Oil Wobbles After Delay to OPEC’s Meeting

How OPEC Divisions, Economic Woes, and US Crude Production Impact Oil’s Recent Volatility

Oil’s bounce seems to have been cut short in recent days as talk of division among members of OPEC emerged. This comes with the backdrop of generally disappointing economic performance in China and slowly but steadily rising production of crude in the USA. This article summarises the context of recent news affecting oil and takes a brief look at the chart.

It appears that the delay to OPEC’s meeting from 26 to 30 November is primarily due to disputed quotas for relatively minor producers such as Angola and Nigeria. These rumours alleviated some of the initial nervousness among participants that Saudi Arabia, Russia or another major member or ally of OPEC might be against the group’s overall reluctance to pump more.

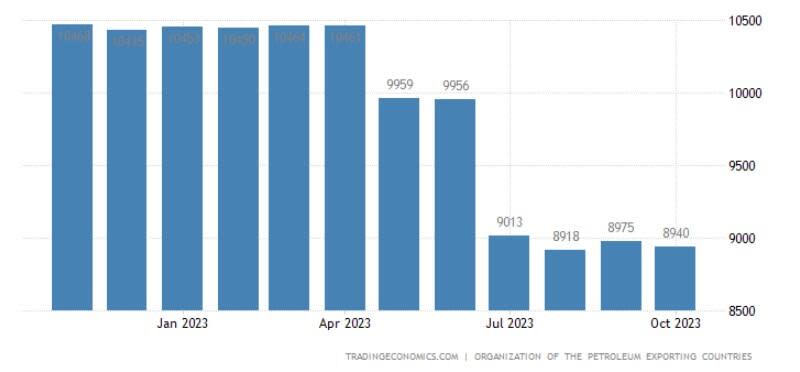

These are still rumours, not facts: traders will await the rescheduled meeting for a definite confirmation that current quotas will be extended into next year. Among OPEC+, Saudi Arabia is still committed to the biggest overall cut relative to actual capacity:

OPEC in general and the Kingdom in particular seem very eager to shore up prices as demand from major importers, primarily China, hasn’t grown strongly this year.

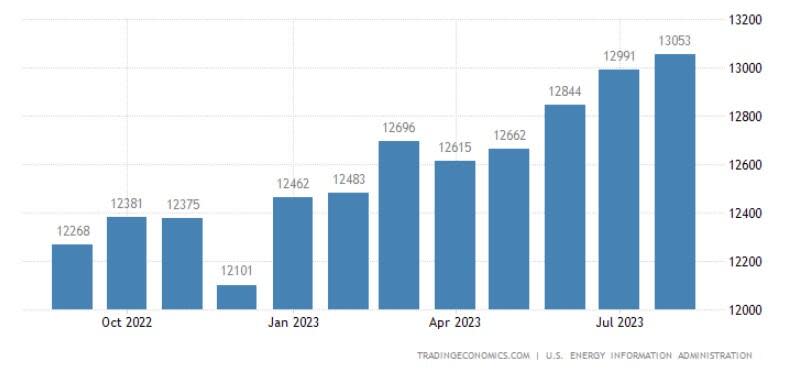

Meanwhile total production in the USA has continued to grow fairly steadily in the year to date for which statistics are available:

The USA first started to outstrip Saudi Arabia consistently in average daily production of crude oil in late 2019-early 2020, shortly before the start of the pandemic. This situation has persisted since then. It’s politically expedient though difficult given environmental regulations for the federal government to encourage more production, keeping prices low at the pumps. Earlier this year it would have been difficult to imagine the possibility of oversupply, but now it’s more of a danger:

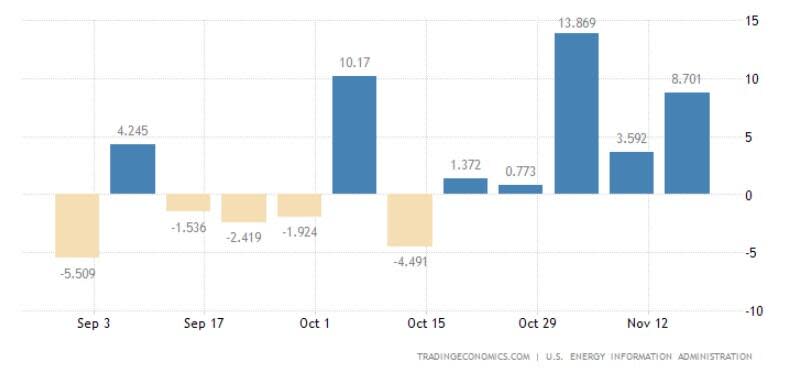

Data from the Energy Information Administration have shown buildups in American stocks for crude for several consecutive weeks, with last week in particular showing a much greater increase than the 1.16 million barrels expected. Although this is a negative factor for the price of oil in itself, the government might take advantage of the situation to refill the Strategic Petroleum Reserve (‘SPR’), which would contribute to a rise in prices unless the amount involved was unusually small.

Approximately half of the SPR has been sold off since the middle of last year. The roughly 350 million barrels remaining represent the lowest level in 40 years. Although refilling the SPR is on hold for now, $67-72 for American light oil (symbol ‘USOIL’) is likely to be a strong area of support because this is the target zone for resumption of filling the USA’s reserves.

The Daily Chart of USOIL

American light oil has broken through two important areas of support so far this month, the 200-day simple moving average and the 50% weekly Fibonacci retracement. The price is currently testing the 61.8% Fibonacci retracement area and might push lower to retest the latest low around $72.50.

The technical conditions for a modest to moderate move downward seem to be good. There’s no longer an oversold signal from either the slow stochastic or Bollinger Bands and ATR hasn’t dropped significantly in November. All of the 20, 50, 100 and 200 SMAs remain above the price.

However, demand from buyers remains quite strong. 22 November’s session formed the largest tail for several months amid a spike in buying, so any break below $72.50 might simply be a fakeout as buyers await the next key support around $72 with the American government’s ‘target area’ in mind.

Balancing fundamentals and technicals, consolidation around the 61.8% Fibo seems to be likely in the runup to OPEC’s meeting unless significant new information or rumours reach traders. Traders should be particularly cautious of holding positions over the weekend because Monday’s open will almost certainly produce at least a small gap one way or the other.

The opinions in this article are personal to the writer. They do not reflect those of Exness or FX Empire.

This article was originally posted on FX Empire