OFS Capital Corp Reports Mixed Q4 and Full Year 2023 Results; NAV Declines Amid Investment ...

Net Investment Income: $0.35 per share for Q4, surpassing the quarterly distribution.

Net Loss on Investments: $0.66 per share for Q4, primarily from unrealized depreciation.

Net Asset Value (NAV): Decreased to $12.09 per share at the end of Q4 from $12.74 in the previous quarter.

Portfolio Composition: 92% floating rate loans; 100% first and second lien loans.

Income Yield: Weighted-average performing income yield declined to 14.1% in Q4 from 14.6% in the previous quarter.

Liquidity and Capital Resources: $45.3 million in cash, with additional credit facilities available subject to conditions.

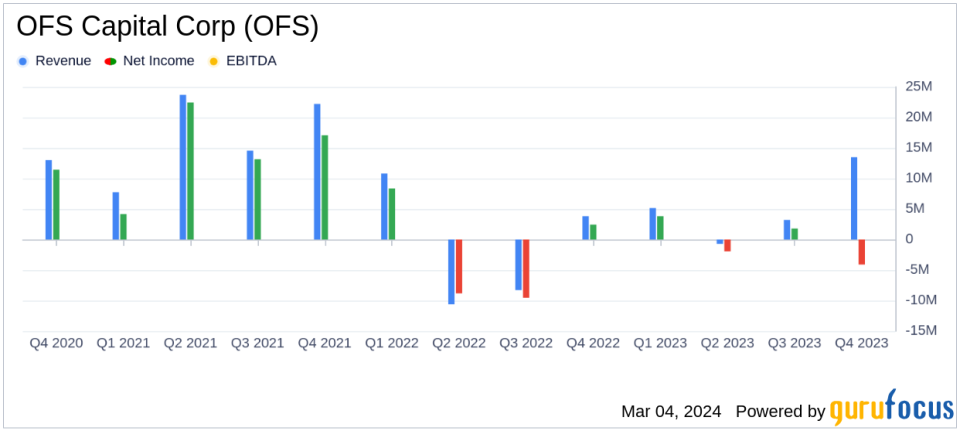

OFS Capital Corp (NASDAQ:OFS), an investment firm focusing on middle-market companies in the United States, released its 8-K filing on March 4, 2024, detailing its financial performance for the fourth quarter and full year ended December 31, 2023. The company, which specializes in senior secured loans and subordinated loans, among other investments, experienced a mixed quarter with net investment income beating the quarterly distribution, but also faced a net loss on investments due to unrealized depreciation.

Financial Performance and Challenges

OFS Capital's net investment income for the fourth quarter was $0.35 per common share, which exceeded the quarterly distribution paid. However, the company reported a net loss on investments of $0.66 per common share for the same period, primarily comprised of net unrealized depreciation of $0.58 per common share. No new non-accrual loans were reported during the fourth quarter, which is a positive sign for the company's credit quality. The net asset value per common share decreased from $12.74 at the end of the third quarter to $12.09 at the end of the fourth quarter, reflecting the challenges faced in the investment portfolio.

The performance of OFS Capital is significant as it reflects the company's ability to generate income from its investments, which is crucial for maintaining distributions to shareholders. The challenges, such as the decrease in NAV and the net loss on investments, may lead to concerns about the valuation of the portfolio and the potential for future income generation.

Financial Achievements and Industry Importance

Despite the challenges, OFS Capital's financial achievements, such as maintaining a high percentage of floating rate loans, are important in the current interest rate environment. This positioning could benefit the company if interest rates rise, as the income from these loans would increase. Additionally, the company's focus on first and second lien loans provides a measure of security, as these investments are typically senior in the capital structure and may offer better protection in the event of a borrower's default.

Income Statement and Balance Sheet Highlights

For the quarter ended December 31, 2023, OFS Capital's total investment income decreased by $1.2 million compared to the previous quarter, primarily due to a decrease in interest income. Total expenses decreased by $0.5 million, mainly from a reduction in base management and incentive fees, as well as a decrease in interest expense. The net loss on investments was primarily due to unrealized depreciation on specific portfolio companies and broader declines in structured finance securities.

On the balance sheet, the investment portfolio at fair value was $420.3 million, a decrease from $457.2 million in the previous quarter. Total assets stood at $469.8 million, while net assets were $162.0 million, down from $170.7 million in the previous quarter.

"We are pleased to announce that net investment income for the fourth quarter exceeded the quarterly distribution paid," said Bilal Rashid, OFS Capitals Chairman and Chief Executive Officer. "We believe that we continue to benefit from the current interest rate environment with the vast majority of our loan portfolio being floating rate and the majority of our debt being fixed-rate."

Liquidity and Capital Resources

OFS Capital reported having $45.3 million in cash as of December 31, 2023, including restricted cash held by a subsidiary. The company also has unused commitments under various credit facilities, which provide additional liquidity, subject to borrowing base requirements and other covenants.

The company's liquidity is crucial for its operations, allowing it to make new investments and manage its debt obligations. The availability of credit facilities also provides flexibility in capital management.

Analysis and Outlook

OFS Capital's performance in the fourth quarter shows resilience in net investment income, despite the broader challenges in the investment portfolio. The company's strategic focus on floating rate loans and senior secured debt positions it to potentially benefit from interest rate movements and to mitigate risks associated with borrower defaults. However, the unrealized depreciation in investments and the decline in NAV highlight the need for careful portfolio management and monitoring of market conditions.

OFS Capital will host a conference call to discuss these results and provide further insights into its performance and strategies. Investors and stakeholders will be keen to understand the company's outlook and how it plans to navigate the current market environment.

For a more detailed discussion of OFS Capital's financial results and other information, readers are encouraged to refer to the company's Form 10-K for the year ended December 31, 2023.

Explore the complete 8-K earnings release (here) from OFS Capital Corp for further details.

This article first appeared on GuruFocus.