OFG Bancorp's Meteoric Rise: Unpacking the 26% Surge in Just 3 Months

OFG Bancorp (NYSE:OFG), a financial holding company operating in the banking industry, has seen a significant surge in its stock price over the past three months. The company's stock price has risen by 25.53% over the past three months, reaching a current price of $31.15. This impressive performance has resulted in a market cap of $1.47 billion. The company's stock price has also seen a gain of 3.30% over the past week, further demonstrating its strong performance.

Understanding OFG Bancorp's Valuation

The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates. Currently, the GF Value of OFG Bancorp is $33.57, indicating that the stock is fairly valued. This is a significant increase from the GF Value of $32.38 three months ago, which suggested that the stock was modestly undervalued. This increase in GF Value aligns with the stock's recent price surge, further validating the stock's strong performance.

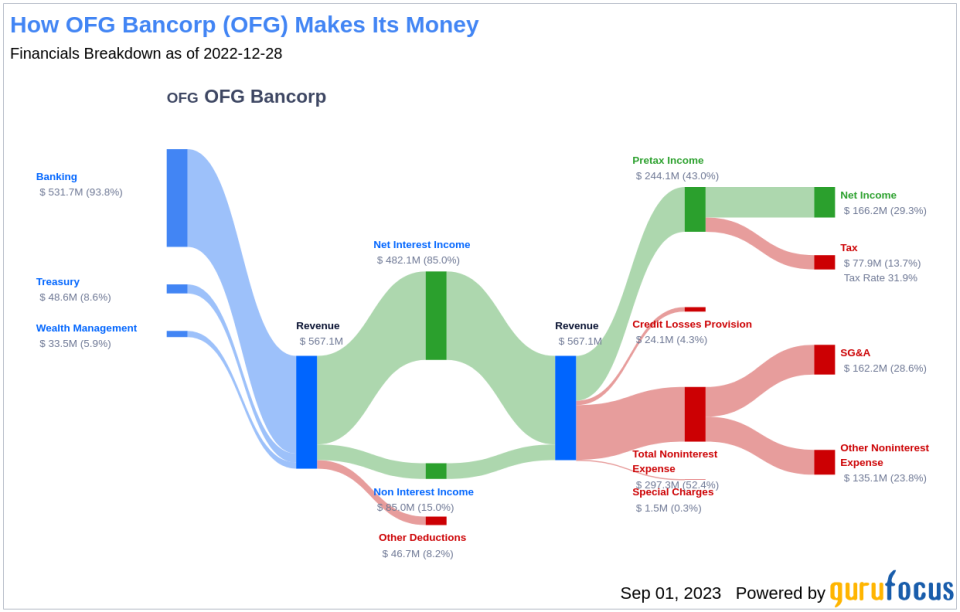

Profitability Analysis of OFG Bancorp

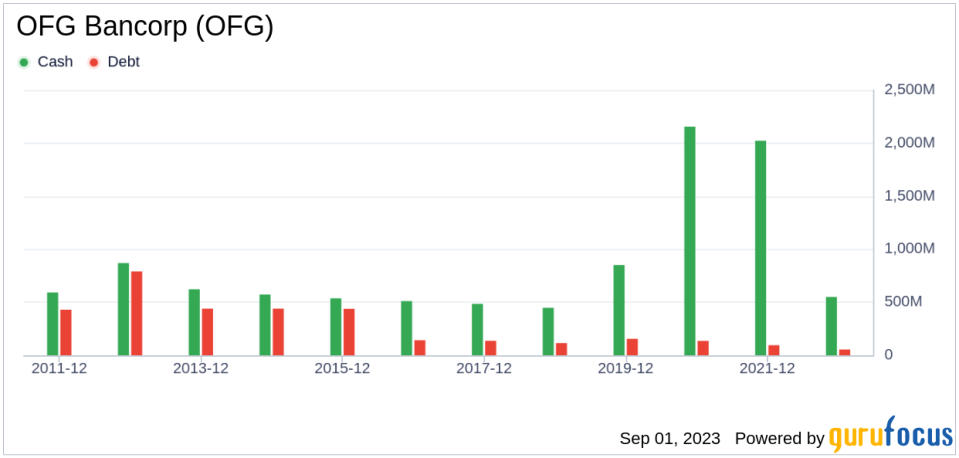

OFG Bancorp has a Profitability Rank of 6/10, indicating a relatively high level of profitability. The company's ROE and ROA, which stand at 17.05% and 1.78% respectively, are higher than the majority of companies in the industry. This suggests that OFG Bancorp is effectively utilizing its assets and equity to generate profits. Furthermore, the company has been profitable for 9 out of the past 10 years, further demonstrating its strong financial performance.

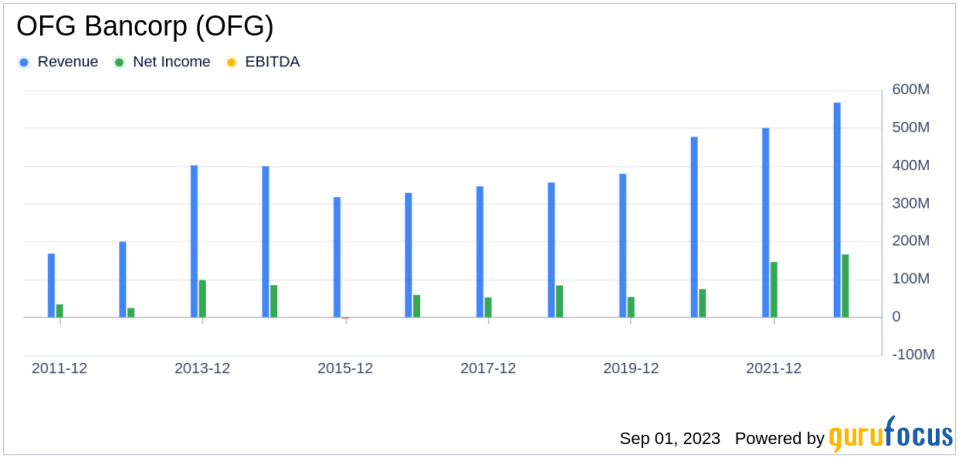

Assessing OFG Bancorp's Growth

OFG Bancorp has a Growth Rank of 7/10, indicating a relatively high level of growth. The company's 3-year and 5-year revenue growth rates per share are 16.90% and 12.10% respectively. Additionally, the company's 3-year and 5-year EPS without NRI growth rates are 55.20% and 29.40% respectively. These figures suggest that OFG Bancorp has been consistently growing its revenue and earnings, contributing to its strong stock performance.

Top Holders of OFG Bancorp

The top three holders of OFG Bancorp's stock are Barrow, Hanley, Mewhinney & Strauss, Chuck Royce (Trades, Portfolio), and Jeremy Grantham (Trades, Portfolio). Barrow, Hanley, Mewhinney & Strauss holds the largest number of shares, with 2,329,314 shares, representing 4.94% of the company's stock. Chuck Royce (Trades, Portfolio) and Jeremy Grantham (Trades, Portfolio) hold 21,084 and 9,556 shares respectively, representing 0.04% and 0.02% of the company's stock.

Competitive Landscape

OFG Bancorp operates in a competitive industry, with main competitors including Trustmark Corp (NASDAQ:TRMK), FB Financial Corp (NYSE:FBK), and Northwest Bancshares Inc (NASDAQ:NWBI). These companies have market caps of $1.43 billion, $1.46 billion, and $1.42 billion respectively, closely matching that of OFG Bancorp. This suggests that OFG Bancorp is well-positioned in the industry, with a competitive market cap and strong financial performance.

Conclusion

In conclusion, OFG Bancorp's stock has seen a significant surge over the past three months, driven by its strong financial performance, high profitability, and consistent growth. The company's fairly valued GF Value and competitive position in the industry further validate its strong performance. Based on this analysis, OFG Bancorp's stock may continue to perform well in the future.

This article first appeared on GuruFocus.