Old Dominion Freight Line Inc. Reports Modest Revenue Growth Amid Economic Softness

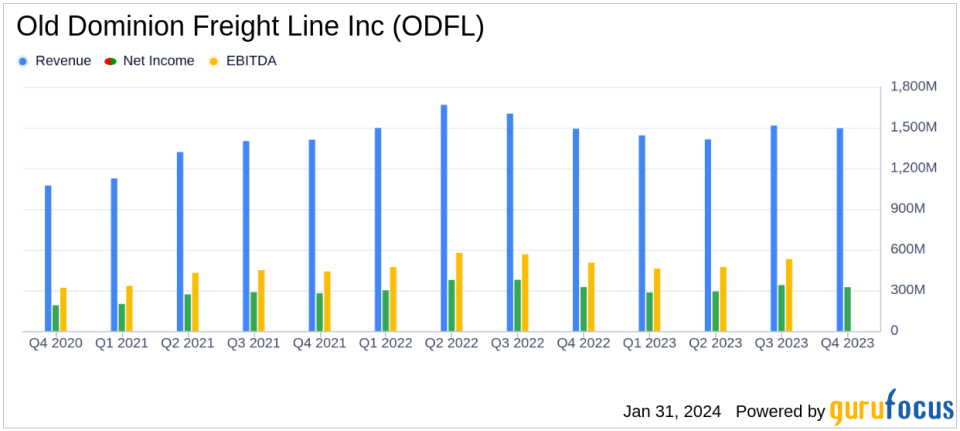

Revenue: Q4 revenue increased marginally by 0.3% year-over-year to $1.495 billion.

Net Income: Net income slightly decreased by 0.3% to $322.8 million in Q4.

Earnings Per Share (EPS): Diluted EPS for Q4 rose to $2.94, up from $2.92 in the previous year.

Operating Ratio: Operating ratio deteriorated slightly to 71.8% in Q4 from 71.2% in the prior year.

Dividend: Quarterly cash dividend to increase by 30% to $0.52 per share.

Capital Expenditure: Capital expenditures for 2023 totaled $757.3 million, with $750 million expected for 2024.

Share Repurchase and Dividends: $453.6 million spent on share repurchases and $175.1 million on cash dividends in 2023.

On January 31, 2024, Old Dominion Freight Line Inc (NASDAQ:ODFL) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. As the second-largest less-than-truckload (LTL) carrier in the United States, ODFL operates with over 250 service centers and more than 11,000 tractors. Known for its disciplined and efficient approach, the company's profitability and capital returns are notable within the trucking industry.

Despite the ongoing economic headwinds, ODFL reported a slight increase in quarterly revenue, up 0.3% to $1.495 billion, while full-year revenue saw a decline of 6.3% to $5.866 billion. The company's net income for the quarter was marginally lower by 0.3% at $322.8 million, and diluted earnings per share increased to $2.94 from $2.92 in the prior year.

Financial Performance and Strategic Focus

ODFL's President and CEO, Marty Freeman, highlighted the company's resilience amidst economic softness, with stable volume trends and a consistent demand for LTL service. The slight revenue increase in Q4 was attributed to a 3.0% increase in LTL revenue per hundredweight, which helped to offset a 2.0% decrease in LTL tons per day. The company's focus on yield-improvement initiatives and a pricing philosophy aimed at offsetting cost inflation has been central to its strategy.

However, ODFL's operating ratio experienced a slight increase to 71.8% for the fourth quarter, up from 71.2% in the previous year. This was due to higher direct operating costs and overhead, including a notable increase in insurance and claims expenses.

Investments and Shareholder Returns

Old Dominion's commitment to investing in its service network, equipment, and technology was evident in its capital expenditures of $757.3 million for the year. Looking ahead, the company plans to invest approximately $750 million in 2024, focusing on real estate, service center expansion, and technological advancements.

In addition to investments, ODFL has been active in returning capital to shareholders. The company utilized $453.6 million for share repurchases and paid out $175.1 million in cash dividends throughout the year. Furthermore, the Board of Directors declared a 30% increase in the quarterly cash dividend to $0.52 per share, signaling confidence in the company's financial health and commitment to shareholder value.

Outlook and Positioning for Growth

Freeman concluded with optimism about the company's positioning for future growth, emphasizing the quality of service and the strength of the OD Family of employees. With a focus on delivering superior service at a fair price, ODFL aims to drive profitable growth and enhance shareholder value as the economy shows signs of improvement.

Old Dominion Freight Line Inc's detailed financial statements and operating statistics reflect a company navigating through economic challenges while maintaining a strategic focus on long-term growth and shareholder returns. The company's disciplined approach to cost management and investment in service quality positions it well for when the economic environment improves.

For further details on ODFL's financial results and strategic initiatives, investors are invited to listen to the conference call or access the replay on the company's investor relations website.

Explore the complete 8-K earnings release (here) from Old Dominion Freight Line Inc for further details.

This article first appeared on GuruFocus.