Olaplex Holdings Inc (OLPX) Faces Decline in Sales and Earnings Amid Market Challenges

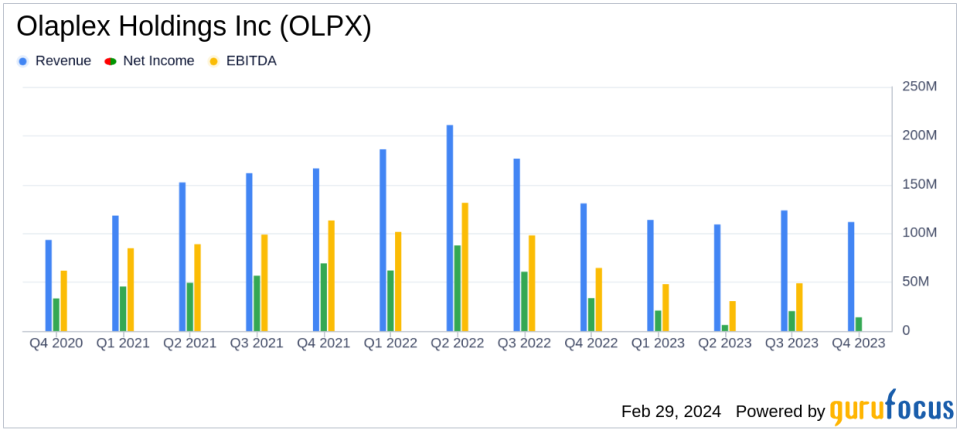

Net Sales: Decreased by 34.9% to $458.3 million for FY 2023.

Net Income: Dropped significantly by 74.8% for the year.

Diluted EPS: Fell to $0.09 for FY 2023 from $0.35 in FY 2022.

Gross Profit Margin: Declined to 69.5% in FY 2023 from 73.8% in FY 2022.

Adjusted EBITDA: Decreased by 59.4% to $174.26 million for the year.

Cash and Cash Equivalents: Increased to $466.4 million as of December 31, 2023.

Guidance for FY 2024: Net sales expected to range between $435-$463 million.

On February 29, 2024, Olaplex Holdings Inc (NASDAQ:OLPX) released its 8-K filing, disclosing its financial results for the fourth quarter and fiscal year ended December 31, 2023. The company, known for its science-enabled, technology-driven beauty products, particularly in hair care, reported a significant decrease in net sales and net income for the fiscal year 2023. Olaplex Holdings Inc operates through a global omnichannel platform, serving professional, specialty retail, and direct-to-consumer channels, and generates revenue through the sale of its specialty hair care products.

Fiscal Year 2023 Performance

Olaplex Holdings Inc faced a challenging fiscal year, with net sales plummeting by 34.9% to $458.3 million compared to the previous year. This decline was more pronounced in the United States, where net sales dropped by 47.8%, while international sales decreased by 18.3%. The company's net income also took a substantial hit, decreasing by 74.8%, with diluted earnings per share (EPS) falling to $0.09 from $0.35 in the prior year. Adjusted net income and adjusted diluted EPS followed a similar downward trend, decreasing by 65.3% and 64.4%, respectively.

The gross profit margin contracted to 69.5% from 73.8% in FY 2022, reflecting the company's struggle to maintain profitability amid declining sales. Selling, general, and administrative (SG&A) expenses rose by 48.4%, further impacting the bottom line. Despite these challenges, Olaplex Holdings Inc managed to increase its cash and cash equivalents to $466.4 million as of December 31, 2023, up from $322.8 million the previous year.

Fourth Quarter Highlights and Management Commentary

The fourth quarter of 2023 also saw declines, with net sales decreasing by 14.5% to $111.7 million. The company experienced a drop in sales across all channels, with the professional channel seeing the largest decrease at 22.7%. Net income for the quarter decreased by 58.1%, and diluted EPS was down to $0.02 from $0.05 in the fourth quarter of 2022.

"Our fourth quarter results were in line with our expectations and represent another positive step towards stabilizing our demand trend. I am confident in the strong foundation of the OLAPLEX brand and believe that our priorities for the year ahead will position the company to return to consistent sales and profit growth," said Amanda Baldwin, OLAPLEXs Chief Executive Officer.

Despite the declines, the management remains optimistic about the company's foundational strength and its potential for a return to growth in the future.

Looking Ahead: Fiscal Year 2024 Guidance

For fiscal year 2024, Olaplex Holdings Inc has provided guidance that suggests a potential stabilization of sales, with net sales expected to range between $435 million and $463 million. Adjusted net income is projected to be between $87 million and $100 million, while adjusted EBITDA is anticipated to be in the range of $143 million to $159 million.

The company's guidance incorporates expectations regarding consumer demand and investments aimed at driving sell-through, improving foundational capabilities, and building a healthier brand. Management expects adjusted gross profit margin to improve slightly due to the lapping of actions taken to address excess inventory and anticipated efficiencies from an internal cost savings program.

Olaplex Holdings Inc's performance in fiscal year 2023 reflects the challenges faced by many companies in the retail-cyclical sector. The company's ability to navigate these challenges and execute its strategic priorities will be critical for investors monitoring its potential for recovery and growth in the coming year.

For more detailed financial information and future updates on Olaplex Holdings Inc, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Olaplex Holdings Inc for further details.

This article first appeared on GuruFocus.