Okta (OKTA) to Report Q2 Earnings: What's in the Cards?

Okta, Inc. OKTA is set to report second-quarter fiscal 2021 results on Aug 27.

For the quarter, Okta anticipates non-GAAP net loss in the range of 1-2 cents per share. The Zacks Consensus Estimate for loss has remained steady at 2 cents per share over the past 30 days.

Okta expects revenues in the range of $185 million to $187 million, up 32% to 33% year over year. The consensus mark for revenues is pegged at $186.4 million, indicating an increase of 32.7% from the year-ago quarter reported figure.

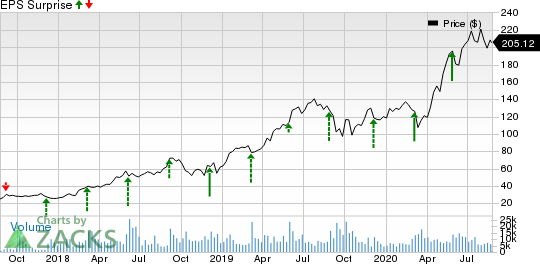

Notably, the company’s earnings beat the Zacks Consensus Estimate in the trailing four quarters, with the average surprise being 58.2%.

Let’s see how things have shaped up for the upcoming announcement.

Okta, Inc. Price and EPS Surprise

Okta, Inc. price-eps-surprise | Okta, Inc. Quote

Higher Investments in Identity Platform to Dent Profits

Second-quarter fiscal 2021 earnings are expected to have been weighed down by higher research and development expenses. Notably, non-GAAP research and development expenses surged 42.5% year over year to $48.5 million in first-quarter fiscal 2021 due to significant investments in Okta identity platform and integration network.

Nevertheless, product innovations and continued adoption of identity solutions are expected to have driven Okta’s top line.

Additionally, Okta’s revenues are expected to have benefited from higher adoption of the company’s Identity solutions.

Markedly, FedEX FDX implemented the Okta Identity Cloud to securely enable its global workforce of essential employees to remotely access the critical applications required to successfully deliver goods and services to customers during the COVID-19 pandemic.

Moreover, Okta announced new and expanded partnerships with customers including Australian Red Cross, Moody’s, Mouvement Edouard Leclerc, Parsons, Servus Credit Union, State of Illinois, T-Mobile, Workday, and Zoom during the to-be-reported quarter.

Moreover, major updates and additions made to Okta Partner Connect program are expected to have attracted new and expanded customer engagements in the to-be-reported quarter.

Notably, the company added 450 new customers in the last reported quarter, taking the total count to 8400, an increase of 28% year over year including new or expanded customer engagements.

Key Developments in Q2

During the quarter, the company announced a new native integration with Amazon’s AMZN Amazon Web Services Single Sign-On (AWS SSO), providing Okta customers with improved security, user experience, and provisioning capabilities.

Additionally, this Zacks Rank #4 (Sell) company collaborated with CrowdStrike CRWD, Netskope, and Proofpoint to help organizations implement an integrated, zero trust security strategy required to protect the remote working environment as a result of coronavirus outbreak.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

FedEx Corporation (FDX) : Free Stock Analysis Report

Okta, Inc. (OKTA) : Free Stock Analysis Report

CrowdStrike Holdings Inc. (CRWD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research