Okta's (NASDAQ:OKTA) Q4: Beats On Revenue, Stock Jumps 18.5%

Identity management software maker Okta (OKTA) reported Q4 FY2024 results topping analysts' expectations , with revenue up 18.6% year on year to $605 million. Guidance for next quarter's revenue was also optimistic at $604 million at the midpoint, 3.3% above analysts' estimates. It made a non-GAAP profit of $0.63 per share, improving from its profit of $0.30 per share in the same quarter last year.

Is now the time to buy Okta? Find out by accessing our full research report, it's free.

Okta (OKTA) Q4 FY2024 Highlights:

Revenue: $605 million vs analyst estimates of $587.6 million (3% beat)

EPS (non-GAAP): $0.63 vs analyst estimates of $0.51 (24% beat)

Revenue Guidance for Q1 2025 is $604 million at the midpoint, above analyst estimates of $584.5 million

Management's revenue guidance for the upcoming financial year 2025 is $2.5 billion at the midpoint, beating analyst estimates by 1.1% and implying 10.5% growth (vs 22% in FY2024)

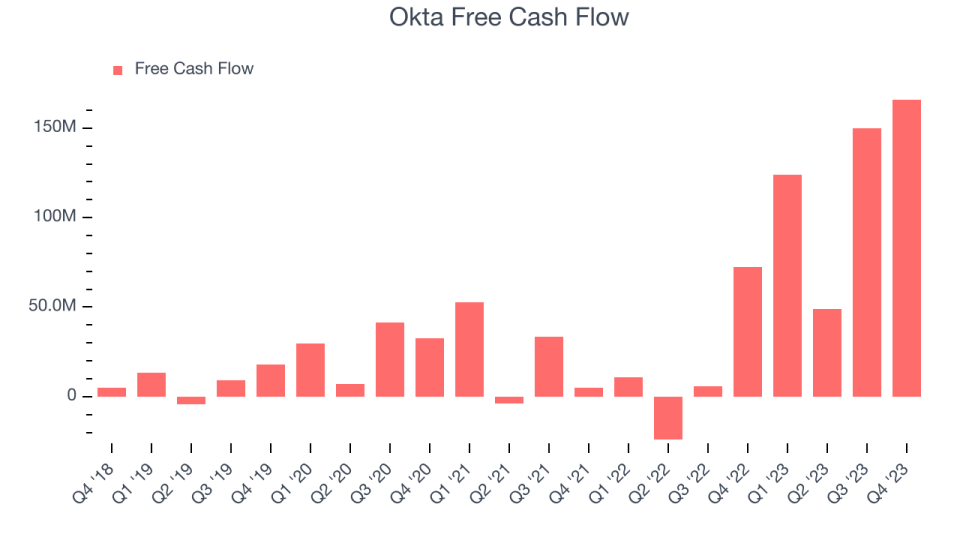

Free Cash Flow of $166 million, up 10.7% from the previous quarter

Gross Margin (GAAP): 76%, up from 72.8% in the same quarter last year

Market Capitalization: $14.37 billion

Founded during the aftermath of the financial crisis in 2009, Okta (NASDAQ:OKTA) is a cloud-based software-as-a-service platform that helps companies manage identity for their employees and customers.

Identity Management

As software penetrates corporate life, employees are using more apps every day, on more devices, in more locations. This drives the need for identity and access management software that help companies efficiently manage who has access to what, and ensure that access privileges are secure from cyber criminals.

Sales Growth

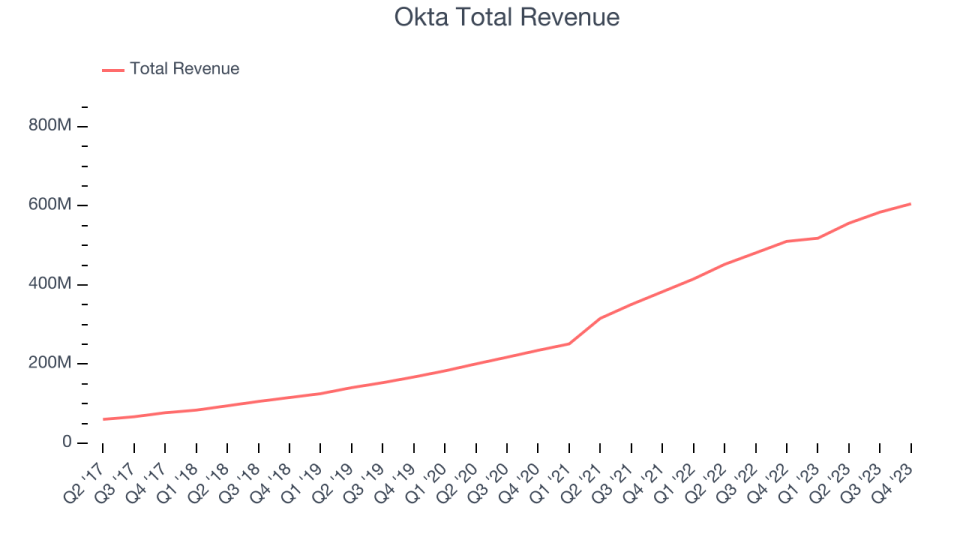

As you can see below, Okta's revenue growth has been very strong over the last two years, growing from $383 million in Q4 FY2022 to $605 million this quarter.

This quarter, Okta's quarterly revenue was once again up 18.6% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $21 million in Q4 compared to $28 million in Q3 2024. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Okta is expecting revenue to grow 16.6% year on year to $604 million, slowing down from the 24.8% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $2.5 billion at the midpoint, growing 10.5% year on year compared to the 21.8% increase in FY2024.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Okta's free cash flow came in at $166 million in Q4, up 129% year on year.

Okta has generated $489 million in free cash flow over the last 12 months, an impressive 21.6% of revenue. This high FCF margin stems from its asset-lite business model and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a cash cushion.

Key Takeaways from Okta's Q4 Results

It was great to see Okta's optimistic revenue guidance for next quarter, which exceeded analysts' expectations. We were also glad its revenue in Q4 outperformed Wall Street's estimates, alongside strong free cash flow. Overall, this quarter's beat & raise results seemed very positive and shareholders should feel optimistic. The stock is up 18.7% after reporting and currently trades at $103.74 per share.

Okta may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.