Old Dominion says Yellow freight redistribution not settled

Carrying excess capacity through the downcycle allowed Old Dominion Freight Line to minimize impacts to service as it onboarded Yellow’s abandoned shipments.

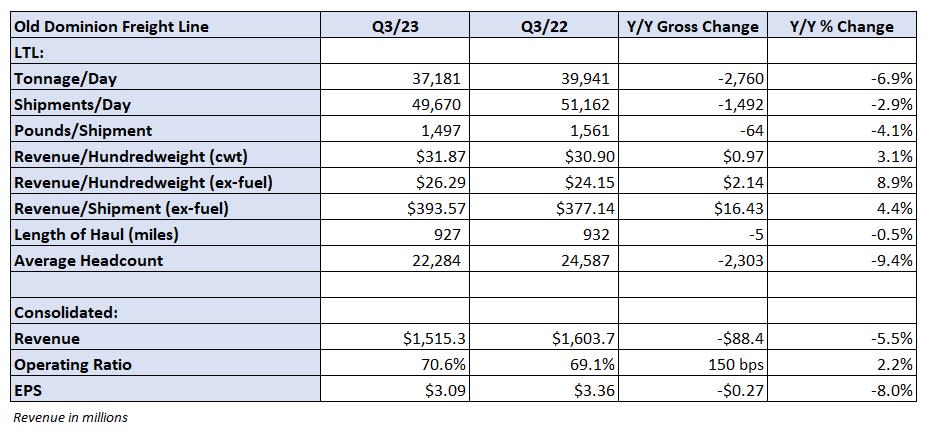

The less-than-truckload carrier beat third-quarter expectations Wednesday, posting earnings per share of $3.09. The result was 18 cents above consensus but 27 cents lower year over year (y/y).

“Investing ahead of the curve” remains the company’s strategy. It views the incremental cost of holding latent capacity, which allows it to be proactive when market inflections occur, as necessary to avoid the negative impacts some carriers experience when they are forced to scramble to respond to market upswings.

Old Dominion (NASDAQ: ODFL) has invested $2 billion in real estate over the past decade, which has allowed it to grow door capacity by 50%.

The company processed nearly 50,000 shipments daily during the third quarter, an increase of 2,600 shipments from the first half of the year when Yellow was still in business. The increase in volumes was attributed to Yellow’s exit as well as a cybersecurity attack at private carrier Estes. Excluding those events, management said the freight market continues to be soft but noted that it is winning market share at some accounts.

Old Dominion currently has 25% to 30% excess door capacity in the network, compared with 30% at the time of its July call. It said while Yellow’s freight has been redistributed, some of it is likely to come back to the market given service issues at competitors.

“We’re hearing it every day,” said CFO Adam Satterfield. “We’re hearing about competitors that are missing pickups. They don’t have the people part of the capacity equation solved and maybe took on too much freight and are starting to have negative implications from their overall service product.”

A recent Morgan Stanley (NYSE: MS) survey showed that 35% of shippers and 3PLs that worked with Yellow are still looking for a permanent home for their LTL freight. Satterfield said shippers are likely to reassess their carrier relationships over the next six months as the industry sees a normal seasonal slowdown.

Old Dominion expects to continue to take market share. It recently rebooted hiring initiatives in some markets and ramped efforts at its driver training schools.

Asked if the market will become oversupplied as Yellow’s idled terminals hit the auction block next month, Satterfield said some of the facilities will likely be repurposed away from LTL operations and cautioned potential suitors that the freight has already been absorbed.

“All of those shipments … it’s been several months now, they’ve found a new home,” Satterfield said. “If you’re someone on the strategic side that might be investing, you got to look and think about how that would make sense. How much incremental capacity do you want to buy … and how would you use it?”

Third-quarter reports from companies with LTL exposure show Yellow’s impact as well.

TFI International (NYSE: TFII) reported Monday that shipments in its U.S. LTL segment increased 5% sequentially from the second quarter to the third, with tonnage up 10% over that period. The company grew volumes sequentially even though it has an ongoing campaign to weed out undesirable freight from its network. Revenue per hundredweight, or yield, was down 2.2% excluding fuel surcharges. However, the metric was dragged down by a 4.6% increase in weight per shipment, implying actual pricing was likely 2.4% higher sequentially.

Third-quarter numbers from Knight-Swift Transportation (NYSE: KNX) last week showed a 4% sequential increase in shipments at the company’s nearly $1 billion LTL operation. Yield (excluding fuel surcharges) increased 5% sequentially, but the metric was aided by a 1.5% decline in average shipment weight.

Q3 results and Q4 expectations

Old Dominion’s revenue declined 6% y/y to $1.52 billion as tonnage per day was off 7%, which was partially offset by a 3% increase in yield. Excluding fuel surcharges, yield was 9% higher y/y. The metric benefited from a 4% decline in weight per shipment.

Compared to the second quarter, Old Dominion’s tonnage increased 4% as shipments were up 6% and weight per shipment declined 2%. The company’s shipment count usually increases just 1.8% on average from the second to the third quarter. Shipments were down month over month by 1.5% in July before climbing 4.7% in August and again by 2.7% in September.

Yield excluding fuel was 3% higher but only slightly positive when accounting for the lower shipment weights.

Management expects revenue per day in October to increase 1.5% to 2% y/y even though tonnage is expected to decline 2% to 2.5%. The company is facing an easier comparison to the year-ago quarter when tonnage was down 9%.

The carrier posted a 70.6% operating ratio in the quarter, 150 basis points worse y/y.

Salaries, wages and benefits expense as a percentage of revenue increased 170 bps y/y even as head count declined 9%. Depreciation and amortization expense was up 130 bps given prior network investments. Operating supplies, mostly diesel fuel costs, were 160 bps lower in the quarter. Retail diesel prices were off 15% y/y but increased more than 20% from the beginning to the end of the period.

The third-quarter OR improved 170 bps from the second quarter.

The fourth-quarter OR is expected to deteriorate by 160 to 200 bps from the third quarter. Normal deterioration is 200 to 250 bps given seasonally weaker revenues and an annual wage increase every September. The company reiterated a long-term goal of pricing freight 100 to 150 bps above costs.

Old Dominion generated $429 million in cash flow from operations in the quarter, $1.1 billion in the first nine months of 2023, which was 15% lower y/y. It increased capital expenditures guidance by $20 million, to $720 million in total. The capex plan includes $260 million in real estate investments, $385 million for tractors and trailers (a $20 million increase from the prior guide) and $75 million for IT projects.

Shares of LTL carriers were off Wednesday at 2:10 p.m. EDT, with Old Dominion leading the move lower, down 3.6%. By comparison, the S&P 500 was down 1.4%.

Deutsche Bank (NYSE: DB) analyst Amit Mehrotra said “the outlook for ODFL shares rarely ever relies on how shares respond on the day of earnings,” in a Wednesday afternoon note to clients.

He noted that over the last 11 years Old Dominion’s shares are down on the day it reports earnings about half of the time, but end up recording gains in the month following the report more than 70% of the time.

“We find nothing in today’s release that is anything less than highly impressive, and this has very positive implications when there is a broader recovery in freight,” Mehrotra said.

More FreightWaves articles by Todd Maiden

LTL survey: Averitt No. 1 overall, Old Dominion top national carrier

Knight-Swift sees inflection coming, beats lowered Q3 expectations

The post Old Dominion says Yellow freight redistribution not settled appeared first on FreightWaves.