Old Dominion sees August impact from Yellow’s shutdown

Operating metrics for less-than-truckload carrier Old Dominion Freight Line saw a sharp inflection in August when compared to July. The company attributed the change to the shutdown of Yellow Corp.

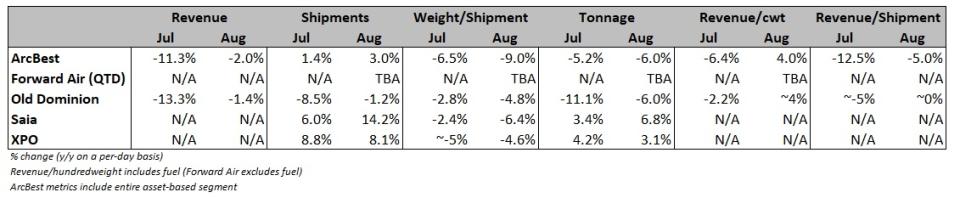

Revenue per day was down just 1.4% year over year (y/y) in August compared to a 13.3% decline in July. Throughout the downturn, Old Dominion (NASDAQ: ODFL) has been more protective of yields than most carriers. It has resisted lowering rates to keep freight in its network.

Old Dominion’s tonnage was down 6% y/y in August following an 11.1% decline in July. Both months were better than the 14.1% decline in the second quarter. Management noted “continued softness in the domestic economy” in a Wednesday news release but said shipments were up 6% sequentially in August to 50,000 per day. The carrier handled roughly 47,000 shipments each day for the first seven months of the year.

“This incremental increase is due in part to the direct and indirect impact of one of our largest competitors ceasing operations in July, as we believe underlying demand has remained relatively consistent,” stated Marty Freeman, Old Dominion president and CEO.

Industrial freight accounts for two-thirds of total volumes for most carriers.

The Manufacturing Purchasing Managers’ Index remained in contraction territory for a 10th straight month in August. A 47.6 reading was 1.2 percentage points better than the July reading but below the neutral threshold of 50. Index components like new orders (46.8) and order backlog (44.1) remained in decline during the month.

Old Dominion’s revenue per hundredweight, or yield, was up 1.8% y/y for the first two months of the third quarter (8.8% higher excluding fuel surcharges). Diesel fuel prices are off roughly 19% y/y so far in the quarter.

Yield growth accelerated from July to August as the carrier previously reported a 7.4% y/y increase in yield (excluding fuel) during July. In addition to improved competitive dynamics, lower weight per shipment is also pushing the metric higher.

The company previously said it was unsure how much freight it would get following the capacity shakeup but did say it expected to win share from other competitors that onboarded Yellow’s freight too fast. The rationale was that the quick influx of volume in other carrier networks would negatively impact service levels and send shippers searching for better options. As such, the total impact from Yellow’s closure could take longer to play out for Old Dominion.

By comparison, carriers ArcBest (NASDAQ: ARCB), Saia (NASDAQ: SAIA) and XPO (NYSE: XPO) have experienced more notable increases.

ArcBest said shipments at its core accounts have improved roughly 20% since June (up just 3% in total during August).

Saia provided an update to August results on Wednesday, which showed some acceleration in volumes as the month progressed. Shipments in the month were 14.2% higher y/y versus up 13% in the first two weeks of the month. Tonnage increased 6.8% y/y in August, following a 3.4% increase in July.

Tonnage trends should improve more meaningfully for Old Dominion in the last four months of the year. Like most other carriers, Old Dominion’s volumes turned negative at the end of last summer with the declines accelerating through the end of the year.

Deutsche Bank (NYSE: DB) analyst Amit Mehrotra expects earnings estimates for Saia and Old Dominion to move higher given the better-than-expected updates.

“With two months of volume data now disclosed, and big moves in fuel prices since the last update, it’s fair to say both companies will likely report 3Q results that are ahead of current consensus,” Mehrotra said.

Less-than-truckload carriers see disproportionate earnings growth when diesel prices accelerate. The per-gallon cost is roughly 7% higher sequentially so far in the third quarter. Mehrotra said consensus earnings estimates aren’t accounting for new diesel forecasts, which have moved higher.

Old Dominion recently entered a $1.5 billion stalking horse bid on roughly 170 of the terminals Yellow owns. The offer will set a floor for valuation on Yellow’s properties as it liquidates assets in bankruptcy. Old Dominion may end up with just a few of the sites as the locations will be marketed and could be sold to higher bidders. The winners of Yellow’s terminals are expected to be revealed in October.

On its quarterly call at the end of July, Old Dominion’s management said it had roughly 30% excess capacity, which was 5 percentage points higher than normal.

More FreightWaves articles by Todd Maiden

Forward Air says ‘earned trust’ a must after Omni acquisition

August transportation prices decline at slowest pace in a year

The post Old Dominion sees August impact from Yellow’s shutdown appeared first on FreightWaves.