As Oil Rises, be Careful With Russia ETFs

Due to escalating tensions in the Middle East and the arrival of the summer driving season, oil futures are rising and the spread between Brent crude, the global benchmark, and West Texas Intermediate has widened in recent weeks.

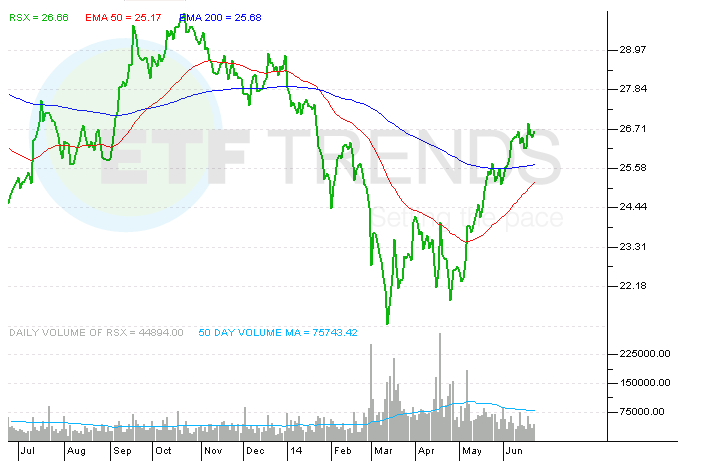

Predictably, exchange traded funds tracking Russian stocks are getting a lift from the oil rally. That makes sense because the one of the most frequently voiced criticisms of Russia ETFs is that these funs are too energy heavy.

The average weight to the energy sector for the Market Vectors Russia ETF (RSX) , iShares MSCI Russia Capped ETF (ERUS) and the SPDR S&P Russia ETF (RBL) is 46%. RSX has the lowest energy sector weight of the trio at 41.7%. [Global ETFs in Focus on Oil's Surge]

However, investors should be careful of buying Russia ETFs simply because oil prices are rising. Yes, that caution is warranted even though Russia is home to some of the largest oil reserves in the world and is the largest non-OPEC producer of oil and natural gas.

“So what does Russia get from this backdrop in terms of a bid to its oil and gas sector? Well, based on history, you have a sentiment indicator which is supportive but hasn’t led to major market gains in the post crisis Russian market as oil spikes, versus pre-crisis when all commodity disruptions were boons to the underlying producing companies and the stocks that were the producers,” writes Tim Seymour for Emerging Money.

It is hard to deny that there are times when Russian equities are highly correlated to oil prices. For example, over the past month, RSX and the United States Brent Oil Fund (BNO) are both up 3.7%. As Seymour notes, oil and gas contribute 40% of Russia’s GDP, but what follows that factoid indicates that either Russia ETFs are reacting too much to oil’s recent gyrations, other catalysts are bolstering Russian stocks or both. [Putin Pause Stokes Inflows to Russia ETFs]

“Russian taxation on the oil sector is very progressive and closely linked to underlying prices (with a 9m lag). Thus, while it’s intuitive for investors to assume that Russian oil and gas stocks should benefit from global turmoil which escalates oil prices, the actual benefit is meager. For every Dollar higher in Brent above $100, Russia oil companies effectively get only 10% of the additional revenue flowing back to them,” according to Seymour.

Seymour notes that because the largest Russian integrate oil companies, such as the ones that dot the top-10 lineups in RSX and the other Russia ETFs, are focused more on exploration and production than on refining, they are less levered to spikes in Brent futures.

RSX up more than twice as much as BNO over the past 90 days, indicating some global investors have focused more on the deep discounts and potential for dividend growth offered by Russian equities than correlations to oil prices. [Russia ETFs Have Potential]

Market Vectors Russia ETF