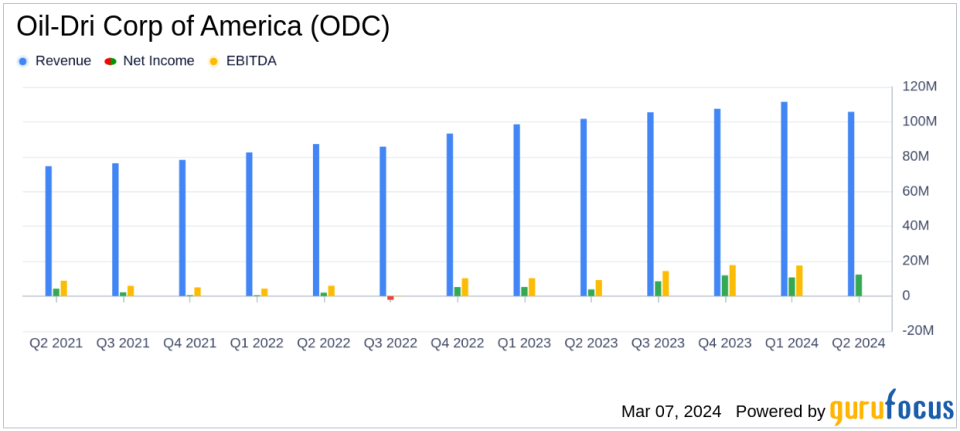

Oil-Dri Corp of America Triples Net Income in Q2, Sees 8% Revenue Growth Year-to-Date

Net Income: Soared to $12.4 million in Q2, a 221% increase over the previous year.

Revenue: Grew by 4% in Q2 to $105.7 million, and 8% year-to-date to $217.1 million.

Earnings Per Share (EPS): Diluted EPS for common stock jumped to $1.70, up 204% from the prior year.

Gross Margin: Improved significantly to 29.3% in Q2 from 22.6% in the previous year.

Cash and Cash Equivalents: Increased to $27.8 million, reflecting a $13.8 million rise from the prior year.

Segment Performance: Business to Business segment's operating income up by 42%, while Retail and Wholesale segment's operating income increased by 37%.

On March 7, 2024, Oil-Dri Corp of America (NYSE:ODC) released its 8-K filing, announcing a remarkable performance for the second quarter and first half of fiscal year 2024. The company, known for its diverse range of sorbent products, including popular brands like Cat's Pride and Jonny Cat, has reported a significant increase in net income and revenue, attributing success to strategic initiatives and a diversified product portfolio.

Financial Highlights and Operational Performance

ODC's consolidated net sales for the second quarter reached $105.7 million, marking a 4% increase over the previous year, and an 8% increase year-to-date to $217.1 million. The company's net income attributable to ODC more than tripled to $12.4 million in the second quarter, compared to $3.9 million in the prior year. Excluding nonrecurring events, net income still showed a remarkable increase of 120% for the quarter.

The company's gross profit hit an all-time high for the second quarter at $30.9 million, a 34% increase over the prior year, with gross margins expanding to 29.3%. This growth was primarily driven by increased sales of renewable diesel and cat litter products, as well as higher selling prices across multiple products and improved product mix.

ODC's Business to Business Products Group reported a 3% increase in net sales to $36.2 million, while the Retail and Wholesale Products Group saw a 4% increase to $69.4 million. Segment operating income for both groups also saw substantial increases, with the Business to Business segment up by 42% and the Retail and Wholesale segment up by 37%.

Challenges and Strategic Initiatives

Despite the positive results, ODC faced challenges in the animal health and agricultural businesses, with sales declines in these areas. However, the company's strategic initiatives to improve gross margins and invest in manufacturing infrastructure have yielded positive results, enabling the company to overcome these hurdles.

President and CEO Daniel S. Jaffee commented on the results, stating:

I am pleased to report another exceptional quarter, marked by growth in consolidated net sales, gross profit, and net income... These achievements can be attributed to our teams ongoing dedication and the diverse product offerings derived from our unique minerals. In the periods ahead, we remain committed to sustaining this momentum, investing in our manufacturing infrastructure, and delivering our value-added products and services to our loyal customers.

Looking Forward

Looking ahead, ODC plans to continue investing in its manufacturing infrastructure and delivering value-added products to its customers. The company's strong cash position, with cash and cash equivalents totaling $27.8 million, provides a solid foundation for future investments and growth initiatives.

ODC's record results for the second quarter of fiscal 2024 demonstrate the company's ability to navigate market challenges and capitalize on strategic opportunities. With a focus on innovation and customer service, ODC is well-positioned to maintain its growth trajectory and continue delivering value to its shareholders.

For more detailed information and to participate in the earnings discussion, interested parties can access the live webcast on the company's website on March 8, 2024, at 10:00 a.m. Central Time.

Explore the complete 8-K earnings release (here) from Oil-Dri Corp of America for further details.

This article first appeared on GuruFocus.