Oil Consolidates After Extension of Production Cuts

Ongoing Lower Supply of Oil is Likely to Remain Positive for the Price This Month

Crude oil has continued its gains in September so far, pushing up to new 10-month highs after Russia and Saudi Arabia announced extensions of their voluntary cuts to production. However, mostly lackluster Chinese data has dented sentiment on the outlook for demand as well. This article summarises recent factors affecting the price of crude oil and looks ahead at how the price could move over the next few weeks.

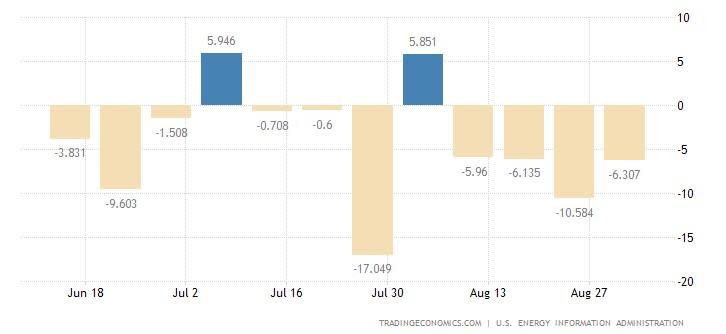

Russia and Saudi Arabia, among the world’s top three producers of oil, announced this week that they will extend their daily cuts to production of 300,000 and a million barrels respectively until the end of the year. Oil reacted positively to this news, with Brent pushing up to more than $90 a barrel as of Friday 8 September. Demand in the USA appears to be strong based on this week’s data, particularly the EIA’s figures for stocks:

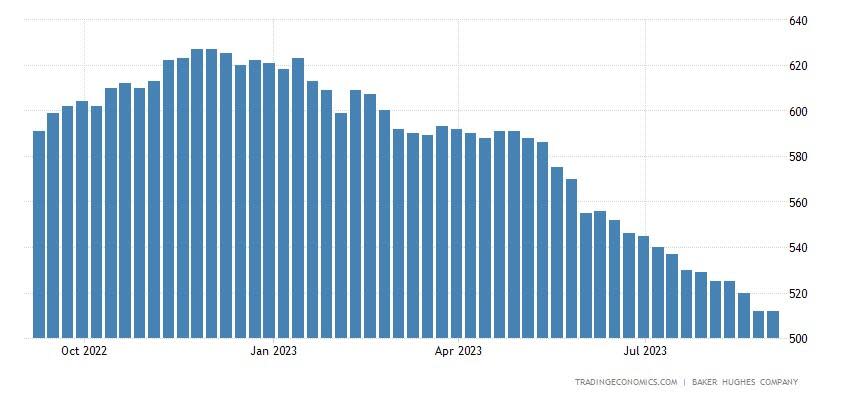

The EIA’s data show that total stocks of oil in the USA have declined for 10 of the last 12 weeks, with this week’s draw larger than the approximately two million barrels expected. Traders are also monitoring the situation of American production, which has been dropping quite consistently over the last several months:

Bakers Hughes’ rig count shows the lowest number of rigs actively drilling since February 2022, which is significant in the context of lower production from the other two main oil countries at the same time. The USA’s situation is different in that it’s politically expedient for the government to keep the price of fuel down as the presidential election approaches next year, plus the country isn’t an ally of OPEC.

However, political and regulatory factors related to climate goals complicate potential expansion of American drilling. For now, it seems very unlikely that the USA can make up for the shortfall from OPEC+.

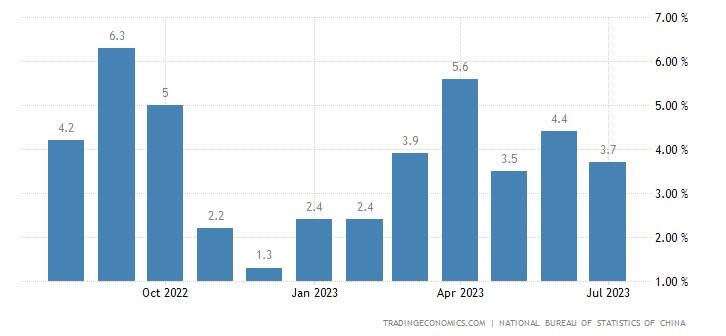

Much has been made in the last few quarters of weak growth in China. While the situation is definitely less positive than had been expected around last year’s reopening, there still aren’t signs currently of a major slowdown in the Chinese economy. Industrial production – though weaker than expected – remains clearly positive:

July’s change in industrial production in China was 0.7% less than the consensus, fuelling the narrative of Chinese slowdown. It appears that OPEC+ expected that or at least had plans for what to do if it happened.

Longer term traders are mindful that oil at $90 raises the likelihood of a resurgence in inflation around the world, which would probably lead to further hawkishness from most central banks and exacerbate any potential economic slowdown. OPEC+ knows this too, so will likely continue to ‘walk the tightrope’ between keeping prices high enough to support their economies and, in Russia’s case, war effort on the one hand while trying to avoid entirely or at least avoid exacerbating the potential recession on the other.

Technical View of Brent

The uptrend for Brent (UKOIL) remains clearly active for the moment although consolidation in the next few days seems favourable. ATR is very low around $1.65 and hasn’t picked up from summer’s lull, while the slow stochastic at 91 is in the zone of buying saturation. The upper band of Bollinger Bands (50, 0, 2) might continue to function as a dynamic resistance into next week.

For a new buyer here, finding an entry might be challenging because it’s not clear when a significant retracement might occur or what its extent might be. The 161.8% monthly Fibonacci extension based on 2020’s crash seems to have been broken for now, but waiting for the moving averages to catch up would traditionally be seen as sensible. Buy limits might be an option around the penultimate high slightly above $87.

However, American inflation coming up on Wednesday 13 September at 12.30 GMT is a key release for how it’s likely to drive the dollar. Equally, traders will analyse the IEA’s monthly oil market report due the same day at 8.00 GMT. Finally next week among major releases there’s Chinese industrial production for August early on Friday 15 September at 2.00 GMT.

If that misses the consensus of 4%, there might be some downward pressure and possible opportunities to sell in the short term or find a place to buy looking further ahead. One should also remember the possibility of a gap over the weekend and check regular stock data from the USA.

The opinions in this article are personal to the writer. They do not reflect those of Exness or FX Empire.

This article was originally posted on FX Empire