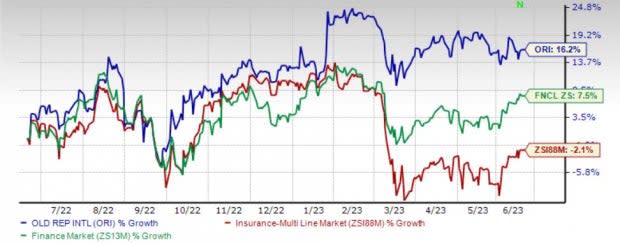

Old Republic (ORI) Gains 16% in a Year: More Upside Left?

Old Republic International ORI shares have gained 16.2% in a year against the industry’s decrease of 2.1%. The Finance sector has risen 7.5% in the said time frame. With a market capitalization of $7.3 billion, the average volume of shares traded in the last three months was 1.4 million.

Solid market presence, niche focus, low property catastrophe exposure in its General Insurance segment and solid capital position continue to drive this Zacks Rank #1 (Strong Buy) insurer.

Old Republic has a solid history of delivering positive surprise in the last four reported quarters and has returned 16% per share for the last 10 years to shareholders.

Return on equity in the trailing 12 months was 13.6%, better than the industry average of 9.8%. This highlights its unique combination of Specialty Property and Casualty and Title franchises that offers diversification.

Image Source: Zacks Investment Research

Can ORI Retain the Momentum?

The Zacks Consensus Estimate for ORI’s 2023 earnings has moved north by 9.1%, while that for 2023 has moved up 6.4% in the past 60 days, reflecting analysts’ optimism.

The General Insurance segment should continue to benefit from better segmentation, improved risk selection, pricing precision and increased use of analytics. The segment delivered a combined ratio below 96 for more than 15 years. ORI aims combined ratio between 90 and 95. The insurer continues to expect growth and profitability through 2023, banking on specialty growth strategy and operational excellence initiatives.

The Title insurance business will likely continue to benefit from its expanding presence in the commercial real estate market.

The third-largest title insurer in the country has been strengthening its balance sheet by improving cash balance and lowering the leverage ratio.

Riding on a solid capital position, ORI increased dividends for 42 straight years. It has been paying dividends for the last 82 years, besides paying special dividends occasionally. Its dividend yield of 3.9% betters the industry average of 2.8%, making it an attractive pick for yield-seeking investors. Old Republic International is one of the 111 companies that have posted at least 27 consecutive years of annual dividend growth. The insurer has a $450 million buyback approval under its kitty.

Attractive Valuation

Shares are trading at a price-to-book multiple of 1.15, lower than the industry average of 2.24.

The company has a Value Score of B. This style score helps find the most attractive value stocks. Back-tested results have shown that stocks with a Value Score of A or B combined with a Zacks Rank #1 or #2 (Buy) offer better returns.

Before its valuation expands, it is advisable to take a position in the stock.

Other Stocks to Consider

Some other top-ranked stocks from the insurance industry are Kinsale Capital Group, Inc. KNSL, RLI Corp. RLI and Root, Inc. ROOT. While RLI Corp. sports a Zacks Rank #1, Kinsale Capital and Root carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Kinsale Capital has a solid track record of beating earnings estimates in each of the last trailing four quarters, the average being 14.77%. In the past year, KNSL has gained 71.7%.

The Zacks Consensus Estimate for KNSL’s 2023 and 2024 earnings per share is pegged at $10.37 and $12.41, indicating a year-over-year increase of 32.9% and 19.6%, respectively.

RLI beat estimates in each of the last four quarters, the average being 43.50%. In the past year, RLI has gained 20.6%.

The Zacks Consensus Estimate for RLI’s 2023 and 2024 earnings has moved 10.1% and 3.7% north, respectively, in the past 60 days.

Root beat estimates in each of the last four quarters, the average being 18.24%. In the past year, the insurer has lost 71.9%.

The Zacks Consensus Estimate for ROOT’s 2023 and 2024 earnings per share indicates a year-over-year increase of 43.8% and 42.5%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

Old Republic International Corporation (ORI) : Free Stock Analysis Report

Kinsale Capital Group, Inc. (KNSL) : Free Stock Analysis Report

Root, Inc. (ROOT) : Free Stock Analysis Report