Ogunlesi to leave Goldman’s board after BlackRock agrees to buy Global Infrastructure Partners for $12.5 billion

The fact that BlackRock’s $12.5 billion purchase of Global Infrastructure Partners shook up a corporate boardroom isn’t entirely shocking. But what if that C-suite is the one belonging to Goldman Sachs?

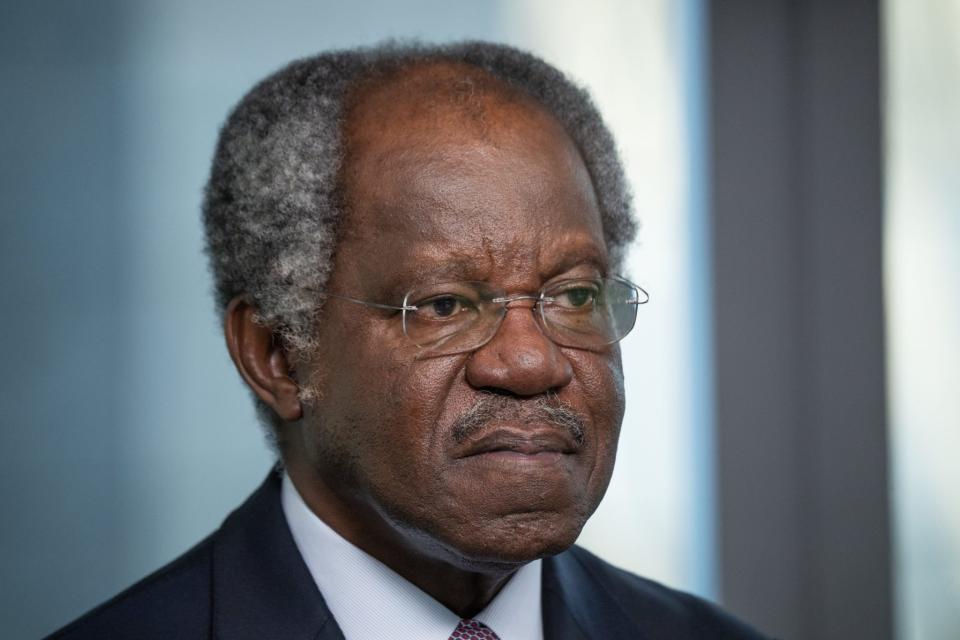

Adebayo Ogunlesi, GIP’s founder, chairman, and CEO, is joining BlackRock, along with four other GIP founding partners. (Of GIP's six founders, only Bill Woodburn, who oversees the firm's operating team, is not moving over. He is retiring, a spokesperson said.) Ogunlesi also plans to join the BlackRock board after the deal closes, likely in the third quarter.

Ogunlesi, Goldman’s lead independent director and the second-most-powerful executive behind CEO and Chairman David Solomon, joined the board in 2012. Ogunlesi also served Lloyd Blankfein, who retired in fall 2018, with Solomon taking over later that year.

“I want to congratulate Bayo Ogunlesi on the sale of GIP to Blackrock,” Solomon said Friday in a statement. “This is testament to the extraordinary firm he and his partners have built. We are grateful for Bayo for his nearly 12 years of exceptional service on our board and 10 years as lead director.”

Ogunlesi, via a GIP spokesperson, declined to comment to Fortune.

It’s unclear when Goldman will appoint its next lead director, with Solomon adding in his statement that the board “has in place governance processes” and a successor will be selected “in due course.”

Ogunlesi becomes the latest person to leave Goldman’s board, currently at 13 members. Drew Faust, the former president of Harvard University, joined in 2018 but stepped down last year. Mark Winkelman, the former co-head of Goldman’s fixed income division, was named to the board in 2014 before retiring last year, a company spokesperson confirmed. Last year, Goldman appointed Thomas Montag, who spent 22 years at Goldman and held several senior positions, including co-head of the securities division, to its board. Montag is considered an ally of Solomon.

Solomon may not be directly affected by Ogunlesi's departure, but, as a former Goldman executive described to Fortune, he was highly regarded and seen as the board’s spokesperson, always supportive of the firm. “I’m sure they are sad to see him go,” the executive added.

After Solomon, who at one point was moonlighting as a DJ called D-Sol, was criticized last year over his management style—some accused him of being a “jerk and bully,” meanwhile his massive push into consumer lending cost Goldman some $3 billion—Ogunlesi came to his defense.

Speculation over who may soon replace Solomon began dying down after Ogunlesi told Mike Mayo, a Wells Fargo equity analyst, in the fall of 2023 that Solomon had the backing of Goldman’s board. In a Sept. 18 research note, Mayo wrote, in part: “Our meeting with the board’s lead director leads us to conclude that the CEO will stay in his role for at least the medium term.”

This story was originally featured on Fortune.com