OGE Energy Corp. Reports Decline in 2023 Earnings, Sets 2024 Outlook

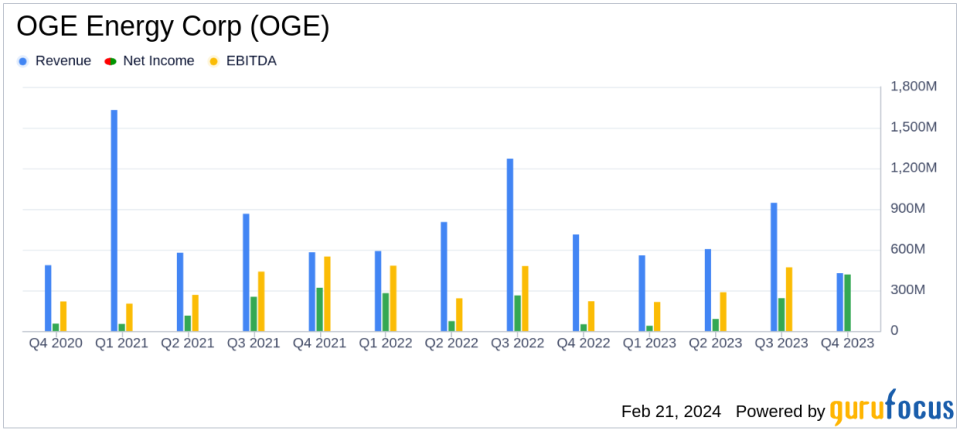

Net Income: OGE Energy Corp. reported a decrease in net income to $416.8 million in 2023 from $665.7 million in 2022.

Earnings Per Share (EPS): Diluted EPS for 2023 stood at $2.07, down from $3.32 in 2022, reflecting the divestiture of natural gas midstream operations.

Operating Revenues: Operating revenues decreased to $2,674.3 million in 2023 from $3,375.7 million in the previous year.

Dividend: A second quarter dividend of $0.4182 per common share has been declared, payable on April 26, 2024.

2024 Outlook: The company forecasts a midpoint consolidated EPS of $2.12 for 2024, with a range of $2.06 to $2.18 per average diluted share.

Capital Investments: OGE Energy continues to focus on investing in infrastructure projects to drive long-term shareholder value and support a 5-7% EPS growth rate.

On February 21, 2024, OGE Energy Corp (NYSE:OGE) released its 8-K filing, detailing its financial performance for the year ended December 31, 2023. The company, a key player in the regulated utilities industry, reported a decrease in earnings per diluted share (EPS) to $2.07 in 2023, down from $3.32 in 2022. This decline is primarily attributed to the divestiture of its natural gas midstream operations, which contributed $1.16 per diluted share to the 2022 earnings.

OGE Energy Corp, the parent company of Oklahoma Gas & Electric (OG&E), has a significant customer base of approximately 896,000 in Oklahoma and western Arkansas. The company has undergone strategic changes, including the full exit from natural gas midstream operations in 2022, which has impacted its financial results.

Performance and Challenges

OG&E, the regulated electric utility segment, contributed earnings of $2.12 per diluted share in 2023, a slight decrease from $2.19 per diluted share in 2022. The dip in net income was largely due to milder weather, higher depreciation, and increased operation and maintenance expenses, despite higher operating revenues from capital investment recovery and load growth.

Other operations, including the holding company, reported a loss of $0.05 per diluted share in 2023, which was a slight increase in loss compared to $0.03 per diluted share in 2022. The increase in net loss was mainly due to higher interest expenses related to increased short-term debt, although this was partially offset by a higher income tax benefit.

Financial Achievements and Importance

OGE Energy's financial achievements in 2023, despite the challenges, underscore the company's resilience and strategic focus on its core electric utility operations. The company's ability to maintain a strong operating revenue base, even after exiting the midstream operations, is crucial for sustaining its investment in infrastructure projects that are expected to drive long-term growth. The consistent dividend payout also reflects the company's commitment to shareholder returns.

Key Financial Metrics

The following are key financial metrics from OGE Energy Corp's income statement and balance sheet:

Financial Metric | 2023 | 2022 |

|---|---|---|

Operating Revenues | $2,674.3 million | $3,375.7 million |

Net Income | $416.8 million | $665.7 million |

Diluted EPS | $2.07 | $3.32 |

Dividend Per Share | $0.4182 | Not specified |

These metrics are important as they provide insights into the company's profitability, revenue generation, and shareholder value. The EPS, in particular, is a critical measure of a company's profitability on a per-share basis, and it's a key indicator for investors.

"In 2023, our team delivered outstanding results as we provided safe and reliable electricity to our customers," said Sean Trauschke, Chairman, President and CEO of OGE Energy Corp. "The fundamentals of our business are strong and our sustainable business model to leverage our low rates and excellent service drives economic growth in Oklahoma and western Arkansas which contributes to a bright future for our company, consistent long-term growth for our shareholders, and ever more reliable service for our customers."

Analysis of Performance

OGE Energy's performance in 2023 reflects a transition period following the divestiture of its midstream operations. The company's focus on its electric utility business and infrastructure investments is expected to support a steady growth trajectory. The guidance for 2024 suggests a stable outlook with a continued emphasis on operational efficiency and capital discipline.

Value investors may find OGE Energy's commitment to long-term growth and shareholder returns appealing, especially given the company's strategic investments and cost management efforts. The utility sector's nature of providing essential services offers a level of stability and predictability in earnings, which can be attractive in uncertain economic times.

For more detailed information, investors are encouraged to review OGE Energy Corp's full 8-K filing and consider the company's future prospects in light of the 2024 outlook and ongoing strategic initiatives.

Explore the complete 8-K earnings release (here) from OGE Energy Corp for further details.

This article first appeared on GuruFocus.