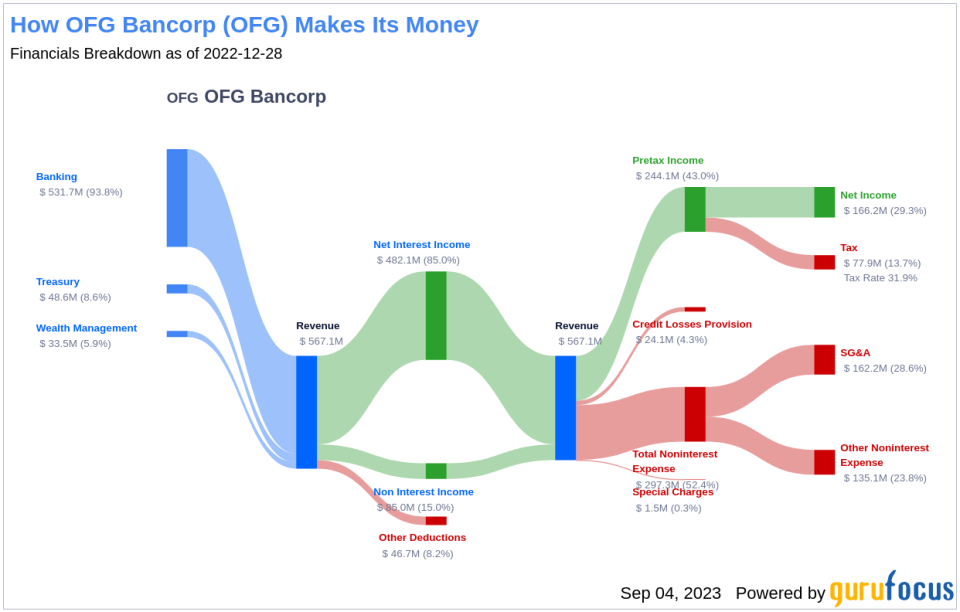

OFG Bancorp is a financial holding company that provides banking and financial services through its subsidiaries. The company operates in three segments: Banking, Wealth Management, and Treasury. Its services cater to a wide range of clients, offering commercial, consumer, auto, and mortgage lending, checking and savings accounts, financial planning, insurance, financial services, and investment brokerage, and corporate and individual trust and retirement services. The company primarily operates in the region of Puerto Rico.

Profitability Analysis

When it comes to profitability, OFG Bancorp holds a Profitability Rank of 6/10, indicating a relatively high level of profitability compared to other companies in the industry. The company's ROE (Return on Equity) stands at 17.05%, which is better than 83.29% of the companies in the industry. Similarly, its ROA (Return on Assets) is 1.78%, outperforming 84.85% of the companies in the industry. Over the past decade, the company has shown consistent profitability, with 9 years of profitability, which is better than 34.4% of the companies in the industry.

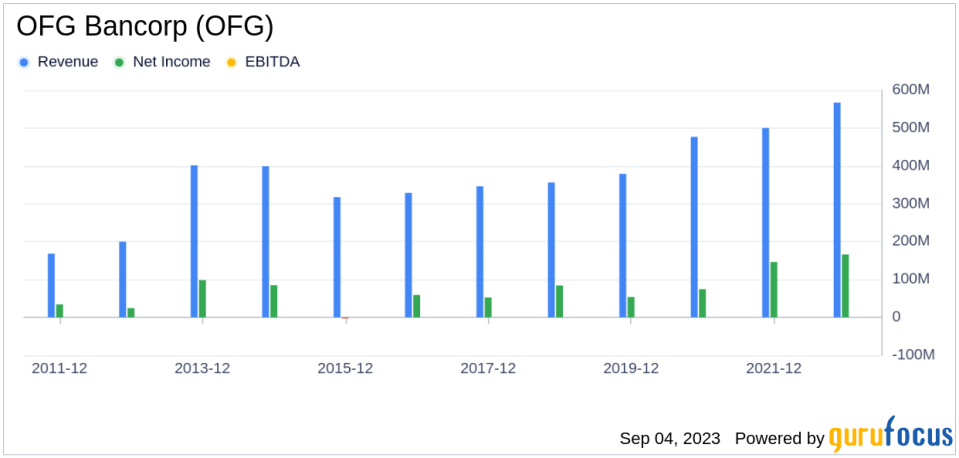

Growth Prospects

OFG Bancorp has demonstrated strong growth potential, with a Growth Rank of 7/10. The company's 3-year revenue growth rate per share is 16.90%, outperforming 86.22% of the companies in the industry. Its 5-year revenue growth rate per share is 12.10%, which is better than 81.6% of the companies in the industry. Furthermore, the company's 3-year EPS without NRI growth rate is 55.20%, which is better than 94.85% of the companies in the industry, and its 5-year EPS without NRI growth rate is 29.40%, outperforming 91.1% of the companies in the industry.

Major Stock Holders

The top three holders of OFG Bancorp's stock are Barrow, Hanley, Mewhinney & Strauss, holding 2,329,314 shares (4.94%), Chuck Royce (Trades, Portfolio), holding 21,084 shares (0.04%), and Jeremy Grantham (Trades, Portfolio), holding 9,556 shares (0.02%).

Competitive Landscape

OFG Bancorp operates in a competitive industry, with its top three competitors being Trustmark Corp (NASDAQ:TRMK) with a stock market cap of $1.45 billion, FB Financial Corp (NYSE:FBK) with a stock market cap of $1.45 billion, and Northwest Bancshares Inc (NASDAQ:NWBI) with a stock market cap of $1.43 billion.

Conclusion

In conclusion, OFG Bancorp has demonstrated strong stock performance, profitability, and growth potential. The company's stock has seen a significant surge over the past three months, and its profitability and growth ranks indicate a high level of profitability and growth potential compared to other companies in the industry. The company's major stock holders and competitors further highlight its position in the market. Given these factors, OFG Bancorp appears to be in a strong financial position with potential for future growth.

This article first appeared on GuruFocus.