Old Dominion Freight Line (ODFL): A Closer Look at Its Fair Market Value

Old Dominion Freight Line Inc (NASDAQ:ODFL) has seen a daily gain of 1.47% and an impressive 3-month return of 24.73%. The company's Earnings Per Share (EPS) (EPS) stands at 11.51. But the question remains: is the stock modestly overvalued? In this article, we will conduct a valuation analysis to answer this question. So, let's dive in.

Company Overview

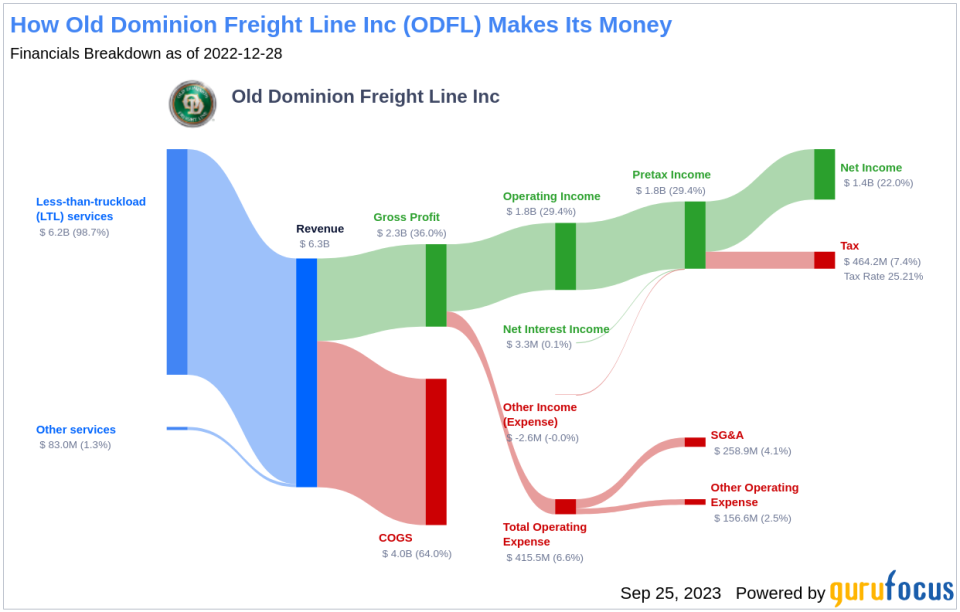

Old Dominion Freight Line is the second-largest less than truckload carrier in the United States. The company operates more than 250 service centers and has over 11,000 tractors. Known for its disciplined and efficient service, Old Dominion Freight Line's profitability and capital returns outperform its peers. The company's strategic initiatives focus on increasing network density through market share gains and maintaining industry-leading service via consistent infrastructure investment.

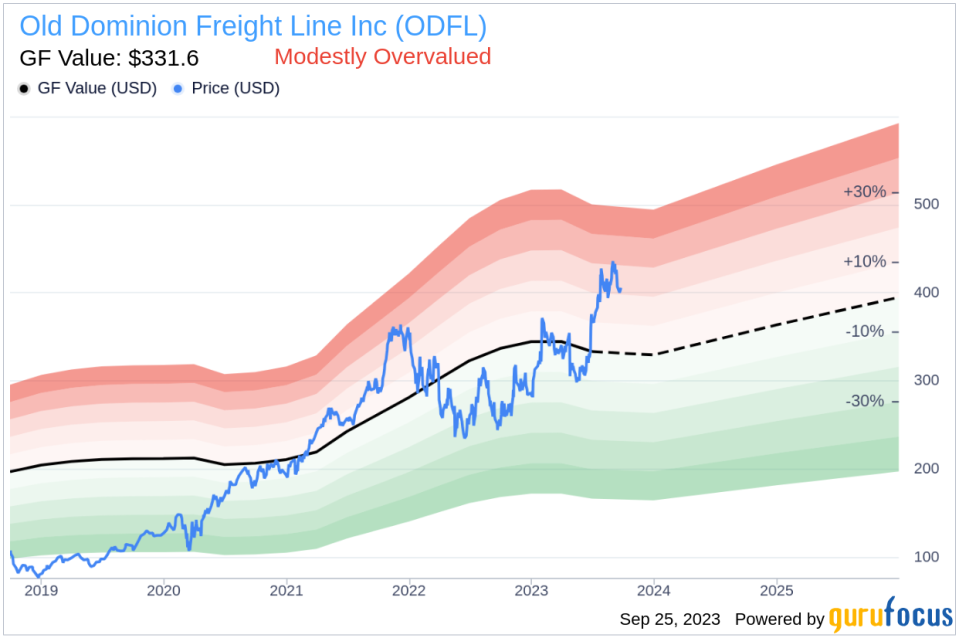

With a current stock price of $406.54 per share, Old Dominion Freight Line has a market capitalization of $44.40 billion. However, the stock appears to be modestly overvalued when compared to our estimate of its fair value, the GF Value.

Understanding the GF Value

The GF Value is our proprietary measure of a stock's intrinsic value, calculated based on historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. If a stock's price is significantly above the GF Value Line, it is considered overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

Based on our analysis, Old Dominion Freight Line's stock appears to be modestly overvalued. Therefore, the long-term return of its stock is likely to be lower than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

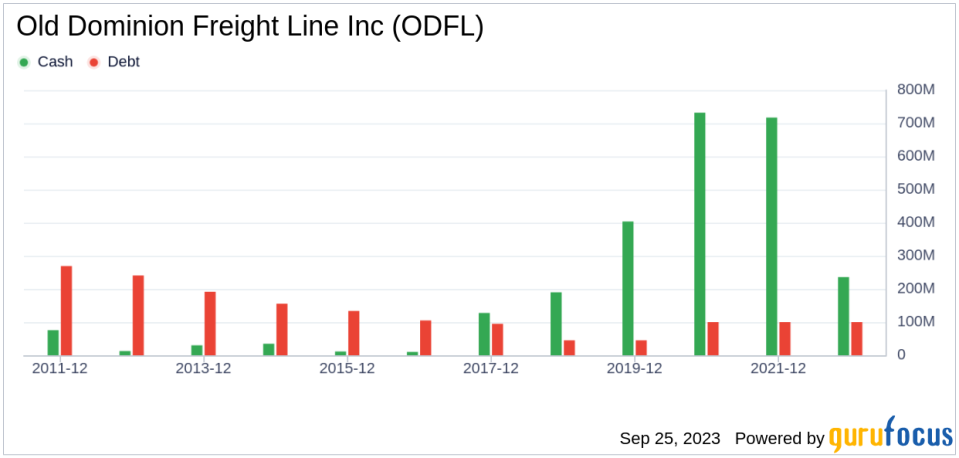

Financial Strength

Investing in companies with robust financial strength minimizes the risk of permanent capital loss. Old Dominion Freight Line has a cash-to-debt ratio of 0.69, better than 59.68% of 940 companies in the Transportation industry. Our overall financial strength rank for Old Dominion Freight Line is 9 out of 10, indicating strong financial health.

Profitability and Growth

Investing in profitable companies, especially those with consistent long-term profitability, poses less risk. Old Dominion Freight Line has been profitable for the past ten years, with a revenue of $6 billion and an EPS of $11.51 over the past twelve months. The company's operating margin is 28.58%, ranking better than 87.29% of 952 companies in the Transportation industry. Overall, we rank Old Dominion Freight Line's profitability at 10 out of 10, indicating strong profitability.

Company growth is a crucial factor in valuation. Old Dominion Freight Line's 3-year average annual revenue growth rate is 17.6%, ranking better than 76.88% of 917 companies in the Transportation industry. The 3-year average EBITDA growth rate is 28%, ranking better than 73.72% of 822 companies in the Transportation industry.

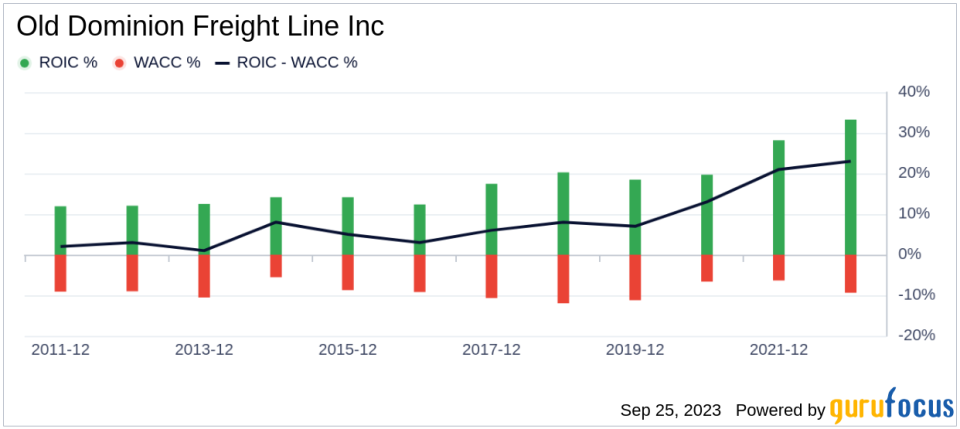

ROIC vs. WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) is another way to assess its profitability. If the ROIC is higher than the WACC, it indicates that the company is creating value for shareholders. Over the past 12 months, Old Dominion Freight Line's ROIC was 29.54, while its WACC came in at 11.79.

Conclusion

In conclusion, Old Dominion Freight Line's stock appears to be modestly overvalued. The company has a strong financial condition, strong profitability, and its growth ranks better than 73.72% of 822 companies in the Transportation industry. To learn more about Old Dominion Freight Line stock, you can check out its 30-Year Financials here.

To find out high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.